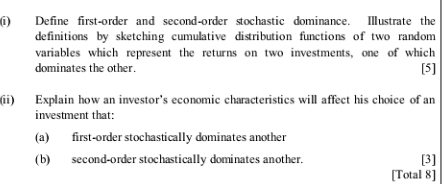

Question: Please refer to the attachment. Define first-order and second-order stochastic dominance. Illustrate the definitions by sketching cumulative distribution functions of two random variables which represent

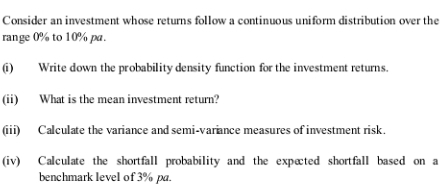

Please refer to the attachment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock