Question: Please provide an analysis of competitive issues, globalisation issues and other relevant issues in Malaysian Automotive Industry on the basis of the case study (1500

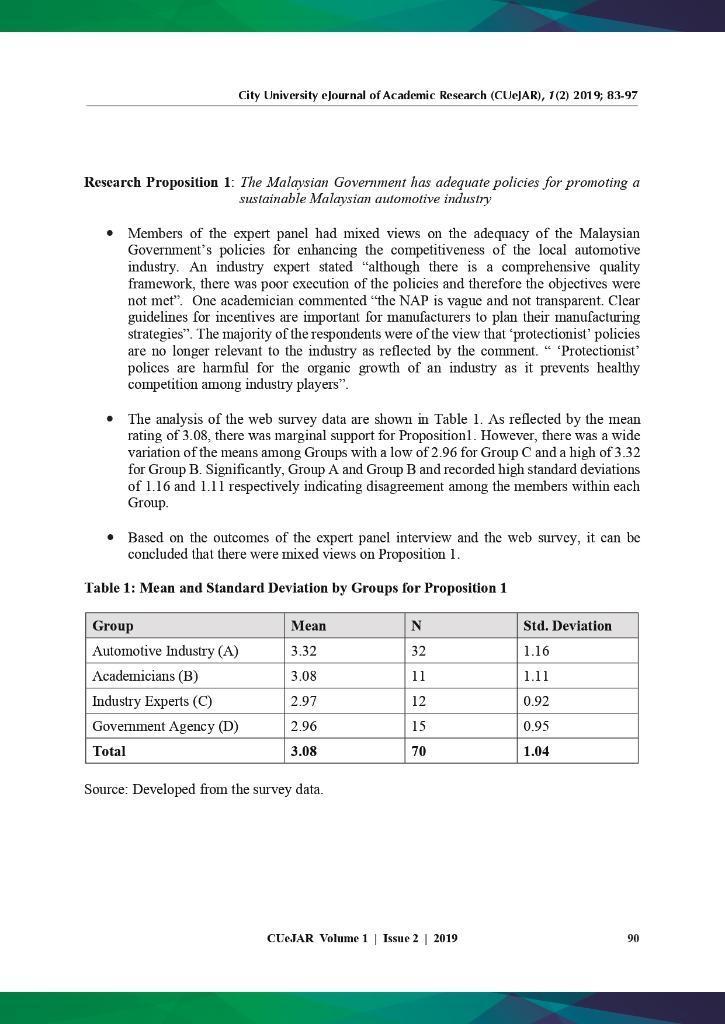

Please provide an analysis of competitive issues, globalisation issues and other relevant issues in Malaysian Automotive Industry on the basis of the case study (1500 words min, 2000 words max).

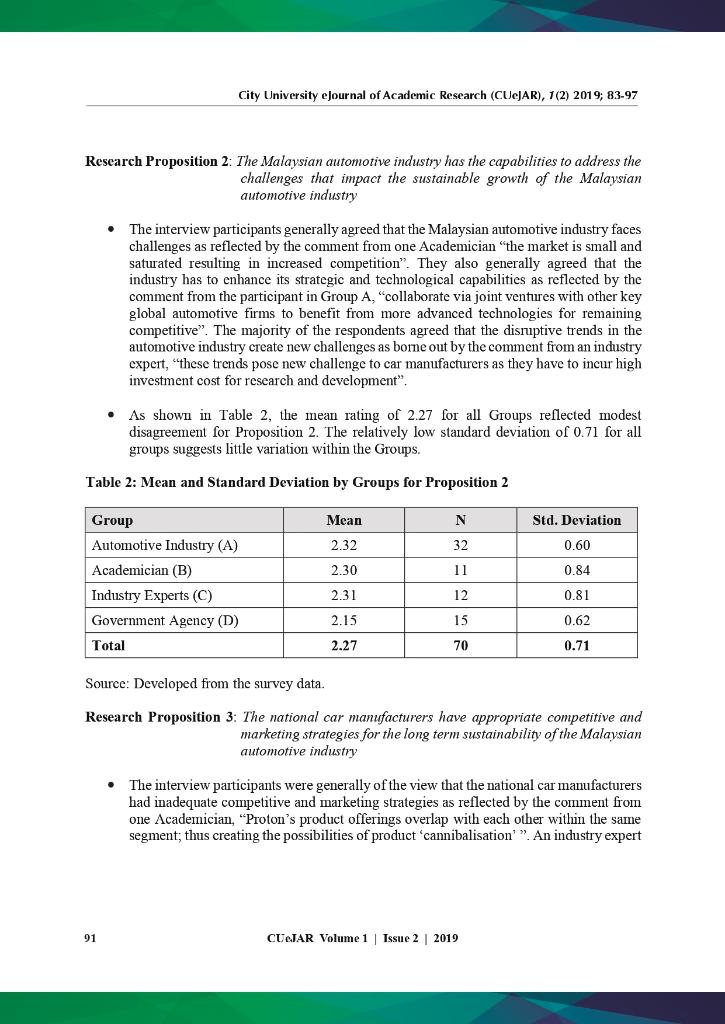

Based on the Malaysian Automotive Industry case study by Lin Lah Tan, Mohd Fahrurazi Bin Othman, and Ming Zhu Li.

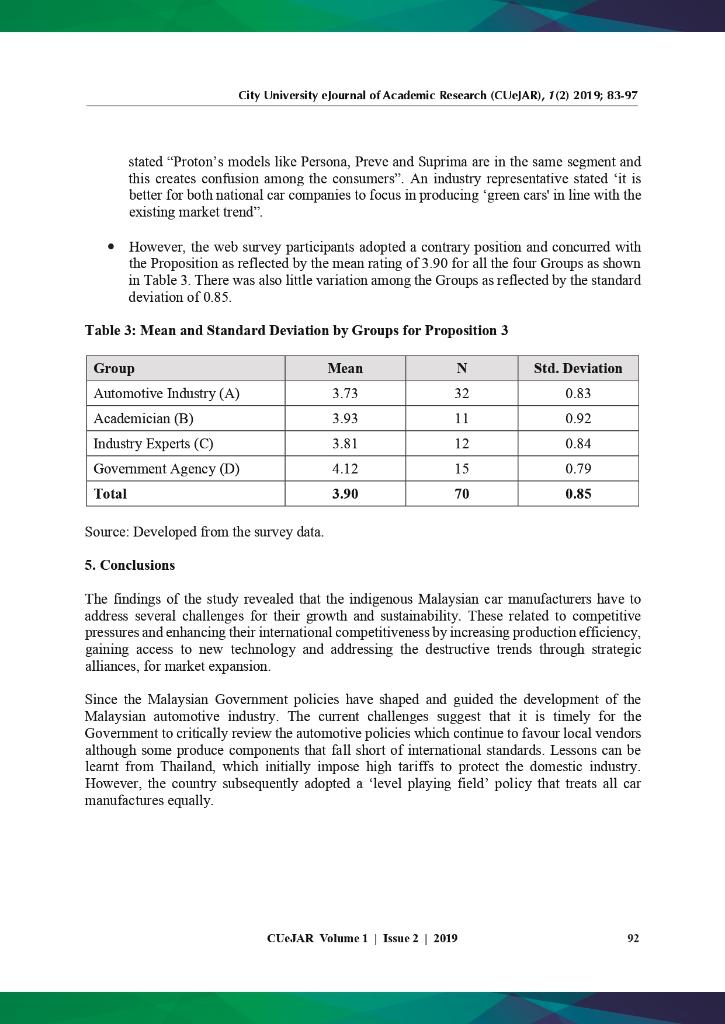

Give the examples and references too.

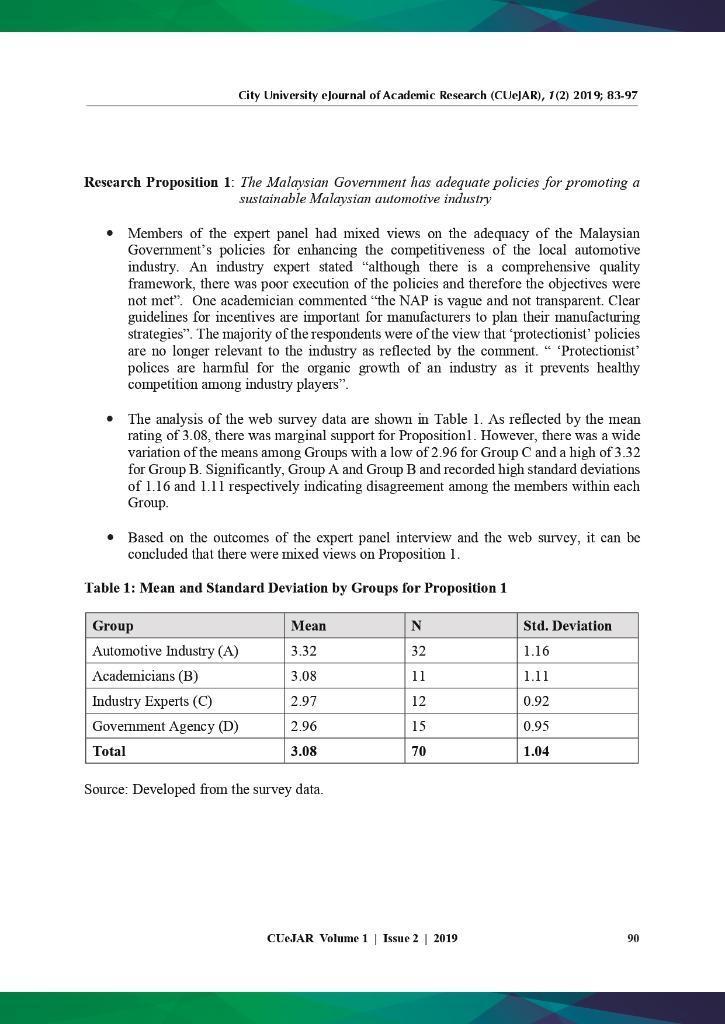

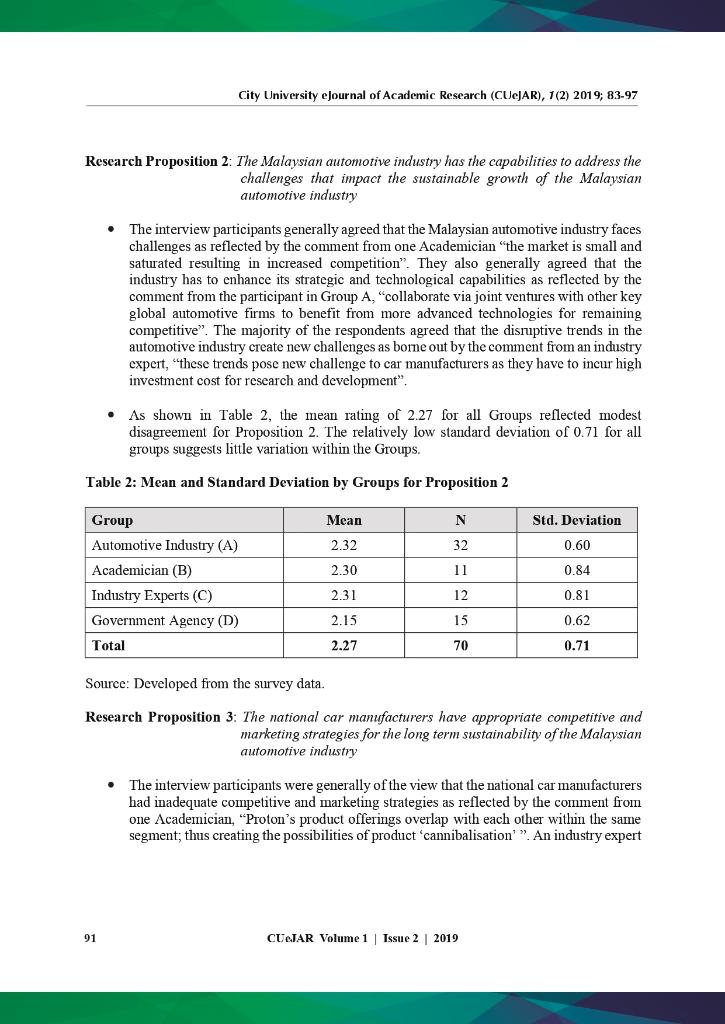

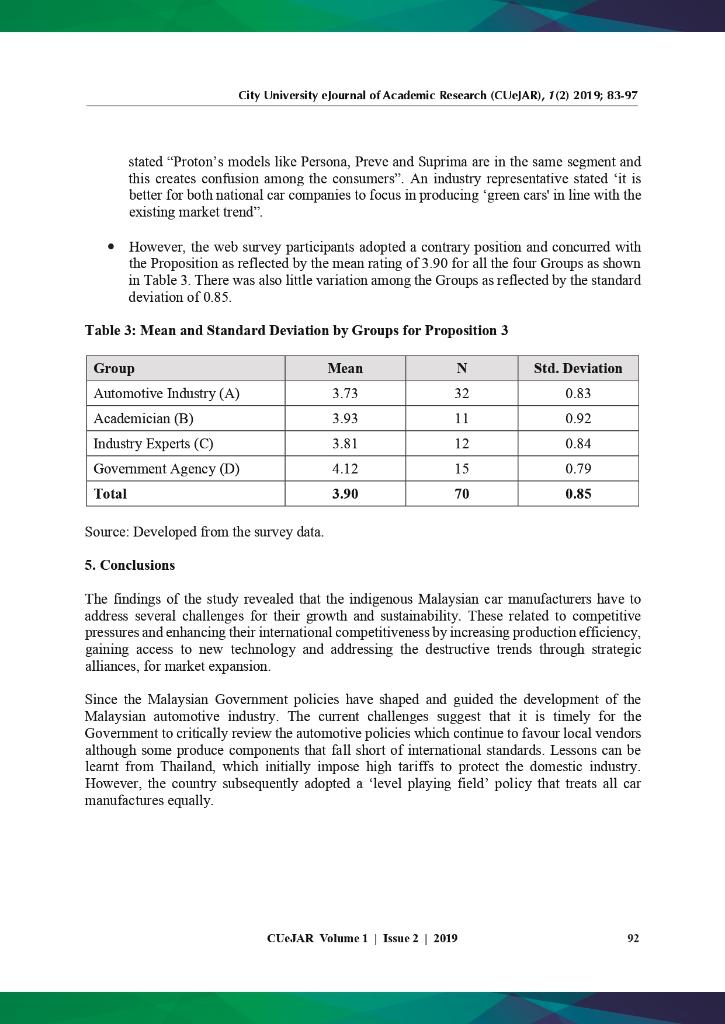

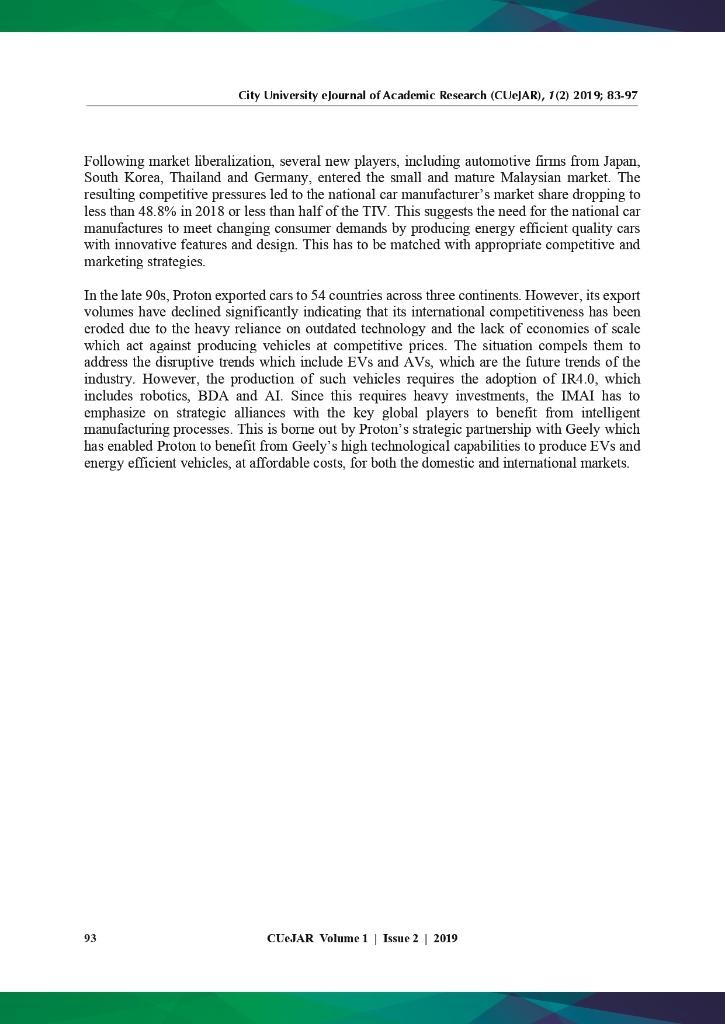

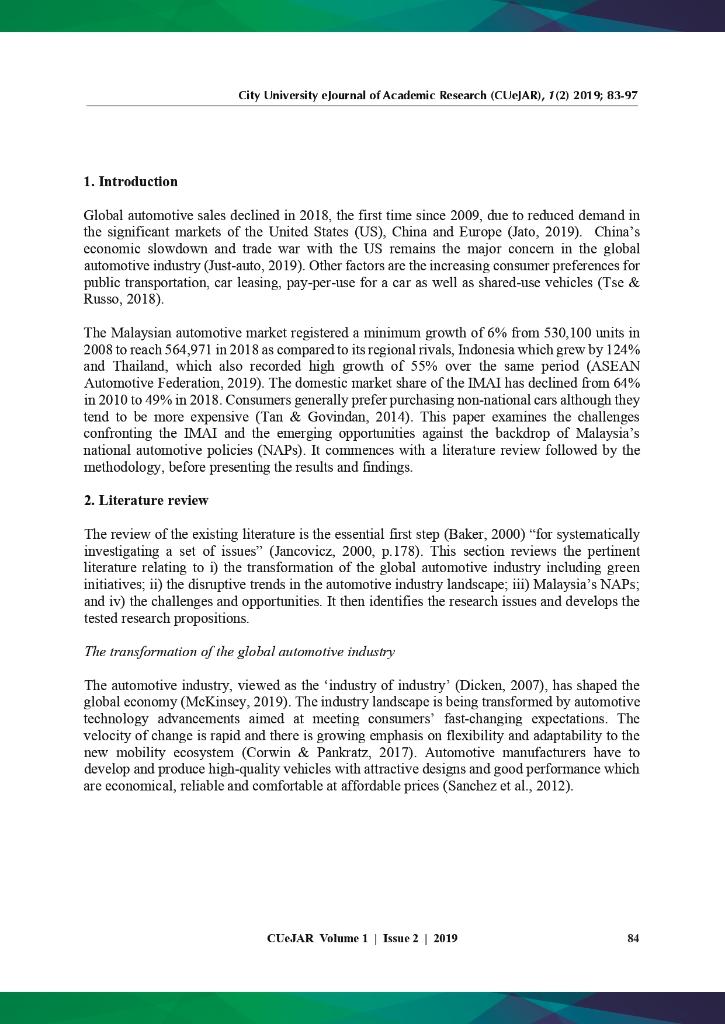

City University eJournal of Academic Research (CUEJAR) e-ISSN: 2682-910X CUJAR Homepage: https://www.city.edu.my/CUJAR OPEN ACCESS Received: 27th September 2019 | Revised: 14th October 2019 | Accepted: 1st November 2019 The challenges and opportunities for enhancing the competitiveness of the indigenous Malaysian automotive industry Lin Lah Tan. Mohd Fahrurazi Bin Othman, Ming Zhu Li Cily Graduate School, City University Malaysia Abstract Introduction: The indigenous Malaysian automotive industry (IMAI) comprising the Proton, and Perodua national brands, accounted for 90% of the Malaysian automotive market in 1998. Despite benefitting from protectionist policies and Government investments, the IMA is losing its competitiveness as reflected by its market share dropping to 42% in 2018. The IMAI is also challenged to align itself to global disruptive trends relating to the new energy vehicles (NEVS) and autonomous vehicles (AVs) which are transforming the automotive industry. This paper identifies the challenges faced by the IMAI, the emerging opportunities and the adequacy of the Government's automotive policies to enhance its competitiveness for sustainable growth. Methodology: Combining inductive and deductive approaches, comprised a qualitative exploratory stage and a descriptive quantitative stage. The data collection instruments were a comprehensive literature review, expert panel interviews and a web survey. Three propositions, developed from the literature review were tested. Findings and discussion: The IMAI are challenged by technology upgrades, weak research and development capability and intense competition in a small fragmented market. The IMAI have to emphasize on Industrial Revolution 4.0 (IR4.0) for manufacturing electric vehicles (EVs) and AVs to effectively compete with the major global players. The Malaysian Government should encourage the IMAI to enter into more joint ventures to gain access to smart technologies. Conclusion: The small domestic market requires the Malaysian national car manufacturers to enhance their international competitiveness, improving quality standards and manufacture environmentally friendly vehicles including EVs and AVs. For this purpose, the Government should create a conducive policy environment. Keywords: IMAI, challenges, competitiveness, disruptive technologies, joint ventures, exports, policies. 83 CUJAR Volume 1 Issue 2 | 2019 City University eJournal of Academic Research (CUEJAR), 1 (2) 2019; 83-97 1. Introduction Global automotive sales declined in 2018, the first time since 2009, due to reduced demand in the significant markets of the United States (US), China and Europe (Jato, 2019). China's economic slowdown and trade war with the US remains the major concern in the global automotive industry (Just-auto, 2019). Other factors are the increasing consumer preferences for public transportation, car leasing, pay-per-use for a car as well as shared-use vehicles (Tse & Russo, 2018) The Malaysian automotive market registered a minimum growth of 6% from 530,100 units in 2008 to reach 564,971 in 2018 as compared to its regional rivals, Indonesia which grew by 124% and Thailand, which also recorded high growth of 55% over the same period (ASEAN Automotive Federation, 2019). The domestic market share of the IMAI has declined from 61% 2010 to 49% in 2018. Consumers generally prefer purchasing non-national cars although they tend to be more expensive (Tan & Govindan, 2014). This paper examines the challenges confronting the IMAI and the emerging opportunities against the backdrop of Malaysia's national automotive policies (NAPs). It cominences with a literature review followed by the methodology, before presenting the results and findings. 2. Literature review The review of the existing literature is the essential first step (Baker, 2000) "for systematically investigating a set of issues" (Jancovicz, 2000, p. 178). This section reviews the pertinent literature relating to i) the transformation of the global automotive industry including green initiatives; ii) the disruptive trends in the automotive industry landscape; iii) Malaysia's NAPs; and iv) the challenges and opportunities. It then identifies the research issues and develops the tested research propositions. The transformation of the global automotive industry The automotive industry, viewed as the 'industry of industry' (Dicken, 2007), has shaped the global economy (McKinsey, 2019). The industry landscape is being transformed by automotive technology advancements aimed at meeting consumers' fast-changing expectations. The velocity of change is rapid and there is growing emphasis on flexibility and adaptability to the new mobility ecosystem (Corwin & Pankratz, 2017). Automotive manufacturers have to develop and produce high-quality vehicles with attractive designs and good performance which are economical, reliable and comfortable at affordable prices (Sanchez et al., 2012). CUJAR Volume 1 Issue 2 | 2019 84 City University eJournal of Academic Research (CUEJAR), 1(2) 2019; 83-97 Road transport accounts for 17% of global greenhouse gas (GHG) emissions which contribute to climate change. The global concerns about GHG emissions have expedited vehicle electrification policies as an alternative to fossil fuel vehicles. Due to environmental pressures, governments are committed to reducing emissions (Gunasekaran & Spalanzani, 2012), and several countries have enacted regulations to prohibit the use of fossil fuel vehicles. They include Norway by 2025, India by 2030, France by 2040 and the United Kingdom by 2050. Automotive manufacturers are developing more efficient engines and drivetrains equipped with sophisticated emissions control technology for producing cleaner vehicles (OICA, 2019). Sustainable initiatives have become the norm among car manufacturers for enhancing their competitive positioning (Luthra et al., 2016). Sustainability includes initiatives for meeting Government regulations, pursuing competitiveness and addressing the growing demand for green products (Woerkom & Zeijl-Rozema, 2017). The automotive industry is emphasizing on green initiatives' to comply with regulatory measures, maintaining sustainable operations, and achieving a better image. These initiatives include green manufacturing, green packaging, green purchasing, green design, green distribution, and reverse logistics (Kumari et al., 2016). Despite the current slowdown, the prospects for the global automotive industry remains bright due to the deployment of new business models that could extend the automotive revenue pool by 30% in 2030 or equivalent to USD1.5 trillion (McKinsey Company, 2016). The disruptive trends in the automotive industry landscape Four significant disruptive trends, namely EVs, shared mobility and AVs, are reconfiguring the automotive industry and leading to a shift from traditional to innovative business models (McKinsey & Company, 2016). EVs are a response to the concerns on climate change and the GHG effects as they contribute to reducing petroleum dependency (Bormann et al., 2018). They also contribute towards improving air quality (Zhou et al., 2014). The EVs related policies, like environmental taxes, incentives as well as price affordability and improved driving range, account for the rapid growth of the EV market (PwC, 2018). Another significant trigger for increasing consumer demand for EVs is the reduced battery cost. In 2016, the battery cost contributed almost half of an EV price, but the percentage is expected to reduce to 18% in 2030 (Pwc, 2018). The lower battery costs have made EVs more price affordable (The Oxford Institute for Energy Studies, 2018) resulting in the global sales of new EVs surpassing 1 million units in 2017 or an increase of 57% as compared to 2016 (PwC, 2018; McKinsey & Company, 2018). The increased driving ranges from a single charge would also contribute to the more rapid penetration of EVs in the market (The Oxford Institute for Energy Studies, 2018; Antoine et al., 2018). The leading vehicle manufacturers are committed to launch more than 100 new EV models by 2040 (McKinsey & Company, 2018) and the forecast is that by 2030, about 40% of new vehicles would use hybrid technology while over 55% would be fully electrified (PwC, 2018). 85 CUJAR Volume 1 Issue 2 | 2019 City University eJournal of Academic Research (CUEJAR), 1(2) 2019; 83-97 The shared mobility or car sharing programs which include free-floating car sharing, stationary car sharing and peer-to-peer car sharing are also gaining popularity (Deloitte, 2017). The growing popularity of shared mobility is manifested by their presence in 2,095 cities with over 157,000 vehicles and 15 million registered members worldwide (Phillips, 2018). A key enabler for this growth is the strong smartphone penetration (Deloitte, 2017). It is forecasted that by 2030, up to one out of ten new cars may likely be a shared vehicle (McKinsey & Company, 2016). Shared mobility presents a competitive value proposition to consumer to avoid issues like traffic jams, lack of parking and additional fees like congestion fee. The younger generation in the urban areas who do not own cars are increasingly preferring to use car sharing concepts in combination with public transport (PwC, 2018). An AV refers to a vehicle that can operate without human control and does not require any human intervention (Bimbraw, 2015). AVs can help to decrease accident rate due to faster reaction time compared to humans. The characteristics of an AV include the ability to sense the local environment, object classification by detection and interpret sensory information to identify appropriate navigation paths (Campbell et al., 2010). The AV technology is positioned to be a game changer in the automotive industry, leading to the greatest relocation of value in the industry (Hayfield, 2019). The forecasted sales for fully AVs, which are only likely to be available after 2020, are estimated at 253, 000 units in 2025, rising to 11.8 million units in 2035 (Hayfield, 2019). Leading car manufacturers are increasingly adopting advanced manufacturing approaches in line with the IR4.0 to develop intelligent manufacturing processes (Sluzarczyk, 2018). They are emphasizing on smart car technologies, involving artificial intelligence (AI), robotics, the Internet of Things and big data (Alamda-Lobo, 2016). Automotive manufacturing robots can improve quality, reduce warranty costs, increase capacity and ease bottlenecks (Acieta, 2019). IoT and AI technologies are accelerating comectivity, autonomous driving, electric powertrains and shared mobility (Singh, 2019). Since big data analytics (BDA) can secure and analyze vast quantities of data on customer purchasing habits their preferences for preferred automotive brands, types of vehicles and the prices they are willing to pay, it enables automotive firms to manufacture automotives that meet changing consumer demands (Heck & Rogers, 2014). However, the adoption of IR4.0 for smart technologies requires heavy investments and this compels vehicle manufacturers to venture into technology-driven mergers and acquisitions which have increased by 60% since 2015 (Ernst & Young, 2018). Several leading firms are teaming up to share the costs and to spread the risks. Ford and Volkswagen are jointly developing EVs and AVs. Honda has invested USD2.75 billion in rival General Motors' driverless unit to jointly launch a fleet of unmanned taxis (Thomas, 2018). CUJAR Volume 1 Issue 2 | 2019 86 City University eJournal of Academic Research (CUEJAR), 1 (2) 2019; 83-97 The IMAI and the Malaysia's NAPS The IMAI, a key industry in the Malaysian economy, has benefitted from the Government's NAPs to become a manufacturer of national cars, namely, Proton and Perodua, within a span of 15 years (Sultana & Ibrahim, 2014). During the early stages, the NAPs were aimed at protecting the 'infant' automotive industry (Rasiah, 2009; Wad & Govindaraju, 2011). Both national car firms were subjected to a lower import duty rate of 13% while the other producers were levied the higher import duty rate of 40% (Torii, 1991). The Government continues to impose non- tariff barriers in the automotive sector in the form of import licences and approved permits for importing cars (Natsuda et al., 2012) to protect the national cars (Rosli & Kari, 2008). The NAPS were reviewed and amended in 2006 and 2009. It was again amended in 2014 with the aim of developing Malaysia as the regional automotive hub in energy efficient vehicles and increasing the exports of vehicles, automotive components, spare parts and related procicts. The targets were to increase the total production volume (TPV) to reach 1.35 million units, the total industry volume (TIV) to reach 1 million units by the year 2020 and increase export volumes to 250,000 units annually (MITI, 2014). The then Prime Minister stated the National Automotive Policy 2014 was holistically developed to move together with the development of the transportation ecosystem in an effort to become more competitive on the global scale" (Ahmad, 2018). However, these targets were not met and the Government, announced in 2018, an update of the NAP which was reported to focus on EVs, comected cars, AI, Next-Gen vehicle and IR4.0. (Tan, 2018). The implementations of the NAP 2018 has been delayed, following the change of Government. However, in August 2019, the current Prime Minister announced that a third national car project would be launched in 2021 and that will be either a hybrid or an EV. Since he also acknowledged "the industry is not doing so well at the moment" (Choong, 2018), the announcement received much criticism, in view of the relatively snall size and fragmented Malaysian market which is shared by more than 30 brands of passenger vehicles (MAA, 2018). Challenges and opportunities The Malaysian automotive industry lacks the economics of scale which constrains the industry from producing vehicles at competitive prices. Despite the massive protection and heavy investments by the Government, the IMAI has not generated the expected results. Over the period 2005-2010, although the Thailand's automotive industry started after the Malaysian automotive industry, Thailand attracted 20 times more foreign direct investments than Malaysia (Natsuda & Tohburn, 2014), Thailand has successfully emerged as one of the automotive manufacturing hubs, and has been referred to as the 'Detroit of Asia (Somolavanij, Jeenanunta & Ammarapala, 2009). This can be attributable to Thailand realizing that protectionist measures act against the rapid development of the local automotive industry since high car prices limit domestic demand, create inefficiencies and not be conducive to industry development (Wan- Ping & Samuel, 2013). Malaysia's NAP, which required Malaysian based car manufacturers to procure selected components from local suppliers, has resulted in some local suppliers producing poor quality components that did not meet international standards (Ferlito, 2015). 87 CUJAR Volume 1 Issue 2 2019 City University eJournal of Academic Research (CUEJAR), 1(2) 2019; 83-97 The challenges are reflected by the problems that impacted on Proton, Malaysia's first national car project. In 1993, Proton had a market share of 73.5%, largely due to the protectionist policies (Muhammad, 2002). It initially exported cars to 54 countries in ASEAN, Europe and South America since its establishment in 1985 (Chung, 2003). However, following market liberalization, Proton's production rapidly decreased by approximately 60% from 233, 297 units in 2001 to 111,871 units in 2007 (Natsuda et al., 2012). Furthermore, by 2018, Proton's market share dropped to 10.8% (MAA, 2019). In view of the firm's poor performance, Khazanah, the Malaysian government's investment arm, sold Proton to DRB-Hicom. In July 2017, DRB- Hicom subsequently sold 49.9% of its controlling stakes to Geely as a strategic partnership to acquire new technologies and penetrate more international markets (The Star Online, 2017). Malaysia is challenged by high carbon emissions which were 12.3 tonnes per capita in 2011 as compared to the world's average of 7.9 tonnes (Malaysia Energy Commission, 2015). The transport sector consumed the highest amount of energy or 43.3% resulting in an increase of CO2 emission of 184.9% within a span of 40 years. This pin-points the need for sustainable environmental control as well as promoting motor vehicle safety (Mohd Jawi et al., 2016) for the long term sustainability of the automotive ccosystem (Borneo Post, 2019). However, market liberalization creates opportunities for the Malaysian national car manufacturers to venture into more international markets through the existing free trade agreements including the China-ASEAN Free Trade Agreement (CAFTA). The growth prospects for Proton are bright. Benefitting from smart technologies from Geely, Proton's sales grew by 23% in June 2019 compared with June 2018, to capture an 18.1% share of the local TIV. It sold 7,615 units, although the TIV for the Malaysian automotive market was estimated to have shrunk by 30.8% to 12,090 units. Proton ranked second in the sales table for three consecutive months (Proton, 2019). The target for the Proton and Geely partnership is to manufacture and sell a total of 400,000 cars in 2027. This enable the brand to regain its leadership position in Malaysia and to become the third largest auto company in ASEAN. As stated by Victor Young, Vice-President of the Geely group, "Proton can sell one million vehicles in 10 years" (Foon, 2019). He also was confident of increasing exports to the ASEAN countries where "only about 3.3 million cars are sold although the population is more than 600 million" (Foon, 2019). The prospects are also bright for Perodua, which rolled out its first model in 1994, through collaboration with Daihatsu. It has been able to enhance its market share from 17.7% in 1995 to 42.6% in 2018. The company which is ranked number 1 in terms of sales in the Malaysian domestic market, is exporting its models to Indonesia, Singapore, Brunei and Sri Lanka (Lee, 2019). CUJAR Volume 1 Issue 2 2019 88 City University eJournal of Academic Research (CUEJAR), 1(2) 2019, 83-97 Research issues and research propositions developments The analysis of the secondary data from the literature review revealed three significant research issues related to the challenges and opportunities for the Malaysian automotive industry, the IMAI and the NAPs (Ridzuan, 2015; Ferlito, 2015; Natsuda & Thoburn, 2014). Based on these, three Propositions which are "theoretical statements about the relationship between two and more concepts" (Neuman, 2006, p.58) were crafted and tested. Research Proposition 1: The Malaysian Government has adequate policies for promoting a sustainable Malaysian automotive industry. Research Proposition 2: The indigenous Malaysian automotive industry has the capabilities to address the challenges that impact the sustainable growth of the Malaysian automotive industry. Research Proposition 3: The national car manufacturers have appropriate competitive and marketing strategies for the long term sustainability of the Malaysian automotive industry. 3. Research methodology Mixed method research, also referred as the thud research methodological movement, has become a preferred choice for much research in multidisciplinary areas (Cameron, 2009). "Its central premise is that the use of qualitative and quantitative approaches in combination provides better understanding of research problems that either approach along" (Creswell & Plano Clark, 2007, p. 5). Accordingly, this study adopted a two stage approach. The first was a qualitative exploratory stage followed by a descriptive quantitative stage. The data collection instruments were a comprehensive literature review, expert panel interviews and a web survey. The interview and web survey participants, drawn from the target population were categorized into four Groups, i) automotive industry; ii) academicians, iii) industry experts and iv) Government agencies. The expert panel interviews benefited from 12 participants while the web survey comprised 70 participants. Content analysis was used to analyse the qualitative data and descriptive statistics were generated from the analysis of the quantitative data. 4. Results and discussion Three discussion topics related to each research Proposition, were addressed by the participants in the expert panel. These discussion topics were the basis for scripting the questions for the web survey. Each proposition was tested by matching the views expressed by members of the expert panel with the findings of the web survey. 89 CUJAR Volume 1 Issue 2 2019 City University eJournal of Academic Research (CUEJAR), 1(2) 2019; 83-97 Research Proposition 1: The Malaysian Government has adequate policies for promoting a sustainable Malaysian automotive industry Members of the expert panel had mixed views on the adequacy of the Malaysian Government's policies for enhancing the competitiveness of the local automotive industry. An industry expert stated "although there is a comprehensive quality framework, there was poor execution of the policies and therefore the objectives were not met". One academician commented the NAP is vague and not transparent. Clear guidelines for incentives are important for manufacturers to plan their manufacturing strategies. The majority of the respondents were of the view that protectionist' policies are no longer relevant to the industry as reflected by the comment. 'Protectionist polices are harmful for the organic growth of an industry as it prevents healthy competition among industry players". . The analysis of the web survey data are shown in Table 1. As reflected by the mean rating of 3.08, there was marginal support for Proposition. However, there was wide variation of the means among Groups with a low of 2.96 for Group C and a high of 3.32 for Group B. Significantly, Group A and Group B and recorded high standard deviations of 1.16 and 1.11 respectively indicating disagreement among the members within each Group . Based on the outcomes of the expert panel interview and the web survey, it can be concluded that there were mixed views on Proposition 1. Table 1: Mean and Standard Deviation by Groups for Proposition 1 Mean N Std. Deviation 3.32 32 1.16 3.08 11 Group Automotive Industry (A) Academicians (B) Industry Experts (C) Government Agency (D) Total 1.11 0.92 2.97 12 2.96 15 0.95 3.08 70 1.04 Source: Developed from the survey data. CUJAR Volume 1 Issue 2 | 2019 90 City University eJournal of Academic Research (CUEJAR), 1 (2) 2019; 83-97 Research Proposition 2: The Malaysian automotive industry has the capabilities to address the challenges that impact the sustainable growth of the Malaysian automotive industry The interview participants generally agreed that the Malaysian automotive industry faces challenges as reflected by the comment from one Academician "the market is small and saturated resulting in increased competition. They also generally agreed that the industry has to enhance its strategic and technological capabilities as reflected by the comment from the participant in Group A, "collaborate via joint ventures with other key global automotive firms to benefit from more advanced technologies for remaining competitive. The majority of the respondents agreed that the disruptive trends in the automotive industry create new challenges as bome out by the comment from an industry expert, these trends pose new challenge to car manufacturers as they have to incur high investment cost for research and development". . As shown in Table 2, the mean rating of 2.27 for all Groups reflected modest disagreement for Proposition 2. The relatively low standard deviation of 0.71 for all groups suggests little variation within the Groups. Table 2: Mean and Standard Deviation by Groups for Proposition 2 Mean N Std. Deviation 2.32 32 0.60 2.30 11 0.84 Group Automotive Industry (A) Academician (B) Industry Experts (C) Government Agency (D) Total 2.31 12 0.81 2.15 15 0.62 2.27 70 0.71 Source: Developed from the survey data Research Proposition 3: The national car manufacturers have appropriate competitive and marketing strategies for the long term sustainability of the Malaysian automotive industry The interview participants were generally of the view that the national car manufacturers had inadequate competitive and marketing strategies as reflected by the comment from one Academician, "Proton's product offerings overlap with each other within the saine segment; thus creating the possibilities of product cannibalisation'"An industry expert 91 CUJAR Volume 1 Issue 2 2019 City University eJournal of Academic Research (CUEJAR), 1 (2) 2019; 83-97 stated "Proton's models like Persona, Preve and Suprima are in the same segment and this creates confusion among the consumers". An industry representative stated 'it is better for both national car companies to focus in producing 'green cars' in line with the existing market trend". However, the web survey participants adopted a contrary position and concuired with the Proposition as reflected by the mean rating of 3.90 for all the four Groups as shown in Table 3. There was also little variation among the Groups as reflected by the standard deviation of 0.85. Table 3: Mean and Standard Deviation by Groups for Proposition 3 Mean 3.73 N 32 Std. Deviation 0.83 Group Automotive Industry (A) Academician (B) Industry Experts (C) Government Agency (D) 3.93 11 0.92 3.81 12 0.84 4.12 15 0.79 Total 3.90 70 0.85 Source: Developed from the survey data. 5. Conclusions The findings of the study revealed that the indigenous Malaysian car manufacturers have to address several challenges for their growth and sustainability. These related to competitive pressures and enhancing their international competitiveness by increasing production efficiency, gaining access to new technology and addressing the destructive trends through strategic alliances, for market expansion Since the Malaysian Government policies have shaped and guided the development of the Malaysian automotive industry. The current challenges suggest that it is timely for the Government to critically review the automotive policies which continue to favour local vendors although some produce components that fall short of international standards. Lessons can be learnt from Thailand, which initially impose high tariffs to protect the domestic industry. However, the country subsequently adopted a 'level playing field policy that treats all car manufactures equally. CUJAR Volume 1 Issue 2 2019 92 City University eJournal of Academic Research (CUEJAR), 1 (2) 2019; 83-97 Following market liberalization, several new players, including automotive firms from Japan, South Korea, Thailand and Germany, entered the small and mature Malaysian market. The resulting competitive pressures led to the national car manufacturer's market share dropping to less than 48.8% in 2018 or less than half of the TIV. This suggests the need for the national car manufactures to meet changing consumer demands by producing energy efficient quality cars with innovative features and design. This has to be matched with appropriate competitive and marketing strategies. In the late 90s, Proton exported cars to 54 countries across three continents. However, its export volumes have declined significantly indicating that its international competitiveness has been croded due to the heavy reliance on outdated technology and the lack of economics of scale which act against producing vehicles at competitive prices. The situation compels them to address the disruptive trends which include EVs and AVs, which are the future trends of the industry. However, the production of such vehicles requires the adoption of IR4.0, which includes robotics, BDA and AI. Since this requires heavy investments, the IMAI has to emphasize on strategic alliances with the key global players to benefit from intelligent manufacturing processes. This is borne out by Proton's strategic partnership with Geely which has enabled Proton to benefit from Geely's high technological capabilities to produce EVs and energy efficient costs, for both lestic markets. at 93 CUJAR Volume 1 Issue 2 2019