Question: please kindly solve the question with detials. i really need to learn this topic. thank you so much! your work is really appreciated. Dr. Nino

please kindly solve the question with detials. i really need to learn this topic. thank you so much! your work is really appreciated.

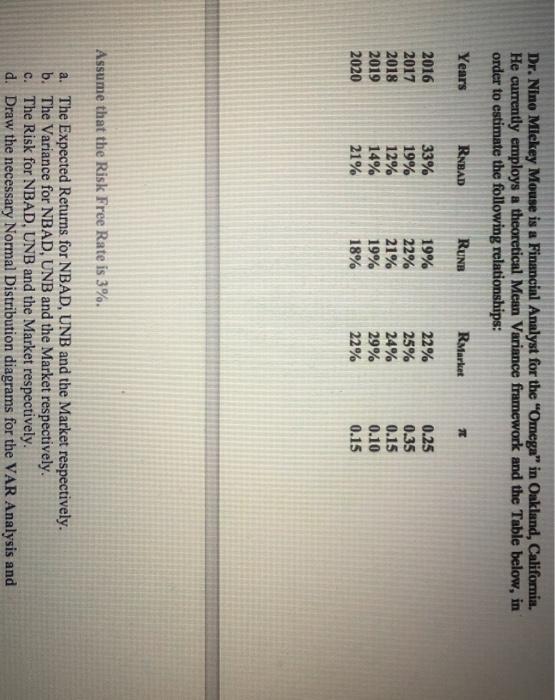

please kindly solve the question with detials. i really need to learn this topic. thank you so much! your work is really appreciated. Dr. Nino Mickey Mouse is a Financial Analyst for the "Omega" in Oakland, California. He currently employs a theoretical Mean Variance framework and the Table below, in order to estimate the following relationships: Years RNBAD RUNS RMarket 7 2016 2017 2018 2019 2020 33% 19% 12% 14% 21% 19% 22% 21% 19% 18% 22% 25% 24% 29% 22% 0.25 0.35 0.15 0.10 0.15 Assume that the Risk Free Rate is 3%. a. The Expected Returns for NBAD, UNB and the Market respectively. b. The Variance for NBAD, UNB and the Market respectively. C. The Risk for NBAD, UNB and the Market respectively. d. Draw the necessary Normal Distribution diagrams for the VAR Analysis and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts