Question: please read carefully and read numbers carefully please. I hope u the pics are clear Stock A has the following probability distributions of expected future

please read carefully and read numbers carefully please. I hope u the pics are clear

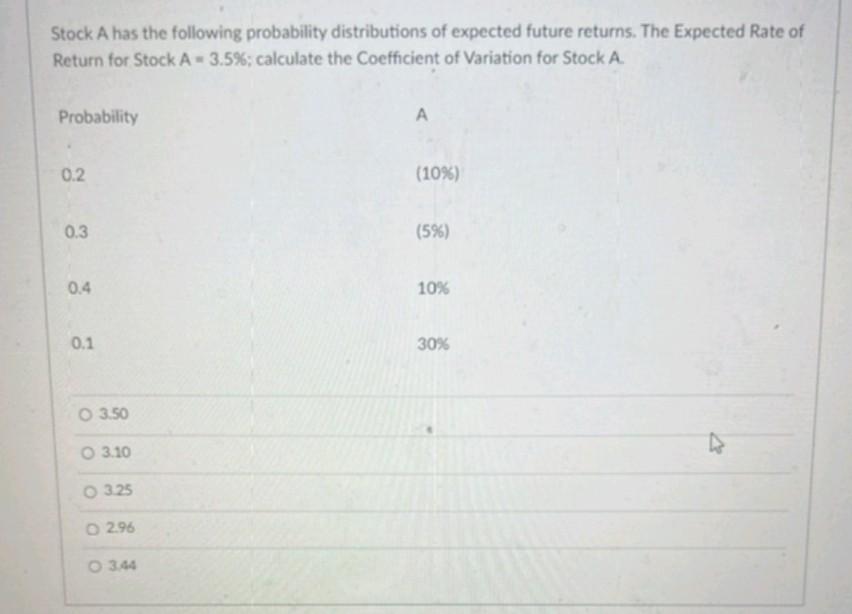

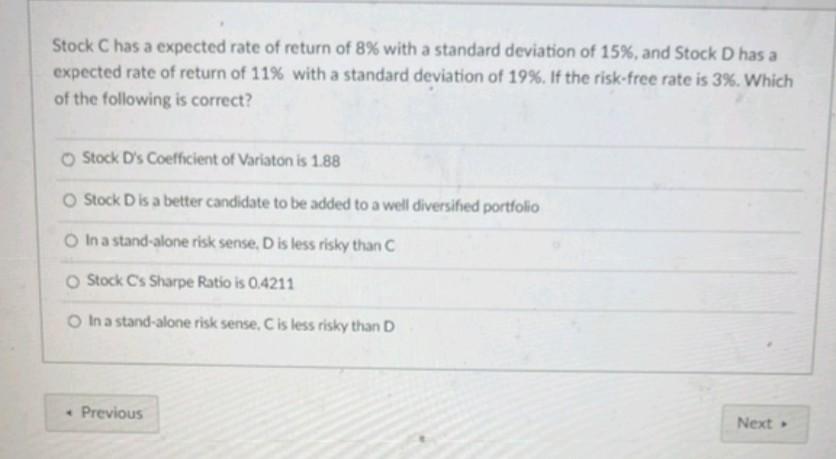

Stock A has the following probability distributions of expected future returns. The Expected Rate of Return for Stock A = 3.5%; calculate the Coefficient of Variation for Stock A Probability A 0.2 (10%) 3 (5%) 0.4 10% 0.1 30% O 3.50 03.10 O 325 2.96 3.44 Stock C has a expected rate of return of 8% with a standard deviation of 15%, and Stock D has a expected rate of return of 11% with a standard deviation of 19%. If the risk-free rate is 3%. Which of the following is correct? Stock D's Coefficient of Variaton is 1.88 Stock D is a better candidate to be added to a well diversified portfolio In a stand-alone risk sense. Dis less risky than Stock Cs Sharpe Ratio is 0.4211 In a stand-alone risk sense. C is less risky than D Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts