Question: Please prepare the journal entry for each question 1-4. I have the depreciation costs calculated already but I don't know how to prepare the journal

Please prepare the journal entry for each question 1-4. I have the depreciation costs calculated already but I don't know how to prepare the journal entries.

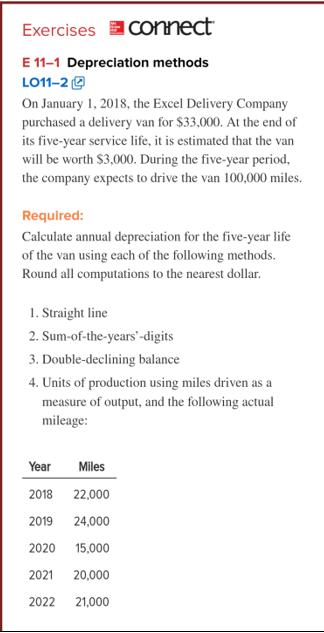

- Straight line: (33000-3000)/5 = $6000 per year

- Sum of the years digits

- 2018: $10000 per year

- 2019: $8000 per year

- 2020: $6000 per year

- 2021: $4000 per year

- 2022: $2000 per year

- Total is $30,000

- Double-declining balance depreciation rate: 40%

- 2018: Depreciation = $13,200

- 2019: Depreciation = $7,920

- 2020: Depreciation = $4,752

- 2021: Depreciation = 2,851

- 2022 Depreciation = 1277

- Units of Production - .30 per mile depreciation rate

- 2018: $6600

- 2019: $7200

- 2020: $4500

- 2021: $6000

- 2022: $5700

ises EConnect Exercises E 11-1 Depreciation methods LO11-22 On January 1, 2018, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 miles. Required Calculate annual depreciation for the five-year life of the van using each of the following methods. Round all computations to the nearest dollar 1. Straight line 2. Sum-of-the-years -digits 3. Double-declining balance 4. Units of production using miles driven as a measure of output, and the following actual mileage YearMiles 2018 22,000 2019 24,000 2020 15,000 2021 20,000 2022 21,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts