Question: Please only answer these if you know the correct answers. One Financial Sunements and Valuation M6.1 Analysts' Forecasts and Valuation: PepsiCo and Coca-Cola II 200

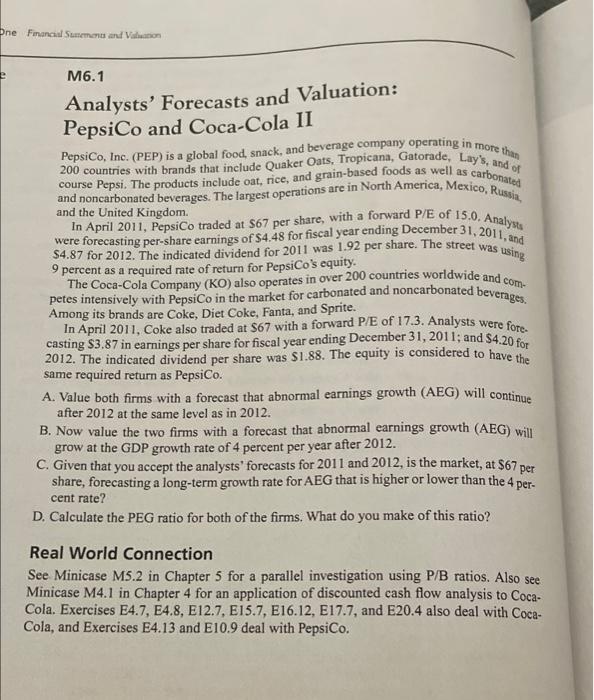

One Financial Sunements and Valuation M6.1 Analysts' Forecasts and Valuation: PepsiCo and Coca-Cola II 200 countries with brands that include Quaker Oats, Tropicana, Gatorade, Lay's, and of PepsiCo, Inc. (PEP) is a global food, snack, and beverage company operating in more than carbonated course Pepsi. The products include oat, rice, and grain-based foods as well as and noncarbonated beverages. The largest operations are in North America, Mexico, Russia, and the United Kingdom. were forecasting per-share earnings of $4.48 for fiscal year ending December 31, 2011, and In April 2011, PepsiCo traded at $67 per share, with a forward P/E of 15.0. Analysts $4.87 for 2012. The indicated dividend for 2011 was 1.92 per share. The street was using 9 percent as a required rate of return for PepsiCo's equity. The Coca-Cola Company (KO) also operates in over 200 countries worldwide and com- petes intensively with PepsiCo in the market for carbonated and noncarbonated beverages. are Coke, Diet Coke, Fanta, and Sprite. In April 2011, Coke also traded at $67 with a forward P/E of 17.3. Analysts were fore casting $3.87 in earnings per share for fiscal year ending December 31, 2011; and $4.20 for 2012. The indicated dividend per share was $1.88. The equity is considered to have the same required return as PepsiCo. A. Value both firms with a forecast that abnormal earnings growth (AEG) will continue after 2012 at the same level as in 2012. B. Now value the two firms with a forecast that abnormal earnings growth (AEG) will grow at the GDP growth rate of 4 percent per year after 2012. C. Given that you accept the analysts' forecasts for 2011 and 2012, is the market, at $67 per share, forecasting a long-term growth rate for AEG that is higher or lower than the 4 per- cent rate? D. Calculate the PEG ratio for both of the firms. What do you make of this ratio? Real World Connection See Minicase M5.2 in Chapter 5 for a parallel investigation using P/B ratios. Also see Minicase M4.1 in Chapter 4 for an application of discounted cash flow analysis to Coca- Cola. Exercises E4.7, E4.8, E12.7, E15.7, E16.12, E17.7, and E20.4 also deal with Coca- Cola, and Exercises E4.13 and E10.9 deal with PepsiCo. One Financial Sunements and Valuation M6.1 Analysts' Forecasts and Valuation: PepsiCo and Coca-Cola II 200 countries with brands that include Quaker Oats, Tropicana, Gatorade, Lay's, and of PepsiCo, Inc. (PEP) is a global food, snack, and beverage company operating in more than carbonated course Pepsi. The products include oat, rice, and grain-based foods as well as and noncarbonated beverages. The largest operations are in North America, Mexico, Russia, and the United Kingdom. were forecasting per-share earnings of $4.48 for fiscal year ending December 31, 2011, and In April 2011, PepsiCo traded at $67 per share, with a forward P/E of 15.0. Analysts $4.87 for 2012. The indicated dividend for 2011 was 1.92 per share. The street was using 9 percent as a required rate of return for PepsiCo's equity. The Coca-Cola Company (KO) also operates in over 200 countries worldwide and com- petes intensively with PepsiCo in the market for carbonated and noncarbonated beverages. are Coke, Diet Coke, Fanta, and Sprite. In April 2011, Coke also traded at $67 with a forward P/E of 17.3. Analysts were fore casting $3.87 in earnings per share for fiscal year ending December 31, 2011; and $4.20 for 2012. The indicated dividend per share was $1.88. The equity is considered to have the same required return as PepsiCo. A. Value both firms with a forecast that abnormal earnings growth (AEG) will continue after 2012 at the same level as in 2012. B. Now value the two firms with a forecast that abnormal earnings growth (AEG) will grow at the GDP growth rate of 4 percent per year after 2012. C. Given that you accept the analysts' forecasts for 2011 and 2012, is the market, at $67 per share, forecasting a long-term growth rate for AEG that is higher or lower than the 4 per- cent rate? D. Calculate the PEG ratio for both of the firms. What do you make of this ratio? Real World Connection See Minicase M5.2 in Chapter 5 for a parallel investigation using P/B ratios. Also see Minicase M4.1 in Chapter 4 for an application of discounted cash flow analysis to Coca- Cola. Exercises E4.7, E4.8, E12.7, E15.7, E16.12, E17.7, and E20.4 also deal with Coca- Cola, and Exercises E4.13 and E10.9 deal with PepsiCo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts