Question: Please make sure the answer is correct and explain how you got it, thanks!. Jiminy's Cricket Farm issued a 20-year, 5 percent semiannual coupon bond

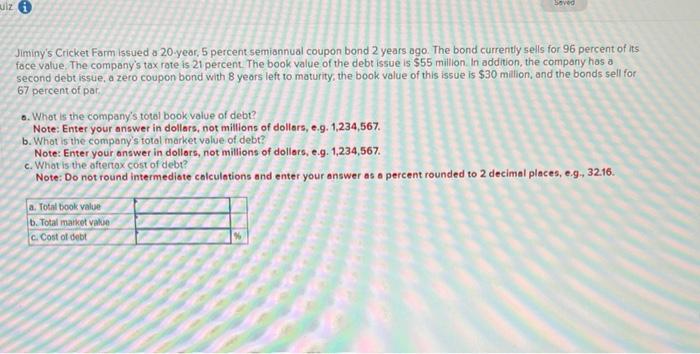

Jiminy's Cricket Farm issued a 20-year, 5 percent semiannual coupon bond 2 years ago. The bond currently sells for 96 percent of its face value. The company's tax rate is 21 percent. The book value of the debt issue is $55 million. In addition, the company has a second debt issue, a zero coupon bond with 8 yeors left to maturity, the book value of this issue is $30 milion, and the bonds sell for 67 percent of par. o. Whot is the company's total book value of debt? Note: Enter your answer in dollars, not millions of dollers, e.9.1,234,567. b. What is the company's total market value of debt? Note: Enter your onswer in dollors, not millions of dollors, e.g. 1,234,567. c. What is the aftertax cost of debt? Note: Do not round intermediote calculations and enter your answer as a percent rounded to 2 decimal places, e.9., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts