Question: Please record the closing entries for a) b) and c) QUESTION 2-Transferring Net Income to capital accounts The Scott Stewart and Rick Smith Partnership earned

Please record the closing entries for a) b) and c)

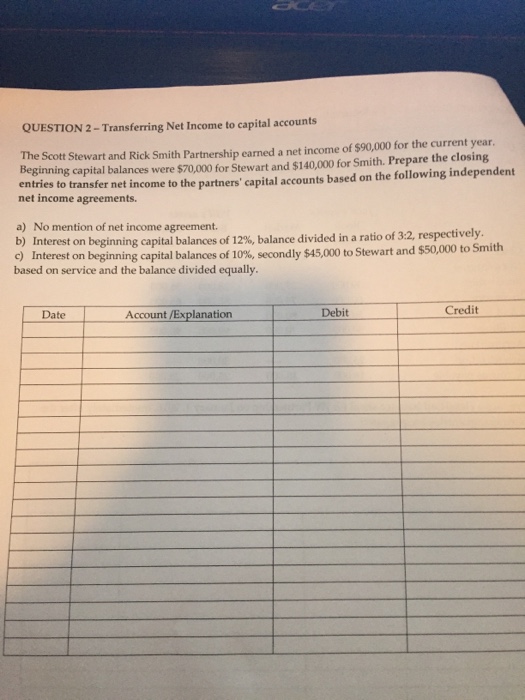

Please record the closing entries for a) b) and c) QUESTION 2-Transferring Net Income to capital accounts The Scott Stewart and Rick Smith Partnership earned a net income of $90,000 for the current year. Beginning capital balances were $70,000 for Stewart and $140,000 for Smith. Prepare the closing entries to tran net income agreements. sfer net income to the partners' capital accounts based on the following independent a) No mention of net income agreement. b) Interest on beginning capital balances of 12% balance divided in a ratio of 32, respectively c) Interest on beginning capital balances of 10% second! based on service and the balance divided equally y $45,000 to Stewart and S50000 to Smith Credit Date Account /Explanation Debit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts