Question: PLEASE READ BEFORE ANSWERING: !! Please refer to data table and requirements for your answer as necessary. !! Right click on image and open image

PLEASE READ BEFORE ANSWERING:

!! Please refer to data table and requirements for your answer as necessary.

!! Right click on image and open image in new tab if text is too blurry or not clear.

!! Please type out your answer or use Excel as it is easier to read than handwriting.

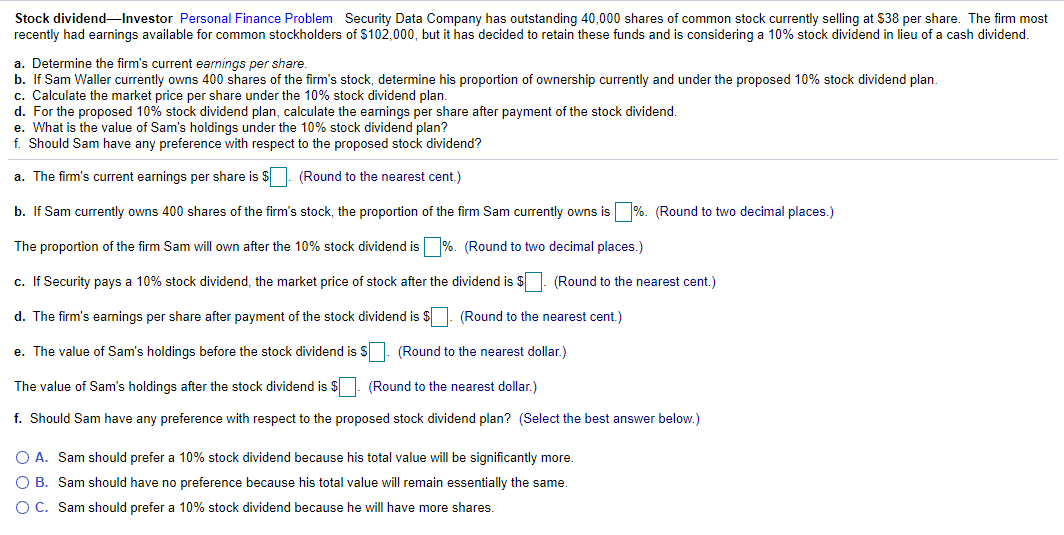

Stock dividendInvestor Personal Finance Problem Security Data Company has outstanding 40,000 shares of common stock currently selling at $38 per share. The firm most recently had earnings available for common stockholders of $102,000, but it has decided to retain these funds and is considering a 10% stock dividend in lieu of a cash dividend. a. Determine the firm's current earnings per share. b. If Sam Waller currently owns 400 shares of the firm's stock, determine his proportion of ownership currently and under the proposed 10% stock dividend plan. c. Calculate the market price per share under the 10% stock dividend plan. d. For the proposed 10% stock dividend plan, calculate the earnings per share after payment of the stock dividend. e. What is the value of Sam's holdings under the 10% stock dividend plan? f. Should Sam have any preference with respect to the proposed stock dividend? a. The firm's current earnings per share is $. (Round to the nearest cent.) b. If Sam currently owns 400 shares of the firm's stock, the proportion of the firm Sam currently owns is %. (Round to two decimal places.) The proportion of the firm Sam will own after the 10% stock dividend is %. (Round to two decimal places.) c. If Security pays a 10% stock dividend, the market price of stock after the dividend is $. (Round to the nearest cent.) d. The firm's earnings per share after payment of the stock dividend is $ (Round to the nearest cent.) e. The value of Sam's holdings before the stock dividend is $. (Round to the nearest dollar.) The value of Sam's holdings after the stock dividend is $. (Round to the nearest dollar.) f. Should Sam have any preference with respect to the proposed stock dividend plan? (Select the best answer below.) O A. Sam should prefer a 10% stock dividend because his total value will be significantly more. O B. Sam should have no preference because his total value will remain essentially the same. O C. Sam should prefer a 10% stock dividend because he will have more shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts