Question: please save the image to see clearly, its a easy question The following is information taken from Bacco Inc.'s adjusted trial balance for the year

please save the image to see clearly, its a easy question

please save the image to see clearly, its a easy question

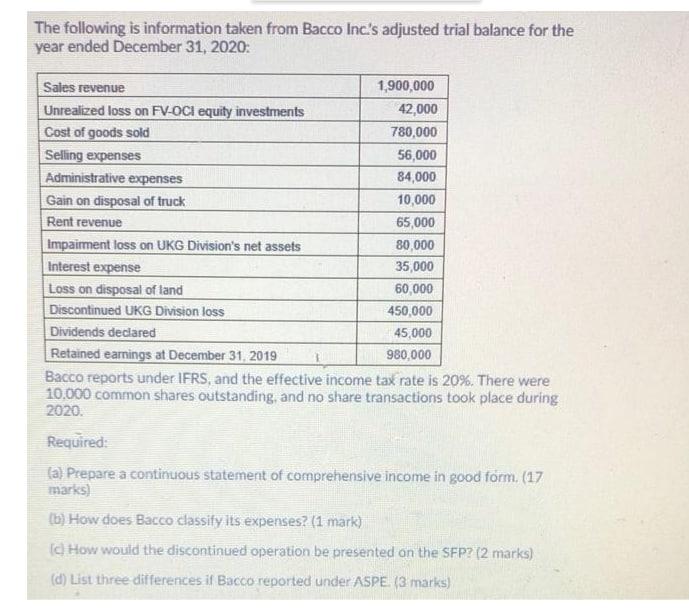

The following is information taken from Bacco Inc.'s adjusted trial balance for the year ended December 31, 2020: Sales revenue 1,900,000 Unrealized loss on FV-OCI equity investments 42,000 Cost of goods sold 780,000 Selling expenses 56,000 Administrative expenses 84,000 Gain on disposal of truck 10,000 Rent revenue 65,000 Impairment loss on UKG Division's net assets 80,000 Interest expense 35,000 Loss on disposal of land 60,000 Discontinued UKG Division loss 450,000 Dividends declared 45,000 Retained earnings at December 31, 2019 980,000 Bacco reports under IFRS, and the effective income tax rate is 20%. There were 10,000 common shares outstanding, and no share transactions took place during 2020 Required: fa) Prepare a continuous statement of comprehensive income in good form. (17 marks) (b) How does Bacco classify its expenses? (1 mark) (c) How would the discontinued operation be presented on the SFP? (2 marks) (d) List three differences if Bacco reported under ASPE 13 marks) The following is information taken from Bacco Inc.'s adjusted trial balance for the year ended December 31, 2020: Sales revenue 1,900,000 Unrealized loss on FV-OCI equity investments 42,000 Cost of goods sold 780,000 Selling expenses 56,000 Administrative expenses 84,000 Gain on disposal of truck 10,000 Rent revenue 65,000 Impairment loss on UKG Division's net assets 80,000 Interest expense 35,000 Loss on disposal of land 60,000 Discontinued UKG Division loss 450,000 Dividends declared 45,000 Retained earnings at December 31, 2019 980,000 Bacco reports under IFRS, and the effective income tax rate is 20%. There were 10,000 common shares outstanding, and no share transactions took place during 2020 Required: fa) Prepare a continuous statement of comprehensive income in good form. (17 marks) (b) How does Bacco classify its expenses? (1 mark) (c) How would the discontinued operation be presented on the SFP? (2 marks) (d) List three differences if Bacco reported under ASPE 13 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts