Question: Please read article and answer all four questions with at least 5-7 sentences per question. The U.K's Official Receiver, acting on behalf of Carillion's creditors,

Please read article and answer all four questions with at least 5-7 sentences per question.

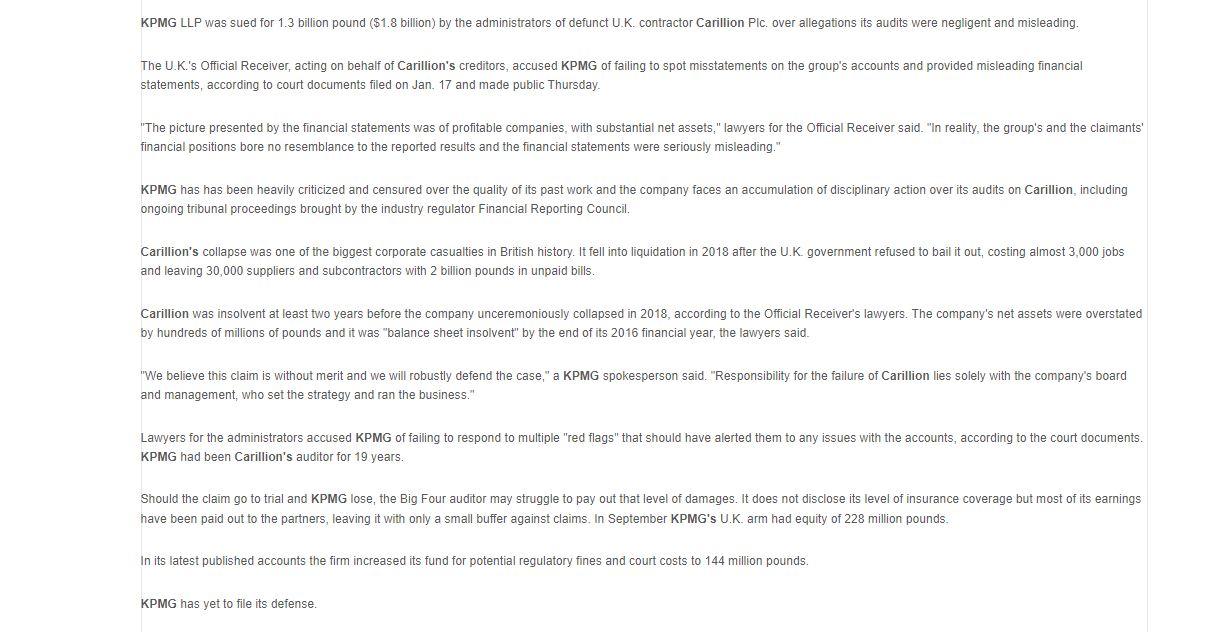

The U.K's Official Receiver, acting on behalf of Carillion's creditors, accused KPMG of failing to spot misstatements on the group's accounts and provided misleading financial statements, according to court documents filed on Jan. 17 and made public Thursday. "The picture presented by the financial statements was of profitable companies, with substantial net assets," lawyers for the Official Receiver said. "In reality, the group's and the claimants' financial positions bore no resemblance to the reported results and the financial statements were seriously misleading." KPMG has has been heavily criticized and censured over the quality of its past work and the company faces an accumulation of disciplinary action over its auding ongoing tribunal proceedings brought by the industry regulator Financial Reporting Council. Carillion's collapse was one of the biggest corporate casualties in British history. It fell into liquidation in 2018 after the U.K. government refused to bail it out, costing almost 3,000 jobs and leaving 30,000 suppliers and subcontractors with 2 billion pounds in unpaid bills. Carillion was insolvent at least two years before the company unceremoniously collapsed in 2018, according to the Official Receiver's lawyers. The company's net assets were overstated by hundreds of millions of pounds and it was "balance sheet insolvent" by the end of its 2016 financial year, the lawyers said. "We believe this claim is without merit and we will robustly defend the case," a KPMG spokesperson said. "Responsibility for the failure of Carillion lies solely with the company's board and management, who set the strategy and ran the business." Lawyers for the administrators accused KPMG of failing to respond to multiple "red flags" that should have alerted them to any issues with the accounts, according to the court documents. KPMG had been Carillion's auditor for 19 years. Should the claim go to trial and KPMG lose, the Big Four auditor may struggle to pay out that level of damages. It does not disclose its level of insurance coverage but most of its earnings have been paid out to the partners, leaving it with only a small buffer against claims. In September KPMG's U.K. arm had equity of 228 million pounds. In its latest published accounts the firm increased its fund for potential regulatory fines and court costs to 144 million pounds. KPMG has yet to file its defense. 1. Analyze the audit report that the CPA firm issued. Ascertain the legal liability to third parties who relied on financial statements under both common and federal securities laws. Justify your response. 2. Speculate on which statement of generally accepted auditing standards (GAAS) that the company violated in performing the audit. 3. Compare the responsibility of both management and the auditor for financial reporting, and give your opinion as to which party should have the greater burden. Defend your position. 4. Analyze the sanctions available under SOX, and recommend the key action or actions that the PCAOB should take in order to hold management or the audit firm accountable for the accounting irregularities. Provide a rationale for your response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts