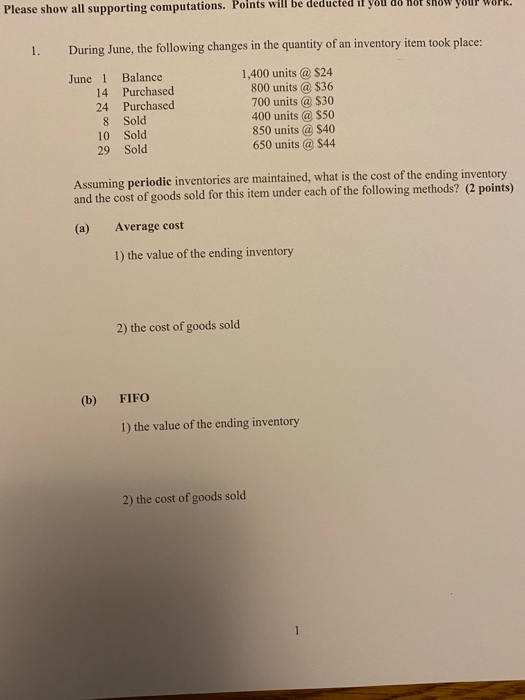

Question: Please show all supporting computations. Points will be deducted if you do not now your work During June, the following changes in the quantity of

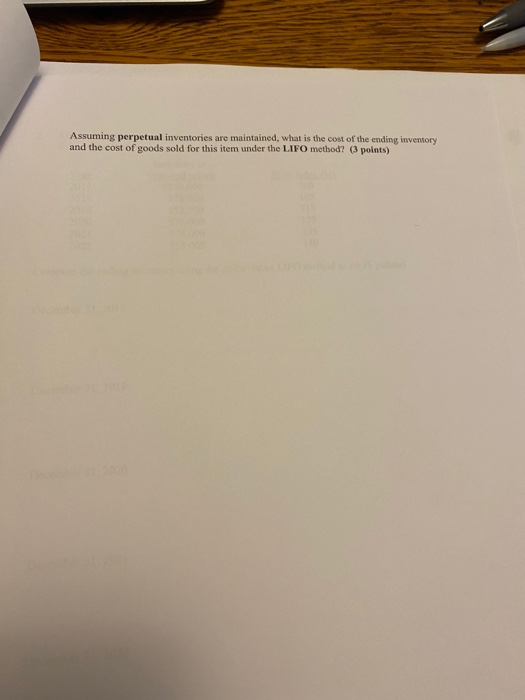

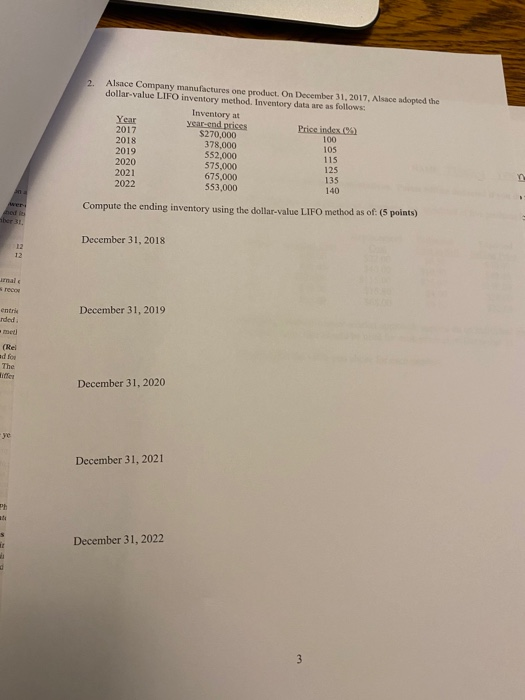

Please show all supporting computations. Points will be deducted if you do not now your work During June, the following changes in the quantity of an inventory item took place: June 1 14 24 8 10 29 Balance Purchased Purchased Sold Sold Sold 1,400 units @ $24 800 units @ $36 700 units @ $30 400 units @ $50 850 units @ $40 650 units @ $44 Assuming periodic inventories are maintained, what is the cost of the ending inventory and the cost of goods sold for this item under each of the following methods? (2 points) (a) Average cost 1) the value of the ending inventory 2) the cost of goods sold (b) FIFO 1) the value of the ending inventory 2) the cost of goods sold Assuming perpetual inventories are maintained, what is the cost of the ending inventory and the cost of goods sold for this item under the LIFO method? (3 points) 2 Alsace Company manufactures one product. On December 31, 2017, Alsace adopted the dollar-value LIFO inventory method. Inventory data are as follows: Inventory at Year year-end prices 2017 Price index S270,000 100 2018 378,000 105 552,000 115 2020 575.000 125 2021 675,000 135 2022 553,000 140 2019 Compute the ending inventory using the dollar value LIFO method as of: (5 points) thof ber 31 December 31, 2018 12 entre nded: December 31, 2019 med (Rel ed for The December 31, 2020 December 31, 2021 December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts