Question: Please show all equations and work as necessary. 6. Standard deviation and beta both measure risk, but they are different in that beta measures A.

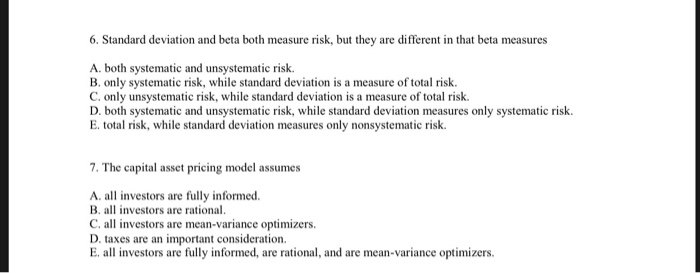

6. Standard deviation and beta both measure risk, but they are different in that beta measures A. both systematic and unsystematic risk. B. only systematic risk, while standard deviation is a measure of total risk. C. only unsystematic risk, while standard deviation is a measure of total risk. D. both systematic and unsystematic risk, while standard deviation measures only systematic risk E. total risk, while standard deviation measures only nonsystematic risk 7. The capital asset pricing model assumes A. all investors are fully informed. B. all investors are rational. C. all investors are mean-variance optimizers. D. taxes are an important consideration. E. all investors are fully informed, are rational, and are mean-variance optimizers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts