Question: Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT,

Questions on Bonds: Answer with a working worksheet making the cashflows in each period explicit (not using the PRICE function or PV, FV, RATE, PMT, NPER functions ) each of the questions below

Please show all steps and excel formulas.

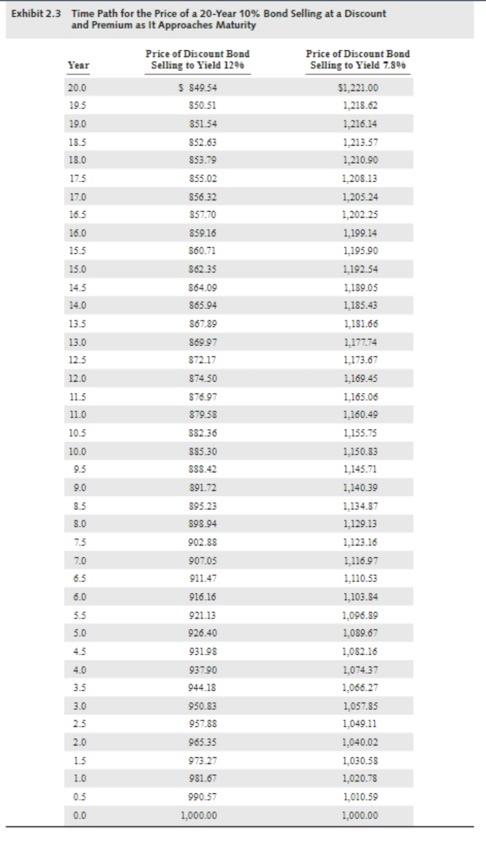

Exhibit 2.3 Time Path for the Price of a 20-Year 10% Bond selling at a Discount and Premium as It Approaches Maturity Price of Discount Bond Price of Discount Bond Year Selling to Yield 1200 Selling to Yield 7.8% 20.0 5 549.54 $1,221.00 29.5 350.31 1,218.62 19.0 351.34 1,216.14 18.5 352.63 1.213.57 18.0 853.79 1,210.90 175 855.02 1 208.13 170 $56.32 1,205.24 16.5 357.70 1.202.25 16.0 $59.16 1,199.14 155 560.71 1.195.90 15.0 $6235 1192.54 143 864.09 1.189.05 14.0 $65.94 1,185.43 135 867.89 1,181.66 13.0 86997 1,17274 123 372.17 1.173.67 12.0 874.30 1,169.45 11.3 37697 1.165.06 11.0 879.58 1.160.49 10.3 $82.36 1,135.75 10.0 855.30 1.150.83 9.5 888.42 1,145.71 9.0 891.72 1.140.39 8.3 395.23 1.134.57 8.0 398.94 1.129.13 3 902.88 1,123.16 7.0 90705 1,116.97 6.5 911.47 1,110.53 6.0 916.16 1.103.84 3.5 92113 3.096.89 3.0 926.40 1,089.67 43 93198 1,062.16 4.0 93790 1,074,37 3.5 94418 1,066.27 3.0 950.83 1,057.85 23 95788 1,049.11 965.35 1,040.02 1.3 97327 1,030.58 1.0 981.67 1,020.78 0.3 990.53 1,010,59 0.0 1,000.00 1,000.00 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts