Question: Please, only solve question 12 if you are able to solve all the problems according to their requirements! I have uploaded the complete document as

Please, only solve question 12 if you are able to solve all the problems according to their requirements! I have uploaded the complete document as you have to take into account other exercises.

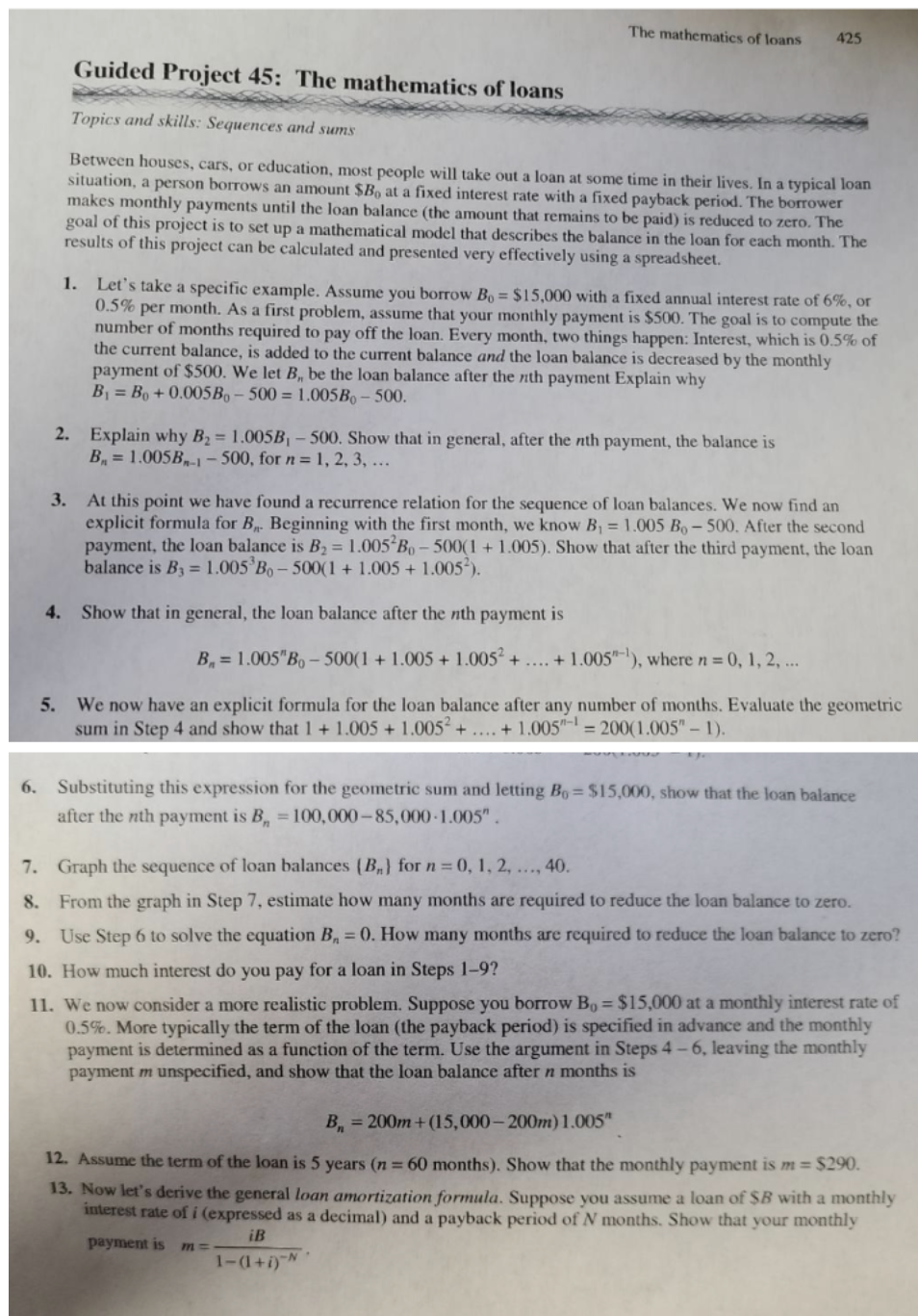

Topics and skills: Sequences and sums Between houses, cars, or education, most people will take out a loan at some time in their lives. In a typical loan situation, a person borrows an amount $B0 at a fixed interest rate with a fixed payback period. The borrower makes monthly payments until the loan balance (the amount that remains to be paid) is reduced to zero. The goal of this project is to set up a mathematical model that describes the balance in the loan for each month. The results of this project can be calculated and presented very effectively using a spreadsheet. 1. Let's take a specific example. Assume you borrow B0=$15,000 with a fixed annual interest rate of 6%, or 0.5% per month. As a first problem, assume that your monthly payment is $500. The goal is to compute the number of months required to pay off the loan. Every month, two things happen: Interest, which is 0.5% of the current balance, is added to the current balance and the loan balance is decreased by the monthly payment of $500. We let Bn be the loan balance after the nth payment Explain why B1=B0+0.005B0500=1.005B0500. 2. Explain why B2=1.005B1500. Show that in general, after the nth payment, the balance is Bn=1.005Bn1500, for n=1,2,3, 3. At this point we have found a recurrence relation for the sequence of loan balances. We now find an explicit formula for Bn. Beginning with the first month, we know B1=1.005B0500. After the second payment, the loan balance is B2=1.0052B0500(1+1.005). Show that after the third payment, the loan balance is B3=1.0053B0500(1+1.005+1.0052). 4. Show that in general, the loan balance after the nth payment is Bn=1.005nB0500(1+1.005+1.0052+.+1.005n1),wheren=0,1,2, 5. We now have an explicit formula for the loan balance after any number of months. Evaluate the geometric sum in Step 4 and show that 1+1.005+1.0052+.+1.005n1=200(1.005n1). 6. Substituting this expression for the geometric sum and letting B0=$15,000, show that the loan balance after the nth payment is Bn=100,00085,0001.005n. 7. Graph the sequence of loan balances {Bn} for n=0,1,2,,40. 8. From the graph in Step 7, estimate how many months are required to reduce the loan balance to zero. 9. Use Step 6 to solve the equation Bn=0. How many months are required to reduce the loan balance to zero? 10. How much interest do you pay for a loan in Steps 1-9? 11. We now consider a more realistic problem. Suppose you borrow B0=$15,000 at a monthly interest rate of 0.5%. More typically the term of the loan (the payback period) is specified in advance and the monthly payment is determined as a function of the term. Use the argument in Steps 46, leaving the monthly payment m unspecified, and show that the loan balance after n months is Bn=200m+(15,000200m)1.005n 12. Assume the term of the loan is 5 years ( n=60 months). Show that the monthly payment is m=$290. 13. Now let's derive the general loan amortization formula. Suppose you assume a loan of $B with a monthly interest rate of i (expressed as a decimal) and a payback period of N months. Show that your monthly payment is m=1(1+i)NiB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts