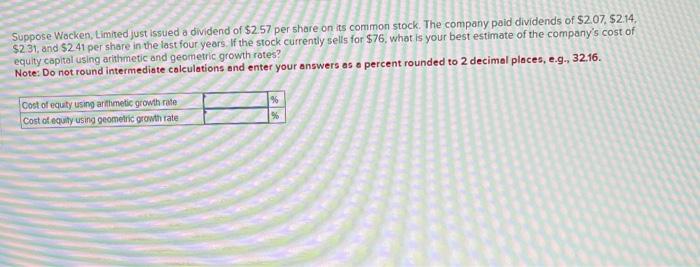

Question: Please make sure the answer is correct and explain how you got it, thanks!. Suppose Wacken, Limited just issued a dividend of $2.57 per share

Suppose Wacken, Limited just issued a dividend of $2.57 per share on its common stock. The company paid dividends of $2.07,$2.14 $2.31, and $241 per share in the lost four years. If the stock currently sells for $76, what is your best estimate of the company's cost of equity capital using arithmetic and geortetric growth rates? Note: Do not round intermediate colculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts