Question: PLEASE PLEASE PLEASE answer all it would really help me out i have no idea what to do on these if i could i would

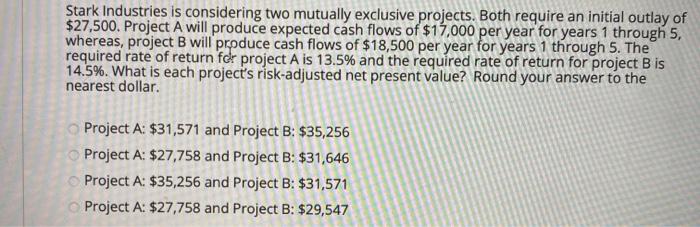

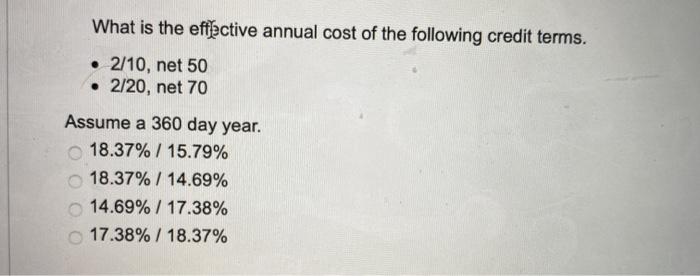

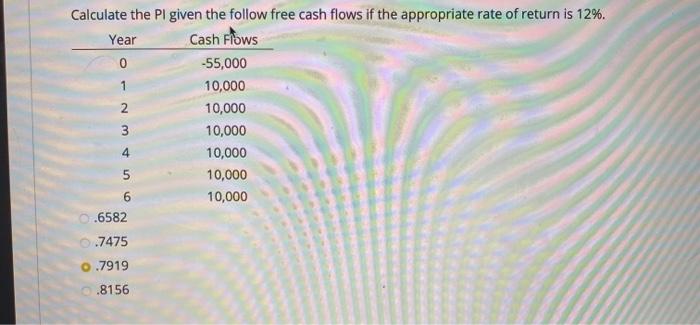

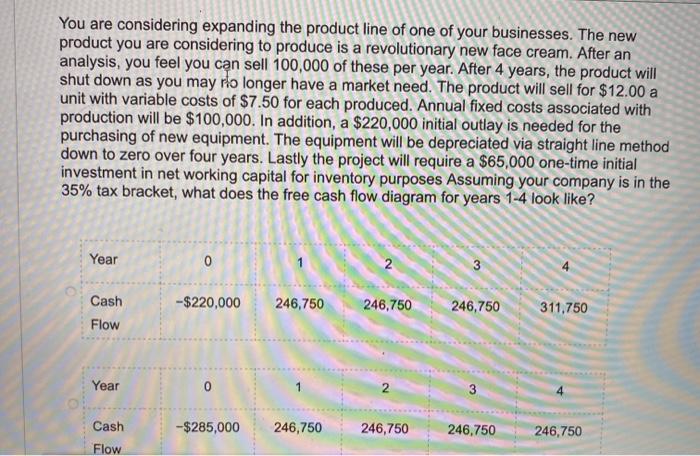

Stark Industries is considering two mutually exclusive projects. Both require an initial outlay of $27,500. Project A will produce expected cash flows of $17,000 per year for years 1 through 5, whereas, project B will produce cash flows of $18,500 per year for years 1 through 5. The required rate of return for project A is 13.5% and the required rate of return for project B is 14.5%. What is each project's risk-adjusted net present value? Round your answer to the nearest dollar. Project A: $31,571 and Project B: $35,256 Project A: $27,758 and Project B: $31,646 Project A: $35,256 and Project B: $31,571 Project A: $27,758 and Project B: $29,547 What is the effective annual cost of the following credit terms. 2/10, net 50 2/20, net 70 Assume a 360 day year. 18.37% / 15.79% 18.37% / 14.69% 14.69% / 17.38% 17.38% / 18.37% 0 Calculate the PI given the follow free cash flows if the appropriate rate of return is 12%. Year Cash Flows -55,000 10,000 10,000 3 10,000 10,000 10,000 10,000 .6582 .7475 0.7919 .8156 You are considering expanding the product line of one of your businesses. The new product you are considering to produce is a revolutionary new face cream. After an analysis, you feel you can sell 100,000 of these per year. After 4 years, the product will shut down as you may rlo longer have a market need. The product will sell for $12.00 a unit with variable costs of $7.50 for each produced. Annual fixed costs associated with production will be $100,000. In addition, a $220,000 initial outlay is needed for the purchasing of new equipment. The equipment will be depreciated via straight line method down to zero over four years. Lastly the project will require a $65,000 one-time initial investment in net working capital for inventory purposes Assuming your company is in the 35% tax bracket, what does the free cash flow diagram for years 1-4 look like? Year 0 2 3 -$220,000 246,750 Cash Flow 246.750 246,750 311,750 Year 2 3 -$285,000 246,750 246,750 Cash Flow 246,750 246,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts