Question: please kindly answer all please. just answer A,B,C or D, thanks in advance sir. 19. Bostian, Inc. has total assets of $625,000. Its total debt

please kindly answer all please. just answer A,B,C or D, thanks in advance sir.

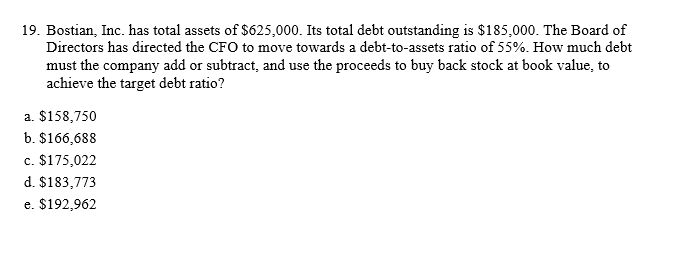

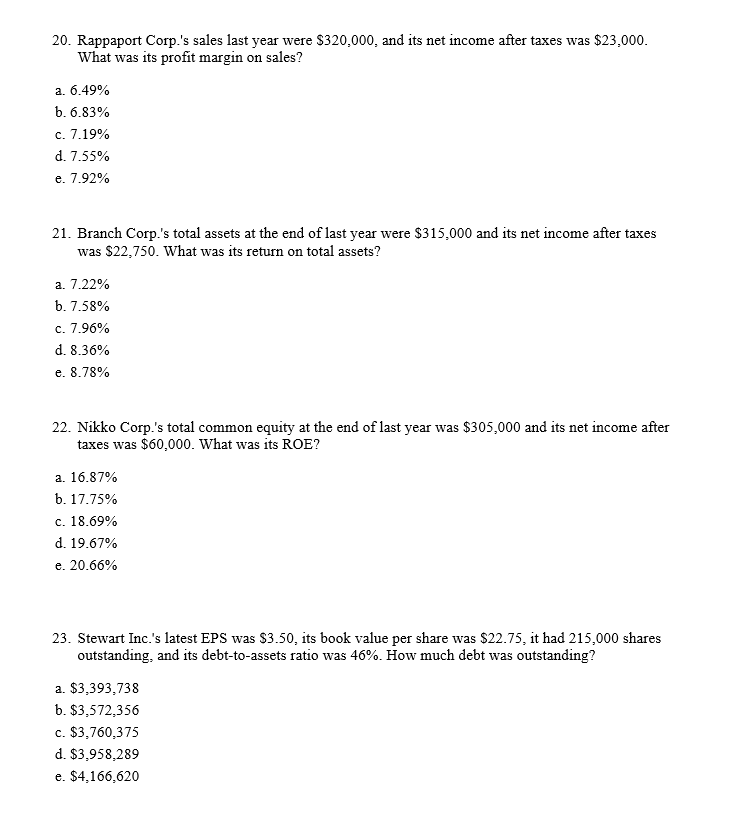

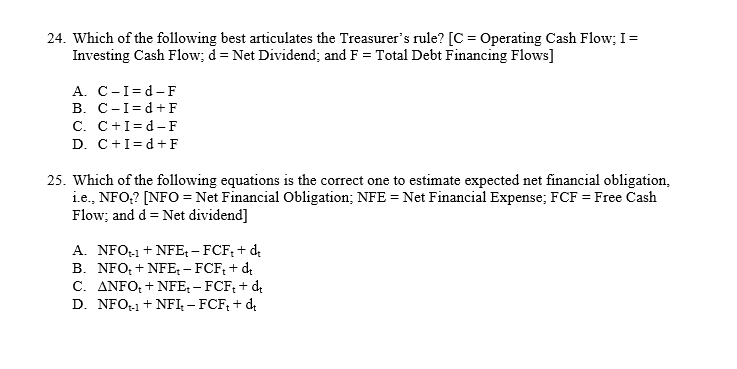

19. Bostian, Inc. has total assets of $625,000. Its total debt outstanding is $185,000. The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%. How much debt must the company add or subtract, and use the proceeds to buy back stock at book value, to achieve the target debt ratio? a. $158,750 b. $166,688 c. $175,022 d. $183,773 e. $192,962 20. Rappaport Corp.'s sales last year were $320,000, and its net income after taxes was $23.000. What was its profit margin on sales? a. 6.49% b. 6.83% c. 7.19% d. 7.55% e. 7.92% 21. Branch Corp.'s total assets at the end of last year were $315,000 and its net income after taxes was $22,750. What was its return on total assets? a. 7.22% 6.7.58% c. 7.96% d. 8.36% e. 8.78% 22. Nikko Corp.'s total common equity at the end of last year was $305,000 and its net income after taxes was $60,000. What was its ROE? a. 16.87% b. 17.75% c. 18.69% d. 19.67% e. 20.66% 23. Stewart Inc.'s latest EPS was $3.50, its book value per share was $22.75, it had 215,000 shares outstanding, and its debt-to-assets ratio was 46%. How much debt was outstanding? a. $3,393,738 b. $3,572,356 c. $3,760,375 d. $3,958,289 e. $4,166,620 24. Which of the following best articulates the Treasurer's rule? (C = Operating Cash Flow: I = Investing Cash Flow; d = Net Dividend; and F = Total Debt Financing Flows] A C-I=d-F B. C-I= d+F C. C+I=d-F D. C+I= d+F 25. Which of the following equations is the correct one to estimate expected net financial obligation, i.e., NFO,? [NFO = Net Financial Obligation; NFE = Net Financial Expense; FCF = Free Cash Flow; and d = Net dividend] A. NFO:-1 + NFE - FCF+ de B. NFO: + NFE - FCF+ de C. ANFO: + NFE:- FCFt + dt D. NFO:-1 + NFI. - FCFt + dt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts