Question: Please post step by step with no excel. answer has to be one of those answers. thanks . 9. You have decided to invest in

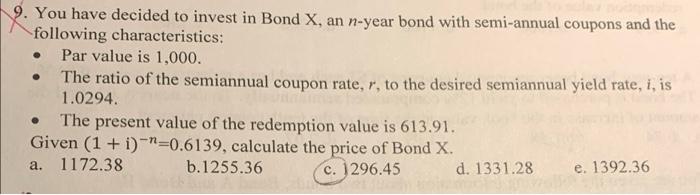

. 9. You have decided to invest in Bond X, an n-year bond with semi-annual coupons and the following characteristics: Par value is 1,000. The ratio of the semiannual coupon rate, r, to the desired semiannual yield rate, i, is 1.0294. The present value of the redemption value is 613.91. Given (1 + i)-n=0.6139, calculate the price of Bond X. 1172.38 b.1255.36 c. 1296.45 d. 1331.28 e. 1392.36 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts