Question: please make sure the answer is correct. thanks 1. Using the information in the table, compute the structure of the optimal portfolio W when there

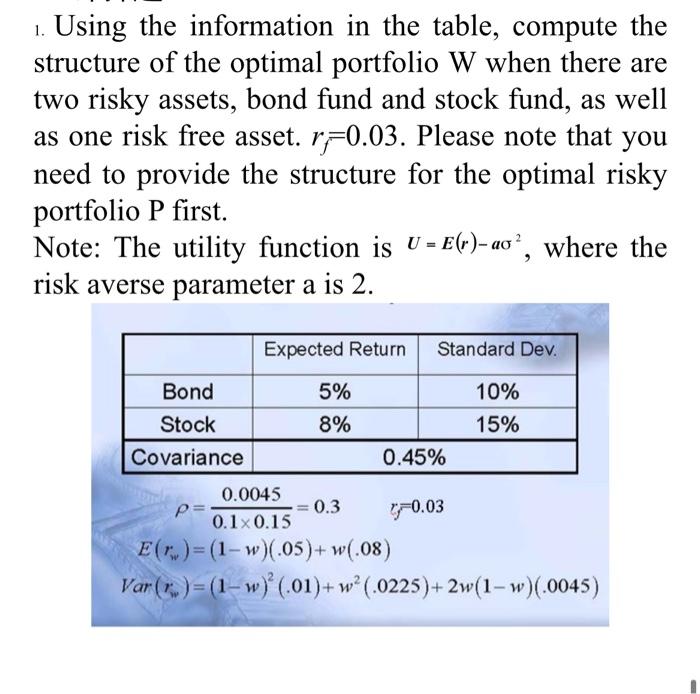

1. Using the information in the table, compute the structure of the optimal portfolio W when there are two risky assets, bond fund and stock fund, as well as one risk free asset. r=0.03. Please note that you need to provide the structure for the optimal risky portfolio P first. Note: The utility function is U = E(r)- ao ?, where the risk averse parameter a is 2. Expected Return Standard Dev. 5% Bond Stock Covariance 10% 15% 8% 0.45% P 10.03 0.0045 -0.3 0.10.15 E(C:)=(1-w)(.05)+ w(.08) Var(..) = (1-w) (.01)+w? (.0225)+ 2w(1-w).0045)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts