Question: please provie step bt step guide and do in excel T RF A B D E F G H 1 Date HSI 0008.HK 0009.HK IBM

please provie step bt step guide and do in excel

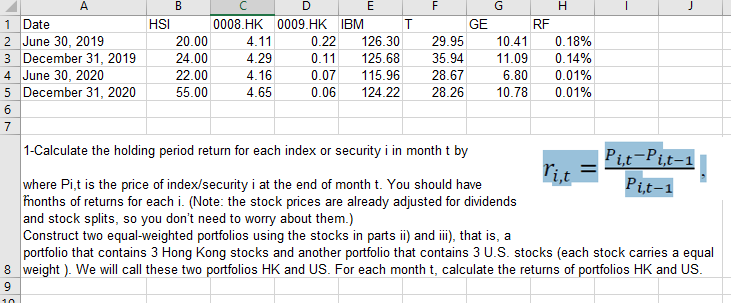

T RF A B D E F G H 1 Date HSI 0008.HK 0009.HK IBM T GE 2 June 30, 2019 20.00 4.11 0.22 126.30 29.95 10.41 0.18% 3 December 31, 2019 24.00 4.29 0.11 125.68 35.94 11.09 0.14% 4 June 30, 2020 22.00 4.16 0.07 115.96 28.67 6.80 0.01% 5 December 31, 2020 55.00 4.65 0.06 124.22 28.26 10.78 0.01% 6 7 1-Calculate the holding period return for each index or security i in month t by Pi,t-Pi.t-1 where Pit is the price of index/security i at the end of month t. You should have Pit-1 months of returns for each i. (Note: the stock prices are already adjusted for dividends and stock splits, so you don't need to worry about them.) Construct two equal-weighted portfolios using the stocks in parts ii) and ii), that is, a portfolio that contains 3 Hong Kong stocks and another portfolio that contains 3 U.S. stocks (each stock carries a equal 8 weight ). We will call these two portfolios HK and US. For each month t, calculate the returns of portfolios HK and US. 9 10 T RF A B D E F G H 1 Date HSI 0008.HK 0009.HK IBM T GE 2 June 30, 2019 20.00 4.11 0.22 126.30 29.95 10.41 0.18% 3 December 31, 2019 24.00 4.29 0.11 125.68 35.94 11.09 0.14% 4 June 30, 2020 22.00 4.16 0.07 115.96 28.67 6.80 0.01% 5 December 31, 2020 55.00 4.65 0.06 124.22 28.26 10.78 0.01% 6 7 1-Calculate the holding period return for each index or security i in month t by Pi,t-Pi.t-1 where Pit is the price of index/security i at the end of month t. You should have Pit-1 months of returns for each i. (Note: the stock prices are already adjusted for dividends and stock splits, so you don't need to worry about them.) Construct two equal-weighted portfolios using the stocks in parts ii) and ii), that is, a portfolio that contains 3 Hong Kong stocks and another portfolio that contains 3 U.S. stocks (each stock carries a equal 8 weight ). We will call these two portfolios HK and US. For each month t, calculate the returns of portfolios HK and US. 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts