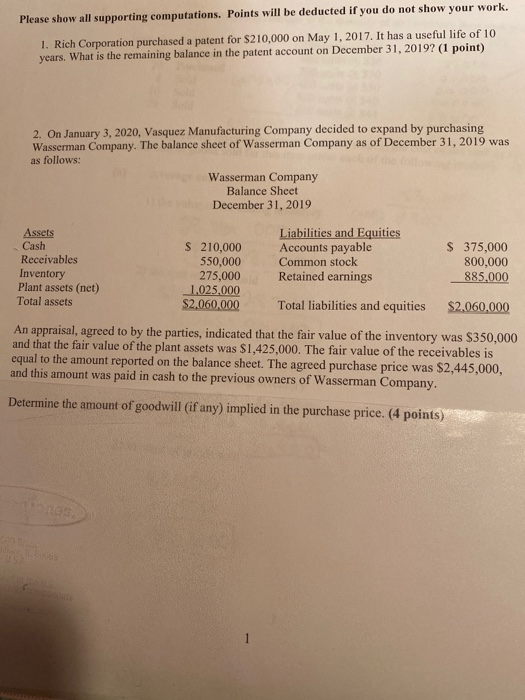

Question: Please show all supporting computations. Points will be deducted if you do not show your work. 1. Rich Corporation purchased a patent for S210,000 on

Please show all supporting computations. Points will be deducted if you do not show your work. 1. Rich Corporation purchased a patent for S210,000 on May 1, 2017. It has a useful life of 10 years. What is the remaining balance in the patent account on December 31, 2019? (1 point) 2. On January 3, 2020, Vasquez Manufacturing Company decided to expand by purchasing Wasserman Company. The balance sheet of Wasserman Company as of December 31, 2019 was as follows: Wasserman Company Balance Sheet December 31, 2019 Assets Cash Receivables Inventory Plant assets (net) Total assets $ 210,000 550,000 275,000 1,025,000 $2,060,000 Liabilities and Equities Accounts payable Common stock Retained earnings $ 375,000 800,000 885,000 Total liabilities and equities $2,060,000 An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $350,000 and that the fair value of the plant assets was $1.425,000. The fair value of the receivables is equal to the amount reported on the balance sheet. The agreed purchase price was $2,445,000 and this amount was paid in cash to the previous owners of Wasserman Company. Determine the amount of goodwill (if any) implied in the purchase price. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts