Question: Please only use excel formulas and show them so I can understand. For e, calculate the required returns using the Security Market Line equation. Please

Please only use excel formulas and show them so I can understand. For e, calculate the required returns using the Security Market Line equation. Please include the rows and columns in your picture so I can follow along. Thank you!

Please only use excel formulas and show them so I can understand. For e, calculate the required returns using the Security Market Line equation. Please include the rows and columns in your picture so I can follow along. Thank you!

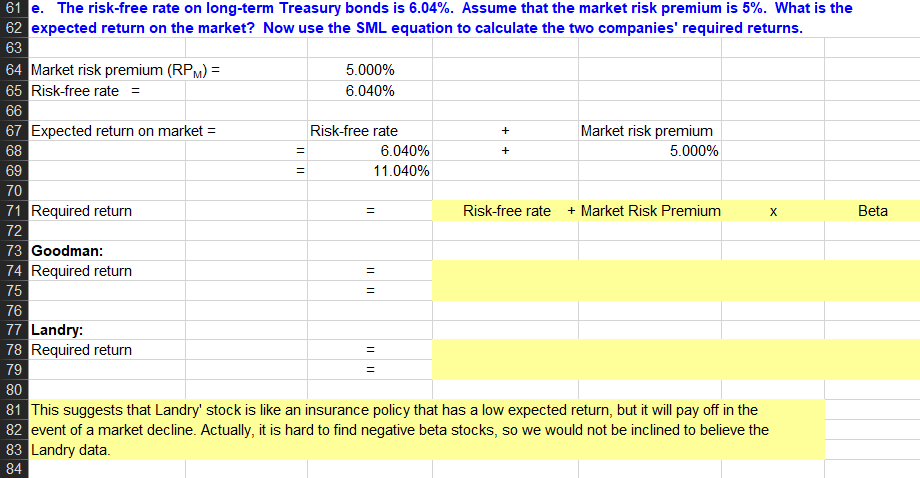

e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is 5%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns 62 63 64 Market risk premium (RPM)- Risk-free rate 5.000% 6.040% 67 68 69 70 Expected return on market- Risk-free rate Market risk premium 5.000% 6.040% 11 .040% Required return Risk-free rate +Market Risk Premium Beta 72 Goodman Required return 75 76 Landry: Required return 79 80 82 83 84 This suggests that Landry' stock is like an insurance policy that has a low expected return, but it will pay off in the event of a market decline. Actually, it is hard to find negative beta stocks, so we would not be inclined to believe the Landry data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts