Question: Please provide step by step working for each question in details You are the managing engineer for a line that is required to produce 350,0002

Please provide step by step working for each question in details

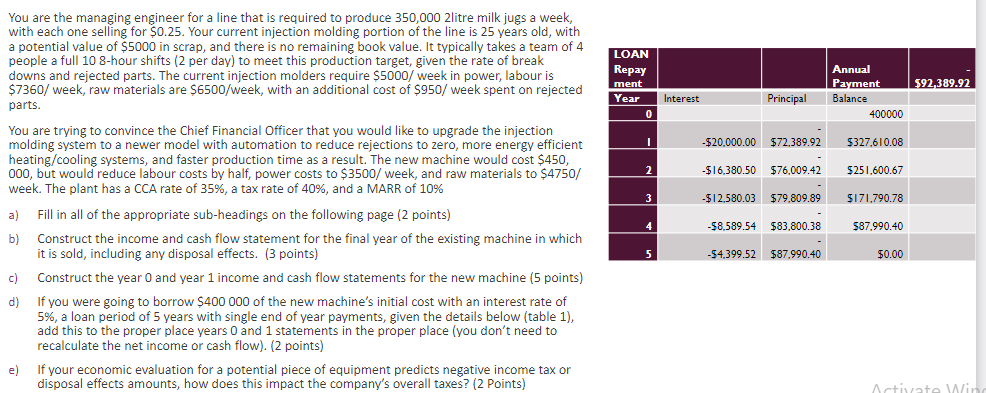

You are the managing engineer for a line that is required to produce 350,0002 litre milk jugs a week, with each one selling for $0.25. Your current injection molding portion of the line is 25 years old, with a potential value of $5000 in scrap, and there is no remaining book value. It typically takes a team of 4 people a full 108 -hour shifts ( 2 per day) to meet this production target, given the rate of break downs and rejected parts. The current injection molders require $5000 / week in power, labour is $7360 / week, raw materials are $6500/ week, with an additional cost of $950/ week spent on rejected parts. You are trying to convince the Chief Financial Officer that you would like to upgrade the injection molding system to a newer model with automation to reduce rejections to zero, more energy efficient heating/cooling systems, and faster production time as a result. The new machine would cost $450, 000 , but would reduce labour costs by half, power costs to $3500/ week, and raw materials to $4750 / week. The plant has a CCA rate of 35%, a tax rate of 40%, and a MARR of 10% a) Fill in all of the appropriate sub-headings on the following page ( 2 points) b) Construct the income and cash flow statement for the final year of the existing machine in which it is sold, including any disposal effects. ( 3 points) c) Construct the year 0 and year 1 income and cash flow statements for the new machine ( 5 points) d) If you were going to borrow $400000 of the new machine's initial cost with an interest rate of 5%, a loan period of 5 years with single end of year payments, given the details below (table 1 ), add this to the proper place years 0 and 1 statements in the proper place (you don't need to recalculate the net income or cash flow). (2 points) e) If your economic evaluation for a potential piece of equipment predicts negative income tax or disposal effects amounts, how does this impact the company's overall taxes? (2 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts