Question: Please refer to data table and requirements for your answer as necessary. Right click on image and open image in new tab if text is

Please refer to data table and requirements for your answer as necessary.

Right click on image and open image in new tab if text is too blurry or not clear.

Please type out your answer or use Excel as it is easier to read than handwriting.

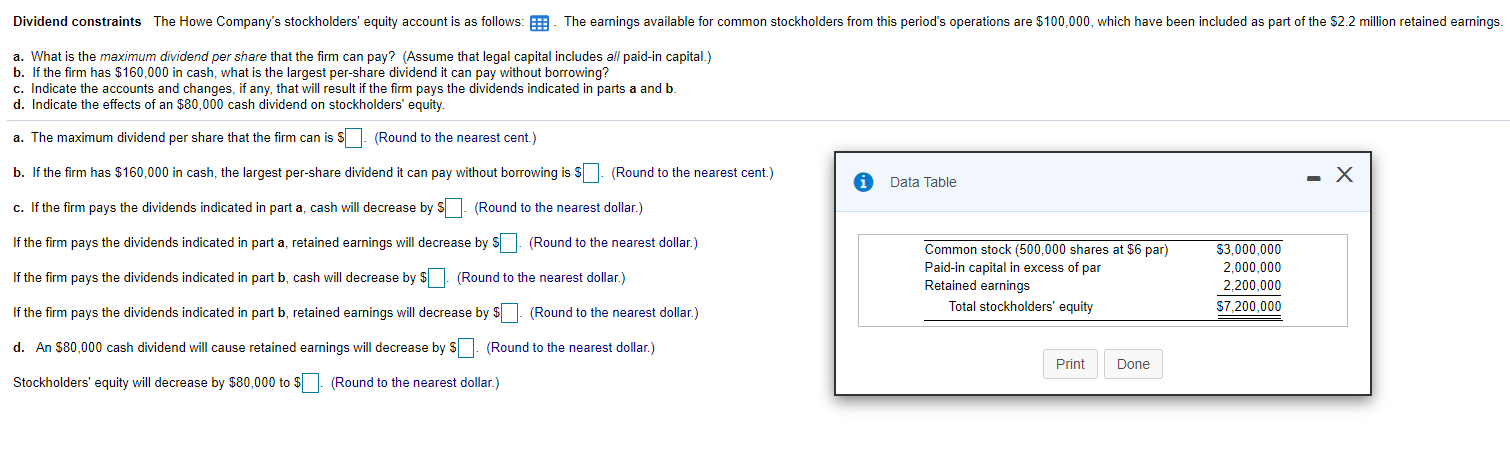

Dividend constraints The Howe Company's stockholders' equity account is as follows: E: The earnings available for common stockholders from this period's operations are $100,000, which have been included as part of the $2.2 million retained earnings. a. What is the maximum dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.) b. If the firm has $160,000 in cash, what is the largest per-share dividend it can pay without borrowing? c. Indicate the accounts and changes, if any, that will result if the firm pays the dividends indicated in parts a and b. d. Indicate the effects of an $80,000 cash dividend on stockholders' equity. a. The maximum dividend per share that the firm can is $. (Round to the nearest cent.) b. If the firm has $160,000 in cash, the largest per-share dividend it can pay without borrowing is $. (Round to the nearest cent.) c. If the firm pays the dividends indicated in part a, cash will decrease by $ (Round to the nearest dollar.) Data Table If the firm pays the dividends indicated in part a, retained earnings will decrease by $ (Round to the nearest dollar.) Common stock (500,000 shares at $6 par) Paid-in capital in excess of par Retained earnings Total stockholders' equity $3,000,000 2,000,000 2,200,000 $7,200,000 If the firm pays the dividends indicated in part b, cash will decrease by $ (Round to the nearest dollar.) If the firm pays the dividends indicated in part b, retained earnings will decrease by $. (Round to the nearest dollar.) d. An $80,000 cash dividend will cause retained earnings will decrease by $. (Round to the nearest dollar.) Stockholders' equity will decrease by $80,000 to $ . (Round to the nearest dollar.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts