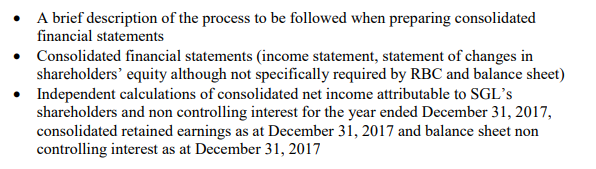

Question: please make the following additional changes to the case: Please provide: The consolidated finnancial statements are to follow IFRS Standards, and RBC is their lender,

please make the following additional changes to the case:

Please provide:

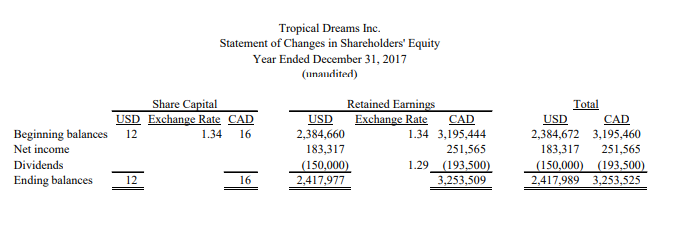

The consolidated finnancial statements are to follow IFRS Standards, and RBC is their lender, it it just saying they would like a statement of changes in shareholders' equity even though not required by their lender.

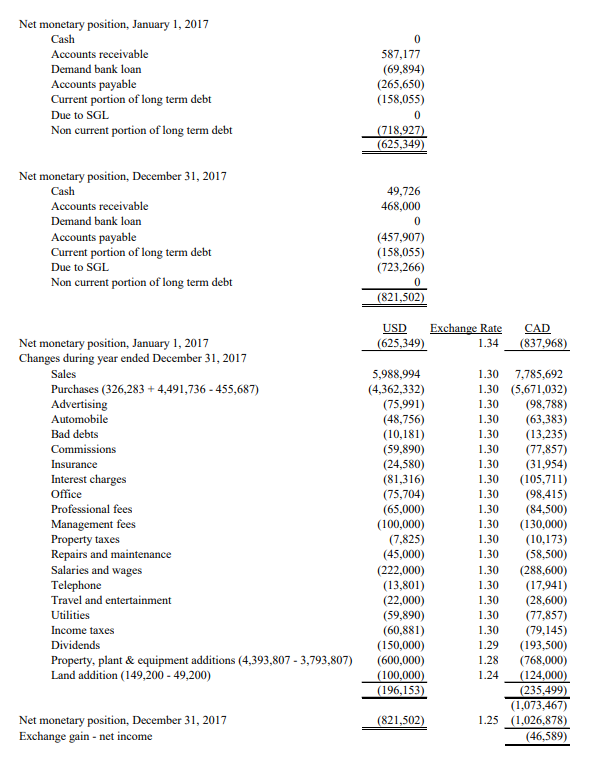

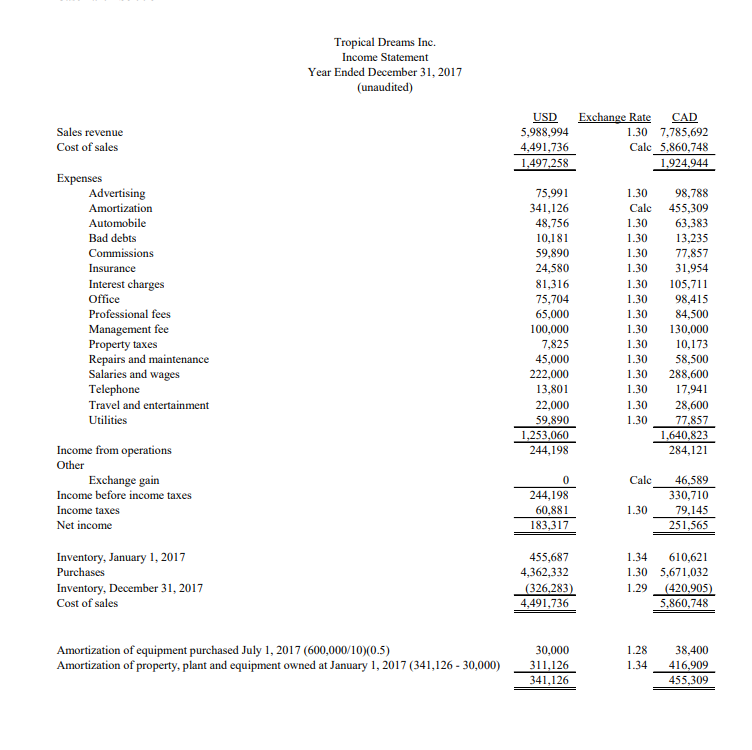

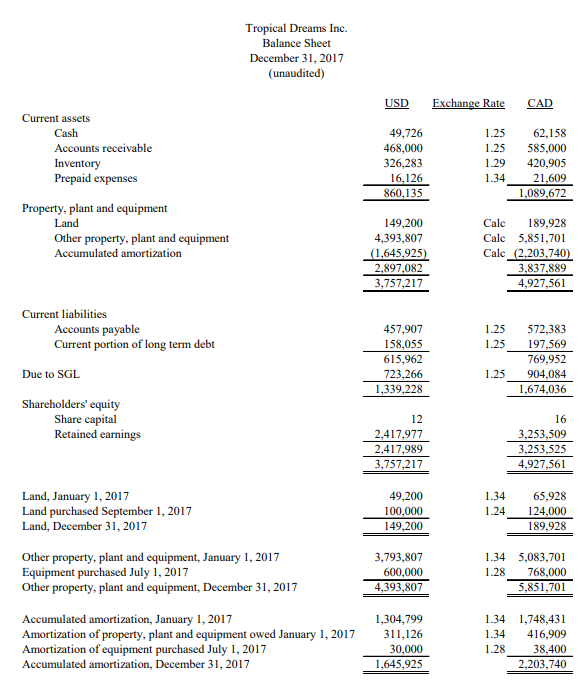

Net monetary position, January 1, 2017 Accounts receivable Demand bank loan Accounts payable Current portion of long term debt Due to SGL Non current portion of long term debt 587,177 (69,894) (265,650) (158,055) (718,927 (625,349) Net monetary position, December 31, 2017 49,726 468,000 Accounts receivable Demand bank loan Accounts payable Current portion of long term debt Due to SGL Non current portion of long term debt (457,907) (158,055) (723,266) (821,502) USD Exchange Rat 1.34 _(837.968) Net monetary position, January 1, 2017 Changes during year ended December 31, 2017 (625,349 5,988,994 (4,362,332) (75,991) (48,756) (10,181) (59,890) (24,580) (81,316) (75,704) (65,000) (100,000) (7,825) (45,000) (222,000) (13,801) (22,000) (59,890) (60,881) (150,000) Property, plant & equipment additions (4,393,807-3,793,807) (600,000) (100.000) (196,153) 1.30 7,785,692 1.30 5,671,032) 1.30 (98,788) 1.30 63,383) 1.30 13,235) 1.30 (77,857) 1.30 31,954) 1.30 (105,711) 1.30 (98,415) 1.30 (84,500) 1.30 130,000) 1.30 10,173) 1.30 (58,500) 1.30 (288,600) 1.30 (17.941) 1.30 (28,600) 1.30 77,857) .30 (79,145) 1.29 (193.500) 1.28 768,000) Purchases (326,283 + 4,491,736-455,687) Automobile Bad debts Office Professional fees Management fees Property taxes Repairs and maintenance Salaries and wages Telephone Travel and entertainment Utilities Income taxes Dividends Land addition (149,200-49,200) 1.24 (124.000 (235.499) (1,073.467) 1.25 (1.026,878) (46,589) Net monetary position, December 31, 2017 Exchange gain net income Net monetary position, January 1, 2017 Accounts receivable Demand bank loan Accounts payable Current portion of long term debt Due to SGL Non current portion of long term debt 587,177 (69,894) (265,650) (158,055) (718,927 (625,349) Net monetary position, December 31, 2017 49,726 468,000 Accounts receivable Demand bank loan Accounts payable Current portion of long term debt Due to SGL Non current portion of long term debt (457,907) (158,055) (723,266) (821,502) USD Exchange Rat 1.34 _(837.968) Net monetary position, January 1, 2017 Changes during year ended December 31, 2017 (625,349 5,988,994 (4,362,332) (75,991) (48,756) (10,181) (59,890) (24,580) (81,316) (75,704) (65,000) (100,000) (7,825) (45,000) (222,000) (13,801) (22,000) (59,890) (60,881) (150,000) Property, plant & equipment additions (4,393,807-3,793,807) (600,000) (100.000) (196,153) 1.30 7,785,692 1.30 5,671,032) 1.30 (98,788) 1.30 63,383) 1.30 13,235) 1.30 (77,857) 1.30 31,954) 1.30 (105,711) 1.30 (98,415) 1.30 (84,500) 1.30 130,000) 1.30 10,173) 1.30 (58,500) 1.30 (288,600) 1.30 (17.941) 1.30 (28,600) 1.30 77,857) .30 (79,145) 1.29 (193.500) 1.28 768,000) Purchases (326,283 + 4,491,736-455,687) Automobile Bad debts Office Professional fees Management fees Property taxes Repairs and maintenance Salaries and wages Telephone Travel and entertainment Utilities Income taxes Dividends Land addition (149,200-49,200) 1.24 (124.000 (235.499) (1,073.467) 1.25 (1.026,878) (46,589) Net monetary position, December 31, 2017 Exchange gain net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts