Question: Please provide specific Excel functions =NPV(), =IRR(), =AVERAGE(), =YIELD() whenever applicable. Q2: The year-by-year annual returns after the World War II are provided on the

Please provide specific Excel functions =NPV(), =IRR(), =AVERAGE(), =YIELD() whenever applicable.

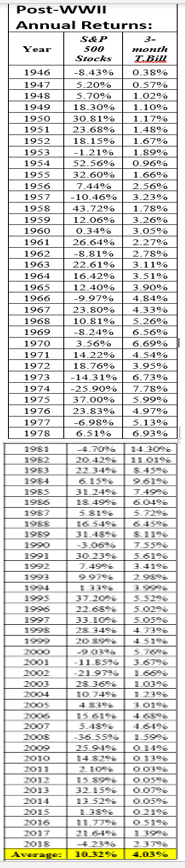

Q2: The year-by-year annual returns after the World War II are provided on the Excel answer sheet, the tab Case 3. Use =AVERAGE function to compute the post-WW2 1946-2018 average return for S&P stock market index (Rm) and for US risk-free T-bill (Rf), respectively. With such Rm and Rf amounts, and if Microthins stock beta = 1.25 (based on the period of 1946-2018), what shall be the required return amount on Microthin stock if you apply the CAPM formula?

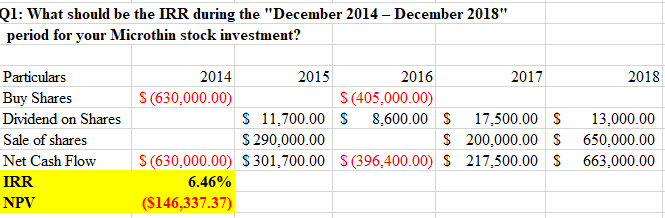

Q3: Based on your answers to Q1 and Q2, and apply both NPV and IRR rules, has your Microthin stock investment over the "Dec 2014 Dec 2018 period been good or bad?

The TABS are correct there should only be 2.

Post-Wwii Annual Returns: S& P Year son Porrhe Stocks TBAN 1946 -8.4396 1947 5.2006 0.5706 1948 5.7096 1949 18 3096 1.1096 1950 30.816 1951 23.6896 1.489 1952 1 18.159 1.679 1953 -1 2196 1954 152.5696 1955 32.6096 1.6696 1956 1957 -10.4696 3.236 1958 43.7206 1.7896 1959 12.06% 3.26% 1960 0.349 3.0506 1961 26.6490 1962 1 -8810 2.780 1963 22.61 3.1196 1964 16.42063.5196 1965 12 40963.9096 -9.976 1967 23 806 4.3396 1968 10.9196 5.2696 1969 -8.24966.5696 1970 3.5696 6.6996 1971 14.220 4.5496 18. 769 3.9596 1973 -143106 6.7396 1974 -25.90 7.7896 1975 37.00965.9996 1976 23.839% 4.9706 1977 -6980 1978 6.519% 6.9396 1966 1981 3.20 14 20 6.159 1984 1985 5 819 1987 1988 1959 1990 1991 31-459 -3.056 30.239 37 2016 22689 33. LOS 1996 1997 S0209 20 39 PODO 2001 -11. SSG 21.972 28369 2003 2004 2019 2005 159 2010 2011 2012 ook O 050 0219 2014 2015 2016 201T 1216 119 vewage 10329 4.0196 Q1: What should be the IRR during the "December 2014 - December 2018" period for your Microthin stock investment? 2018 Particulars Buy Shares Dividend on Shares Sale of shares Net Cash Flow IRR NPV 2014 2015 2016 2017 $ (630,000.00) $(405,000.00 $ 11,700.00 S 8,600.00 $ 17,500.00 $ 290,000.00 $ 200,000.00 S (630,000.00) $ 301.700.00 S (396,400.00) S 217,500.00 6.46% (S146,337.37) $ $ $ 13,000.00 650,000.00 663,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts