Question: PLEASE ONLY ANSWER PART A WHICH IS HIGHLIGHTED Suppose that, on 5 November 2020 , you opened a short position in a two-year futures contract

PLEASE ONLY ANSWER PART A WHICH IS HIGHLIGHTED

PLEASE ONLY ANSWER PART A WHICH IS HIGHLIGHTED

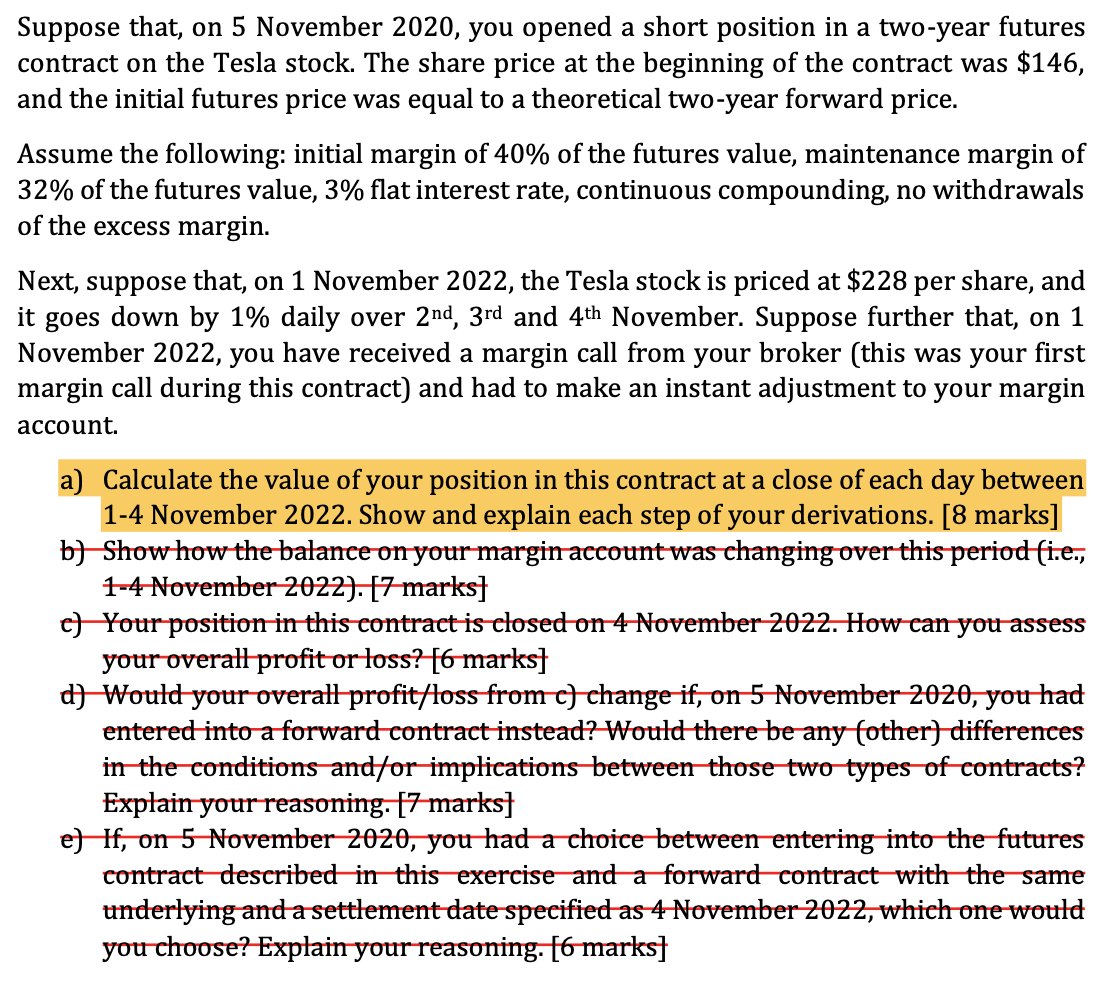

Suppose that, on 5 November 2020 , you opened a short position in a two-year futures contract on the Tesla stock. The share price at the beginning of the contract was $146, and the initial futures price was equal to a theoretical two-year forward price. Assume the following: initial margin of 40% of the futures value, maintenance margin of 32% of the futures value, 3% flat interest rate, continuous compounding, no withdrawals of the excess margin. Next, suppose that, on 1 November 2022 , the Tesla stock is priced at $228 per share, and it goes down by 1% daily over 2nd,3rd and 4th November. Suppose further that, on 1 November 2022, you have received a margin call from your broker (this was your first margin call during this contract) and had to make an instant adjustment to your margin account. a) Calculate the value of your position in this contract at a close of each day between 1-4 November 2022. Show and explain each step of your derivations. [8 marks] b) Show how the balance onyour margin account was changing over this period (i.e., 1-4 November 2022). [7 marks] e) Your position in this contract is closed on 4 November 2022 . How can you assess your overall profit or loss? [ 6 marks] d) Would your overall profit/loss from c) change if, on 5 November 2020 , you had entered into a forward contract instead? Would there be any (other) differences in the conditions and/or implications between those two types of contracts? Explain your reasoning. [7 marks] e) If, on 5 November 2020 , you had a choice between entering into the futures contract described in this exercise and a forward contract with the same underlying and a settlement date specified as 4 November 2022 , which one would you choose? Explain your reasoning. [6 marks] Suppose that, on 5 November 2020 , you opened a short position in a two-year futures contract on the Tesla stock. The share price at the beginning of the contract was $146, and the initial futures price was equal to a theoretical two-year forward price. Assume the following: initial margin of 40% of the futures value, maintenance margin of 32% of the futures value, 3% flat interest rate, continuous compounding, no withdrawals of the excess margin. Next, suppose that, on 1 November 2022 , the Tesla stock is priced at $228 per share, and it goes down by 1% daily over 2nd,3rd and 4th November. Suppose further that, on 1 November 2022, you have received a margin call from your broker (this was your first margin call during this contract) and had to make an instant adjustment to your margin account. a) Calculate the value of your position in this contract at a close of each day between 1-4 November 2022. Show and explain each step of your derivations. [8 marks] b) Show how the balance onyour margin account was changing over this period (i.e., 1-4 November 2022). [7 marks] e) Your position in this contract is closed on 4 November 2022 . How can you assess your overall profit or loss? [ 6 marks] d) Would your overall profit/loss from c) change if, on 5 November 2020 , you had entered into a forward contract instead? Would there be any (other) differences in the conditions and/or implications between those two types of contracts? Explain your reasoning. [7 marks] e) If, on 5 November 2020 , you had a choice between entering into the futures contract described in this exercise and a forward contract with the same underlying and a settlement date specified as 4 November 2022 , which one would you choose? Explain your reasoning. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts