Question: please please please make sure your answer and work is fit to the screen of the image that you send please adjust it to be

please please please make sure your answer and work is fit to the screen of the image that you send please adjust it to be smaller and fit my screen so I can see what you did. PLEASE I have so many of my questions that I can't see the response work.

please please please make sure your answer and work is fit to the screen of the image that you send please adjust it to be smaller and fit my screen so I can see what you did. PLEASE I have so many of my questions that I can't see the response work.

thank you

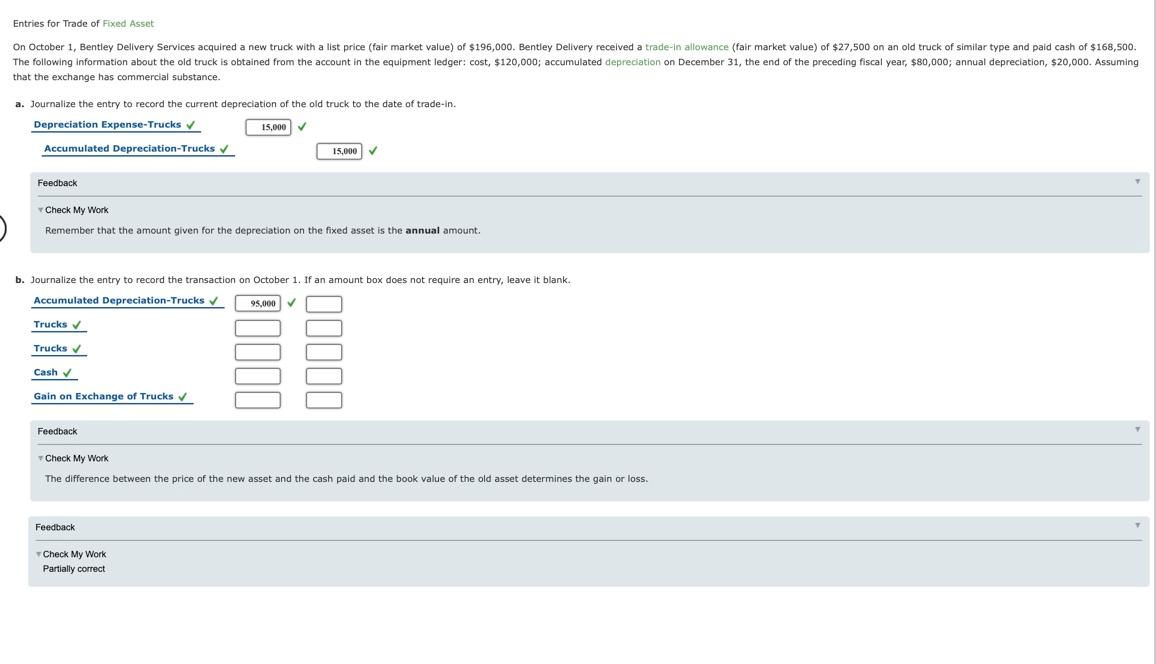

Entries for Trade of Fixed Asset On October 1, Bentley Delivery Services acquired a new truck with a list price (fair market value) of $196,000. Bentley Delivery received a trade-in allowance (fair market value) of $27,500 on an old truck of similar type and paid cash of $168,500. The following information about the old truck is obtained from the account in the equipment ledger: cost, $120,000; accumulated depreciation on December 31, the end of the preceding fiscal year, $80,000; annual depreciation, $20,000. Assuming that the exchange has commercial substance. a. Journalize the entry to record the current depreciation of the old truck to the date of trade-in. Depreciation Expense-Trucks 15,000 Accumulated Depreciation-Trucks 15,000 Feedback Check My Work Remember that the amount given for the depreciation on the fixed asset is the annual amount. amount box does not require an entry, leave it blank. b. Journalize the entry to record the transaction on October 1. If Accumulated Depreciation-Trucks 95.000 Trucks Trucks lllll 11110 Cash Gain on Exchange of Trucks Feedback Check My Work The difference between the price of the new asset and the cash paid and the book value of the old asset determines the gain or loss. Feedback Check My Work Partially correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts