Question: Please note that this is a question from a textbook and I am very confused by the solution. Therefore, please do not copy from there.

Please note that this is a question from a textbook and I am very confused by the solution. Therefore, please do not copy from there.

I do understand that a borrower would be long Forward Rate Agreement. Borrower's position on zero-coupon bonds would be the following:

T=0 (Cash inflow = Cash outflow)

Buy 180 days zero-coupon bonds at 0.97943 x 10m = 9.7943m

Short 1.028403 360 day coupons = 1.028403 x 0.95238 x 10m = 9.7943m

T=1 (Cash Inflow of $10m) - In 180 days the borrower will receive money therefore positive cash flow.

The 180 day zero coupons mature and we receive $10m

T=2 (Cash outflow of $10.28403m) - By the end of the period, the borrower will pay back the loan therefore negative cash flow.

The 360 day zero coupons mature and we pay $10.28403m

The above is TEXTBOOK SOLUTION

However, this question says that "Suppose that you are the counterparty of the borrower". Since we are the counterparty for a borrower, we are in fact the lender and thus short the forward rate agreement.

Therefore, being the counterparty to the borrower i.e. we being the lender and short the forward rate agreement. Shouldn't our position in zero-coupon bonds be the exact opposite of the borrower, which is the following:

T=0 (Cash inflow = Cash outflow)

Short 180 days zero-coupon bonds at 0.97943 x 10m = 9.7943m

Buy 1.028403 360 day coupons = 1.028403 x 0.95238 x10m = 9.7943m

T=1 (Cash outflow of $10m) - In 180 days the lender will lend money therefore negative cash flow.

The 180 day zero coupons mature and we pay $10m

T=2 (Cash Inflow of $10.28403m) - By the end of the period, lender will receive is money therefore positive cash flow.

The 360 day zero coupons mature and we receive $10.28403m

THIS IS MY SOLUTION

TO CONCLUDE, I BELIEVE THAT BEING THE COUNTERPARTY WE SHOULD BE SHORT THE FRA AND HAVE OPPOSITE POSITION ON ZERO COUPON BONDS AS COMPARED TO THE BORROWER. Therefore, shouldn't my solution be more accurate theoretically?

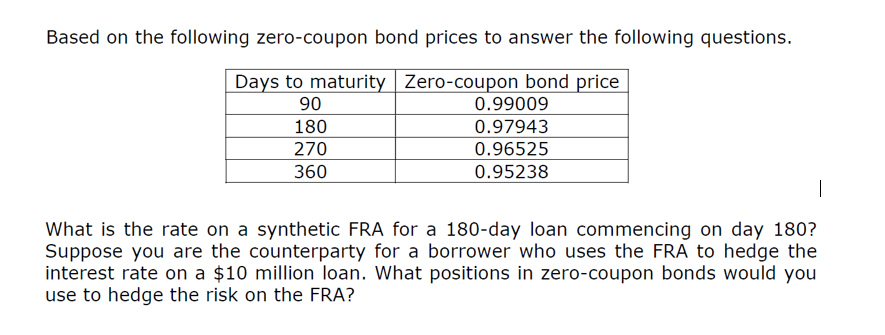

Based on the following zero-coupon bond prices to answer the following questions. Days to maturity Zero-coupon bond price 90 0.99009 180 0.97943 270 0.96525 360 0.95238 | What is the rate on a synthetic FRA for a 180-day loan commencing on day 180? Suppose you are the counterparty for a borrower who uses the FRA to hedge the interest rate on a $10 million loan. What positions in zero-coupon bonds would you use to hedge the risk on the FRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts