Question: Please remember, - Provide proper working for each problem. - Use proper numbering for each solution according to the questions. - Provide formulas where its

Please remember,

- Provide proper working for each problem.

- Use proper numbering for each solution according to the questions.

- Provide formulas where its necessary. If possible mark it down.

- Handwritten is preferred.

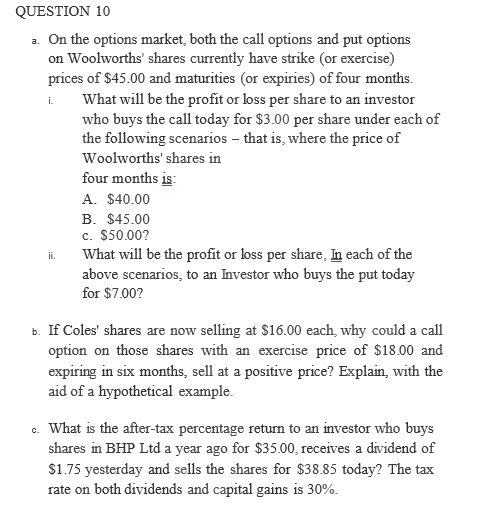

QUESTION 10 a. On the options market, both the call options and put options on Woolworths' shares currently have strike (or exercise) prices of $45.00 and maturities (or expiries) of four months. i. What will be the profit or loss per share to an investor who buys the call today for $3.00 per share under each of the following scenarios - that is, where the price of Woolworths' shares in four months is A. $40.00 B. $45.00 c. $50.00? What will be the profit or loss per share. In each of the above scenarios, to an Investor who buys the put today for $7.00 ii. . If Coles' shares are now selling at $16.00 each, why could a call option on those shares with an exercise price of $18.00 and expiring in six months, sell at a positive price? Explain, with the aid of a hypothetical example. c. What is the after-tax percentage return to an investor who buys shares in BHP Ltd a year ago for $35.00, receives a dividend of $1.75 yesterday and sells the shares for $38.85 today? The tax rate on both dividends and capital gains is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts