Question: Please refer to data table and requirements for your answer as necessary. Right click on image and open image in new tab if text is

Please refer to data table and requirements for your answer as necessary.

Right click on image and open image in new tab if text is too blurry or not clear.

Please type out your answer or use Excel as it is easier to read than handwriting.

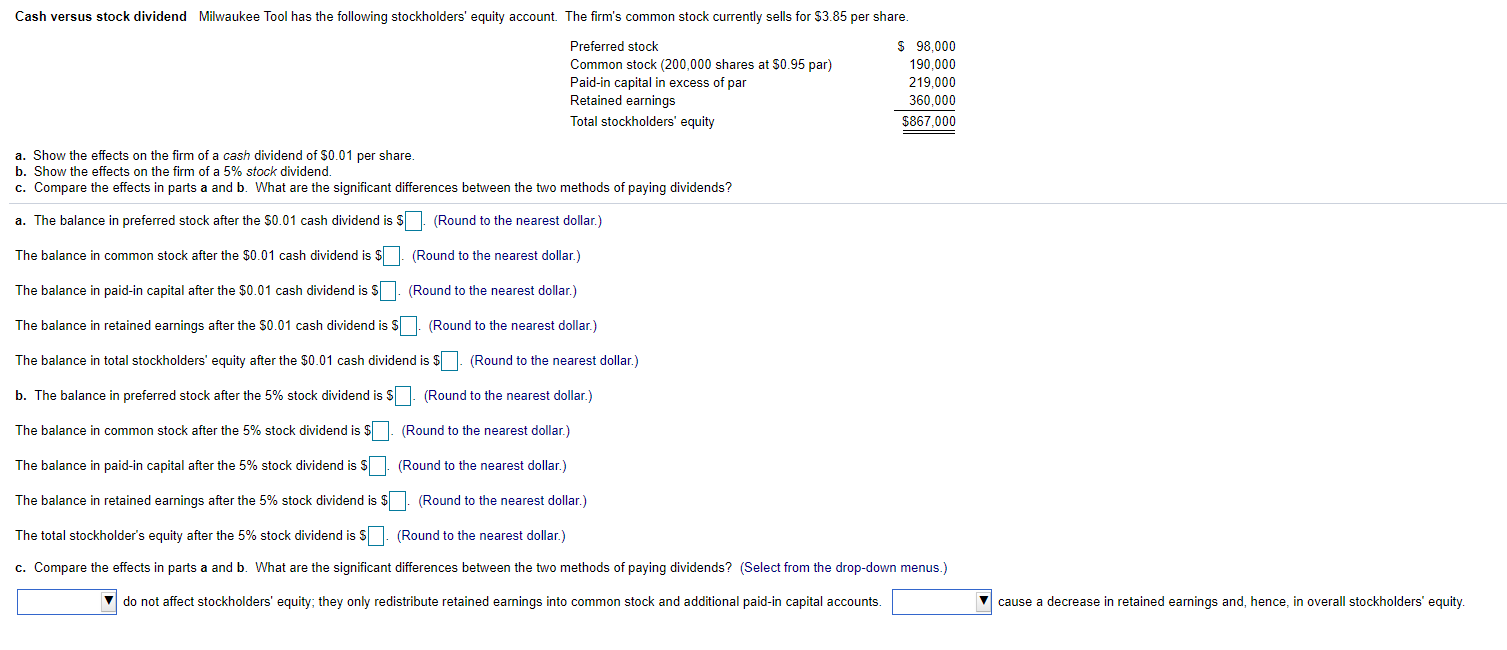

Cash versus stock dividend Milwaukee Tool has the following stockholders' equity account. The firm's common stock currently sells for $3.85 per share. Preferred stock Common stock (200,000 shares at $0.95 par) Paid-in capital in excess of par Retained earnings Total stockholders' equity $ 98,000 190,000 219,000 360.000 $867,000 a. Show the effects on the firm of a cash dividend of $0.01 per share. b. Show the effects on the firm of a 5% stock dividend. c. Compare the effects in parts a and b. What are the significant differences between the two methods of paying dividends? a. The balance in preferred stock after the $0.01 cash dividend is $(Round to the nearest dollar.) The balance in common stock after the $0.01 cash dividend is $. (Round to the nearest dollar.) The balance in paid-in capital after the $0.01 cash dividend is $. (Round to the nearest dollar.) The balance in retained earnings after the $0.01 cash dividend is $. (Round to the nearest dollar.) The balance in total stockholders' equity after the $0.01 cash dividend is $. (Round to the nearest dollar.) b. The balance in preferred stock after the 5% stock dividend is $. (Round to the nearest dollar.) The balance in common stock after the 5% stock dividend is $. (Round to the nearest dollar.) The balance in paid-in capital after the 5% stock dividend is $. (Round to the nearest dollar.) The balance in retained earnings after the 5% stock dividend is $. (Round to the nearest dollar.) The total stockholder's equity after the 5% stock dividend is $. (Round to the nearest dollar.) c. Compare the effects in parts a and b. What are the significant differences between the two methods of paying dividends? (Select from the drop-down menus.) V do not affect stockholders' equity; they only redistribute retained earnings into common stock and additional paid-in capital accounts. cause a decrease in retained earnings and, hence, in overall stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts