Question: Please only use excel formulas and show them so I can understand. For f, calculate beta for Goodman and Landry stock. Here are the values

Please only use excel formulas and show them so I can understand. For f, calculate beta for Goodman and Landry stock.

Please only use excel formulas and show them so I can understand. For f, calculate beta for Goodman and Landry stock.

Here are the values for Goodman and Landry stock. For g, calculate the portfolio's new required return given the new values in g's directions. Thank you!

For g, calculate the portfolio's new required return given the new values in g's directions. Thank you!

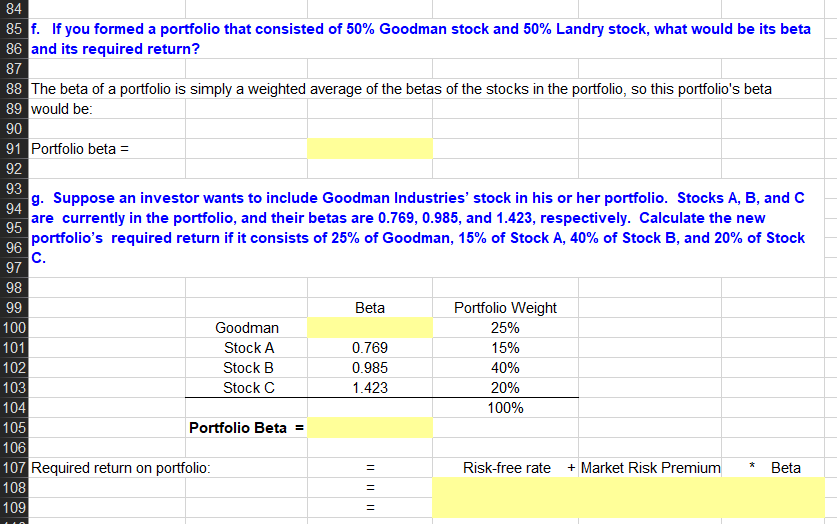

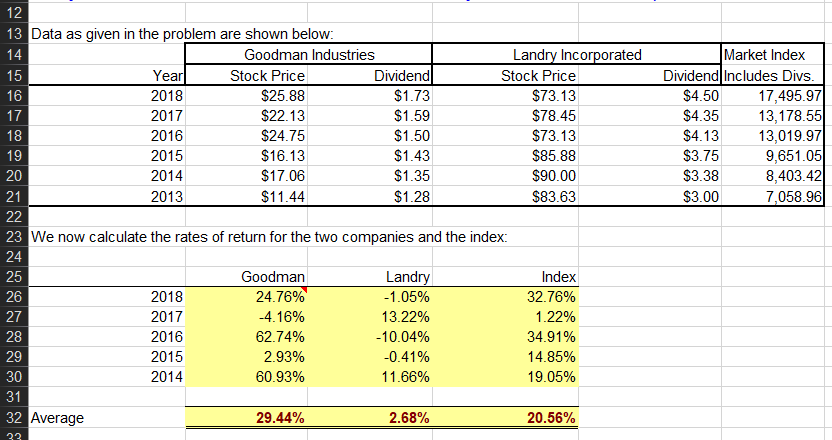

84 85 86 87 f. If you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what would be its beta and its required return? The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's beta 9 would be 90 8 Portfolio beta - 92 93 g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, and C 94 are currently in the portfolio, and their betas are 0.769, 0.985, and 1.423, respectively. Calculate the new 95 portfolio's required return if it consists of 25% of Goodman, 15% of Stock A, 40% of Stock B, and 20% of Stock 96 97 98 Portfolio Weight 25% 15% 40% 20% 100% Beta Goodman Stock A Stock B Stock C 100 101 102 103 104 105 106 0.769 0.985 1.423 Portfolio Beta Risk-free rate +Market Risk PremiumBeta Required return on portfolio 108 109 13 Data as given in the problem are shown below 15 17 Goodman Industries Landry Inco rated Market Index Dividend Includes Divs Year 2018 2017 2016 2015 2014 2013 Stock Price $25.88 $22.13 $24.75 $16.13 $17.06 Dividend $1.73 $1.59 $1.50 $1.43 $1.35 Stock Price $73.13 $78.45 $73.13 $85.88 $90.00 $4.50 $4.35 $4.13 $3.75 $3.38 S3.00 17,495.97 13,178.55 13,019.97 9,651.05 8,403.42 7,058.96 18 20 21 23 24 25 26 27 28 29 30 We now calculate the rates of return for the two companies and the index: 2018 2017 2016 2015 2014 Goodman 24.76% -4.16% 62.74% 2.93% 60.93% Land -1.05% 13.22% -10.04% -0.41% 1 1.66% Index 3276% 1.22% 34.91% 14.85% 19.05% 32 Average 29.44% 2.68% 20.56%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts