Question: Please show all supporting computations. Points will be deducted if you do not show your work. 1. The December 31, 2018 balance sheet for Campbell,

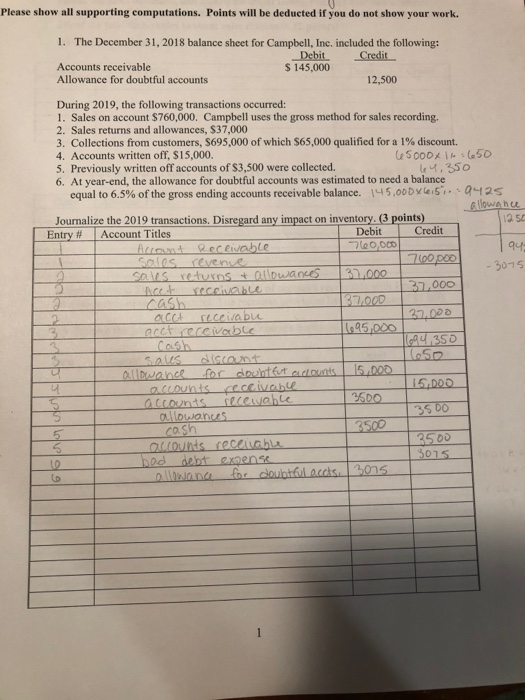

Please show all supporting computations. Points will be deducted if you do not show your work. 1. The December 31, 2018 balance sheet for Campbell, Inc. included the following: Debit Credit Accounts receivable $ 145,000 Allowance for doubtful accounts 12,500 1 12.50 During 2019, the following transactions occurred: 1. Sales on account $760,000. Campbell uses the gross method for sales recording. 2. Sales returns and allowances, S37,000 3. Collections from customers, S695,000 of which S65,000 qualified for a 1% discount. 4. Accounts written off, $15,000. 65000X 650 5. Previously written off accounts of $3,500 were collected. 64.350 6. At year-end, the allowance for doubtful accounts was estimated to need a balance equal to 6.5% of the gross ending accounts receivable balance. 145,00 Dyl:57.9425 allowance Journalize the 2019 transactions. Disregard any impact on inventory. (3 points) Entry # Account Titles Debit Credit Alle Receivable 700,000 194 I sales revence 760 poo 2 sales returns & allowances 32,000 -3075 2 Acct receivable 137,000 Cash 37.000 I acct receivabu 37.000 3 acct receivable 1695,000 1694,350 Los uwance for downtut dlounts 15.000 unds Civable 15.DOO - accounts receivable 3500 Ou dwonus 13500 cash 3500 O counts receivable 3500 I bod debt expense 3015 6 allowanca for doubtful accts, 3015 991

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts