Question: please provide a correct answer! 10 6 7 9 10 1 3 4 5 6 7 exercise, change the status to DONE B D G

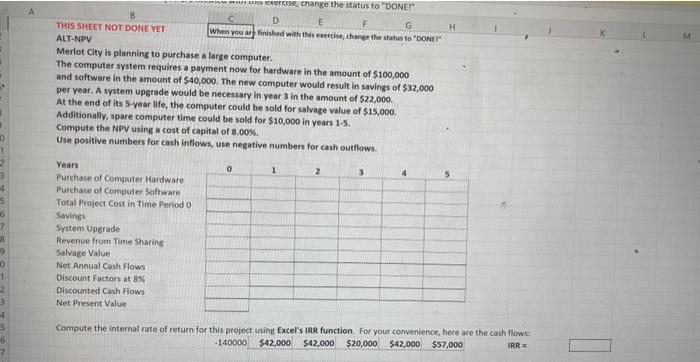

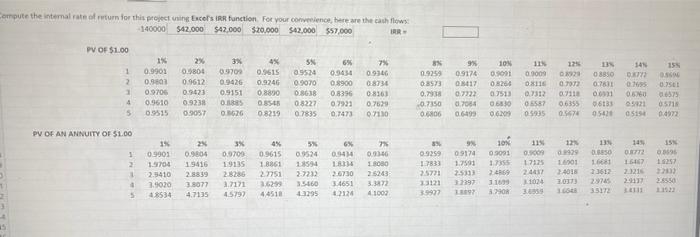

10 6 7 9 10 1 3 4 5 6 7 exercise, change the status to "DONE" B D G H THIS SHEET NOT DONE YET ALT-NPV When you are finished with this exercise, change the status to "DONE" Merlot City is planning to purchase a large computer. The computer system requires a payment now for hardware in the amount of $100,000 and software in the amount of $40,000. The new computer would result in savings of $32,000 per year. A system upgrade would be necessary in year 3 in the amount of $22,000. At the end of its 5-year life, the computer could be sold for salvage value of $15,000. Additionally, spare computer time could be sold for $10,000 in years 1-5. Compute the NPV using a cost of capital of 8.00%. Use positive numbers for cash inflows, use negative numbers for cash outflows. Years 0 1 2 3 4 Purchase of Computer Hardware Purchase of Computer Software Total Project Cost in Time Period 0 Savings System Upgrade Revenue from Time Sharing Salvage Value Net Annual Cash Flows Discount Factors at 8% Discounted Cash Flows Net Present Value Compute the internal rate of return for this project using Excel's IRR function. For your convenience, here are the cash flows: -140000 $42,000 $42,000 $20,000 $42,000 $57,000 IRR = Compute the internal rate of return for this project using Excel's (RR function. For your convenience, here are the cash flows: 140000 $42,000 $42,000 $20,000 $42,000 $57,000 IRR- PV OF $1.00 1% 2% 6% 8% 12% 14% 15% 1 0.5690 3% 4% 0.9901 09804 0.9709 0.9615 2 0.9801 0.9612 0.9426 0.9246 0.9706 0.9423 0.9151 0.8890 0.9610 0.9238 0.8885 0.85-45 5 09515 0.9057 0.8626 0.8219 5% 7% 09524 0.9434 09346 0.9070 0,8900 08734 0.8638 0.8396 0.8163 0.8227 0.7921 0,7629 0.7835 0.7473 07130 9% 10% 11% 0.9259 09174 0.9091 0.0009 03929 08850 08772 08573 08417 0.8264 08116 0.7972 0.7831 0.7695 0.7501 0.7938 0.7722 0.7513 0.7312 0.7118 0.0931 0.6760 06575 -0.7350 0.7064 06830 06587 0.6355 06133 05921 0.6806 0.6499 06209 05935 0.5674 05426 05154 0.4972 4 05718 PV OF AN ANNUITY OF $1.00 3% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1% 0.9901 1.9704 0.9434 0.9346 2% 0.9804 1.9416 2.8839 4% 0.9709 0.9615 19135 1.8861 2.7751 0.9524 18594 2 18334 1.8000 1.7833 3 2.8286 2.7232 2.6730 25771 26243 0.9259 09174 09091 0.9009 0.9929 08850 08772 16467 1.7591 19257 1.7355 17125 16001 1.6681 24018 23612 25313 2.3216 22832 2.4869 24437 1024 3.0373 29137 29745 2.8550 1.6648 3.5172 34111 34959 2.9410 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.2397 13121 3.1699 S 4.8534 4.7135 44518 4.3295 4.1002 42126 39927 45797 1.8097 3.7908 E t NET 96900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts