Question: Hello please kindly solve the question with detials. inreally need to learn this topic. thank you so much! your work is really appreciated. On December

Hello

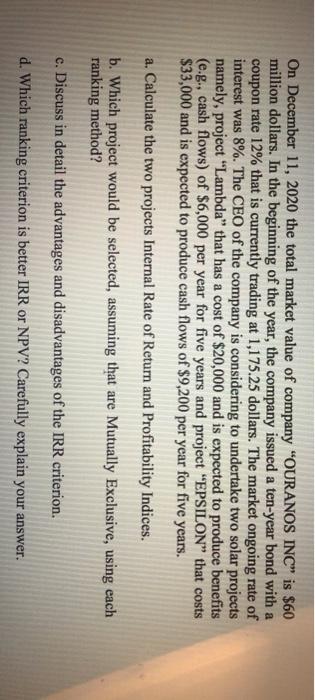

HelloOn December 11, 2020 the total market value of company OURANOS INC" is $60 million dollars. In the beginning of the year, the company issued a ten-year bond with a coupon rate 12% that is currently trading at 1,175.25 dollars. The market ongoing rate of interest was 8%. The CEO of the company is considering to undertake two solar projects namely, project "Lambda" that has a cost of $20,000 and is expected to produce benefits (e.g., cash flows) of $6,000 per year for five years and project "EPSILON that costs $33,000 and is expected to produce cash flows of $9,200 per year for five years. a. Calculate the two projects Internal Rate of Return and Profitability Indices. b. Which project would be selected, assuming that are Mutually Exclusive, using each ranking method? c. Discuss in detail the advantages and disadvantages of the IRR criterion. d. Which ranking criterion is better IRR or NPV? Carefully explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts