Question: PLEASE SHOW ALL STEPS HOW THEY GOT THE ANSWER, NEED FULL STEP BY STEP WITH MATH INCLUDED. Don't skip any steps. Question 16 0.08 /

PLEASE SHOW ALL STEPS HOW THEY GOT THE ANSWER, NEED FULL STEP BY STEP WITH MATH INCLUDED. Don't skip any steps.

PLEASE SHOW ALL STEPS HOW THEY GOT THE ANSWER, NEED FULL STEP BY STEP WITH MATH INCLUDED. Don't skip any steps.

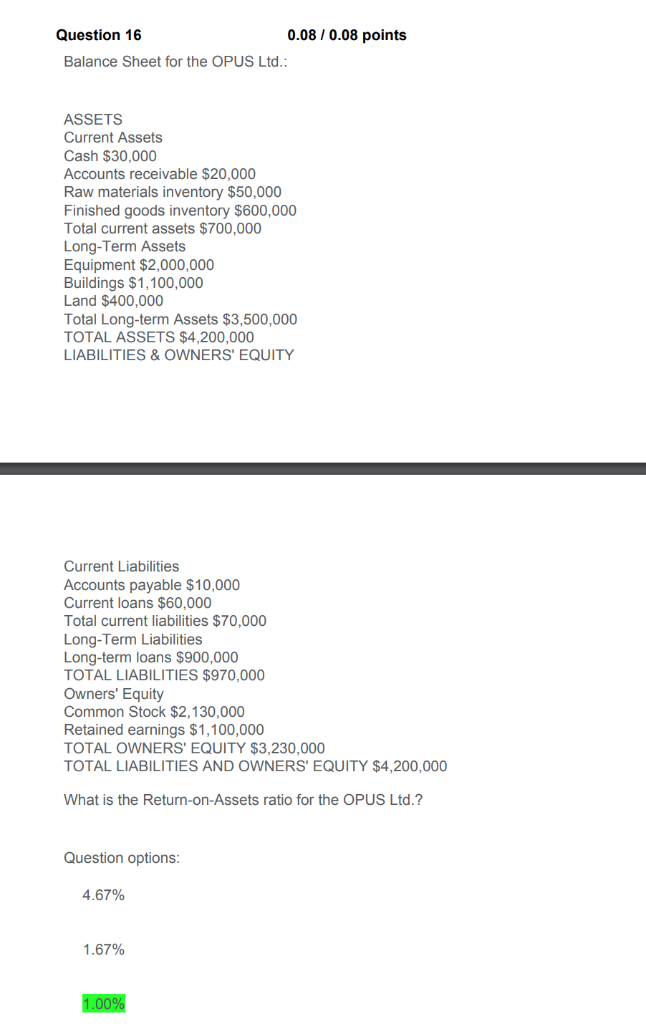

Question 16 0.08 / 0.08 points Balance Sheet for the OPUS Ltd.: ASSETS Current Assets Cash $30,000 Accounts receivable $20,000 Raw materials inventory $50,000 Finished goods inventory $600,000 Total current assets $700,000 Long-Term Assets Equipment $2,000,000 Buildings $1,100,000 Land $400,000 Total Long-term Assets $3,500,000 TOTAL ASSETS $4,200,000 LIABILITIES & OWNERS' EQUITY Current Liabilities Accounts payable $10,000 Current loans $60,000 Total current liabilities $70,000 Long-Term Liabilities Long-term loans $900.000 TOTAL LIABILITIES $970,000 Owners' Equity Common Stock $2,130,000 Retained earnings $1,100,000 TOTAL OWNERS' EQUITY $3,230,000 TOTAL LIABILITIES AND OWNERS' EQUITY $4,200,000 What is the Return-on-Assets ratio for the OPUS Ltd.? Question options: 4.67% 1.67% 1.00% Question 16 0.08 / 0.08 points Balance Sheet for the OPUS Ltd.: ASSETS Current Assets Cash $30,000 Accounts receivable $20,000 Raw materials inventory $50,000 Finished goods inventory $600,000 Total current assets $700,000 Long-Term Assets Equipment $2,000,000 Buildings $1,100,000 Land $400,000 Total Long-term Assets $3,500,000 TOTAL ASSETS $4,200,000 LIABILITIES & OWNERS' EQUITY Current Liabilities Accounts payable $10,000 Current loans $60,000 Total current liabilities $70,000 Long-Term Liabilities Long-term loans $900.000 TOTAL LIABILITIES $970,000 Owners' Equity Common Stock $2,130,000 Retained earnings $1,100,000 TOTAL OWNERS' EQUITY $3,230,000 TOTAL LIABILITIES AND OWNERS' EQUITY $4,200,000 What is the Return-on-Assets ratio for the OPUS Ltd.? Question options: 4.67% 1.67% 1.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts