Question: Please perform a DCF Valuation. Use several different terminal value estimates. Discuss and explain which terminal value estimate you have the most and least confidence

Please perform a DCF Valuation.

- Use several different terminal value estimates. Discuss and explain which terminal value estimate you have the most and least confidence in. Discuss concerns you have with the assumptions underlying the financial forecast. How do reasonable variations in key assumptions affect the valuation?Are there any other valuation methodologies you would consider? If so, describe them.

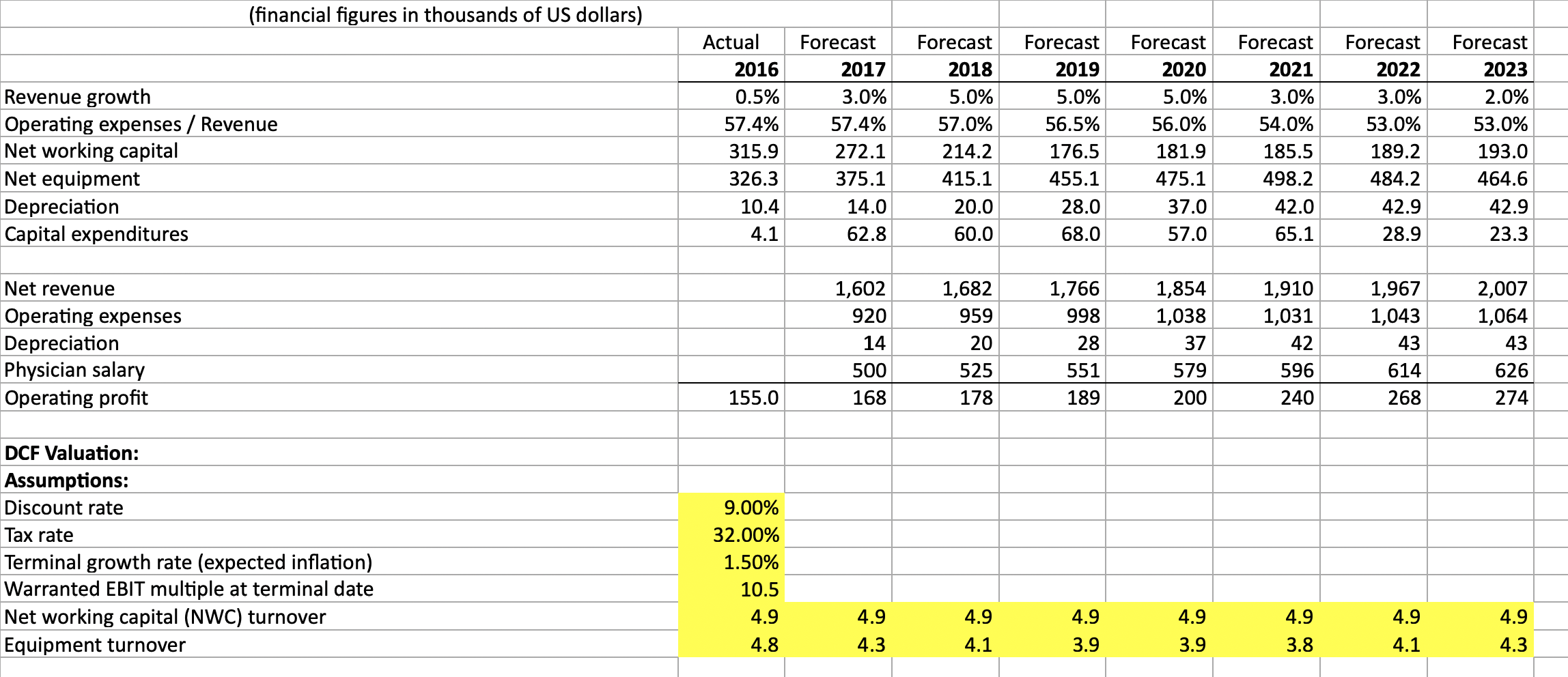

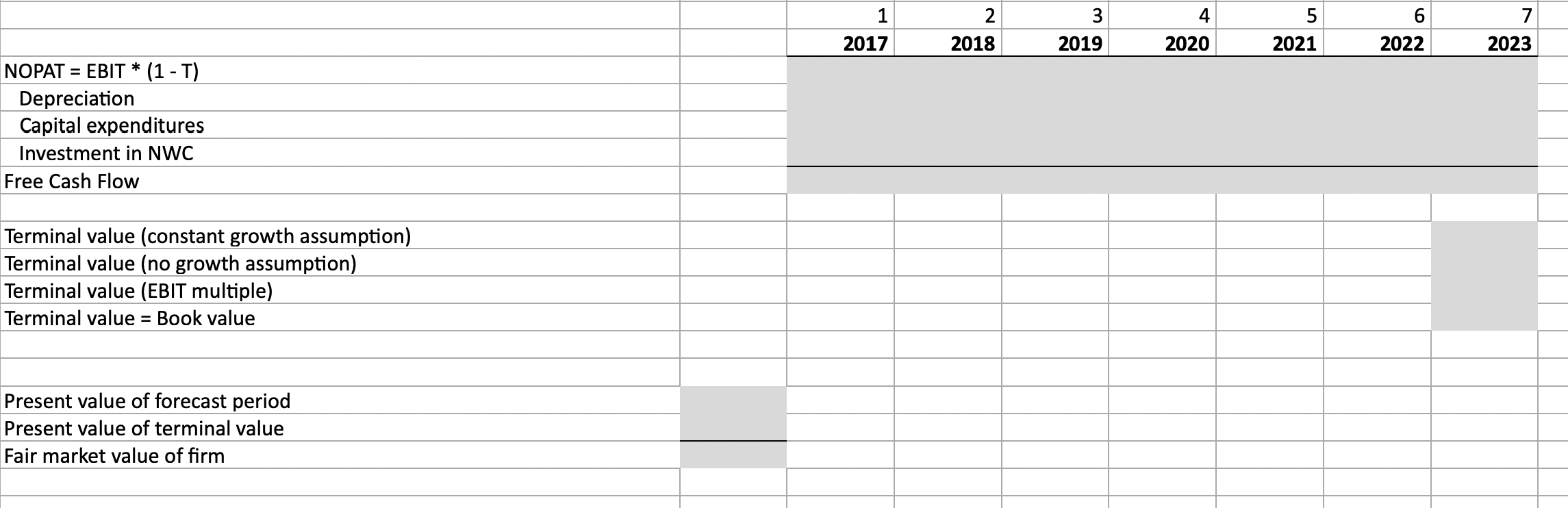

(financial figures in thousands of US dollars) Actual 2016 0.5% 57.4% Forecast 2017 3.0% 57.4% 272.1 375.1 14.0 62.8 Forecast 2018 5.0% 57.0% 214.2 415.1 20.0 60.0 Revenue growth Operating expenses / Revenue Net working capital Net equipment Depreciation Capital expenditures Forecast 2019 5.0% 56.5% 176.5 455.1 28.0 68.0 Forecast 2020 5.0% 56.0% 181.9 475.1 37.0 57.0 Forecast 2021 3.0% 54.0% 185.5 forecast 2022 3.0% 53.0% 189.2 484.2 42.9 28.9 Forecast 2023 2.0% 53.0% 193.0 464.6 42.9 23.3 315.9 498.2 326.3 10.4 42.0 65.1 4.1 Net revenue Operating expenses Depreciation Physician salary Operating profit 1,602 920 14 500 168 1,682 959 20 525 178 1,766 998 28 551 189 1,854 1,038 37 1,910 1,031 42 596 240 1,967 1,043 43 614 268 2,007 1,064 43 626 274 579 200 155.0 9.00% 32.00% DCF Valuation: Assumptions: Discount rate Tax rate Terminal growth rate (expected inflation) Warranted EBIT multiple at terminal date Net working capital (NWC) turnover Equipment turnover 1.50% 10.5 - 4.9 4.8 4.9 4.3 4.9 4.1 4.9 3.9 4.9 3.9 4.9 3.8 4.9 4.1 4.9 4.3 2 2018 3 2019 4 2020 5 2021 6 2022 2017 2023 NOPAT = EBIT * (1 - T) Depreciation Capital expenditures Investment in NWC Free Cash Flow Terminal value (constant growth assumption) Terminal value (no growth assumption) Terminal value (EBIT multiple) Terminal value = Book value Present value of forecast period Present value of terminal value Fair market value of firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts