Question: Please select the correct answer for the 1st blank choosing among the following: number of capital investments total dollar value of capital investments Please select

Please select the correct answer for the 1st blank choosing among the following: number of capital investments total dollar value of capital investments Please select the correct answer for the 2nd blank choosing among the following: greatest cash flow after year 1 of the project greatest NPV greatest payback period lowest NPV shortest payback period Please select the correct answer for the 3rd blank choosing among the following: AARR and IRR fluctuations in the required rate of return the affect of inflation of the NPV calculations worker safety issues and customer confidence

Please select the correct answer for the 1st blank choosing among the following: number of capital investments total dollar value of capital investments Please select the correct answer for the 2nd blank choosing among the following: greatest cash flow after year 1 of the project greatest NPV greatest payback period lowest NPV shortest payback period Please select the correct answer for the 3rd blank choosing among the following: AARR and IRR fluctuations in the required rate of return the affect of inflation of the NPV calculations worker safety issues and customer confidence

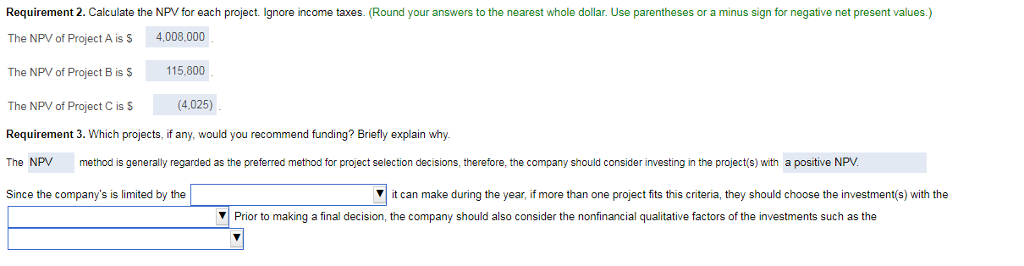

Requirement 2. Calculate the NPV for each project. lgnore income taxes. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project A is 4,008,000 The NPV of Project Bis 115,800 The NPV of Project C iss(4.025) Requirement 3. Which projects, if any, would you recommend funding? Briefly explain why. The NPV method is generally regarded as the preferred method for project selection decisions, therefore, the company should consider investing in the project(s) with a positive NPV. Since the company's is limited by the | it can make during the year, if more than one project fits this criteria, they should choose the investment(s) with the Prior to making a final decision, the company should also consider the nonfinancial qualitative factors of the investments such as the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts