Question: Please show all work in a standard format, Excel formula and equation doesn't help me at all. Thanks Bond X is a premium bond making

Please show all work in a standard format, Excel formula and equation doesn't help me at all.

Thanks

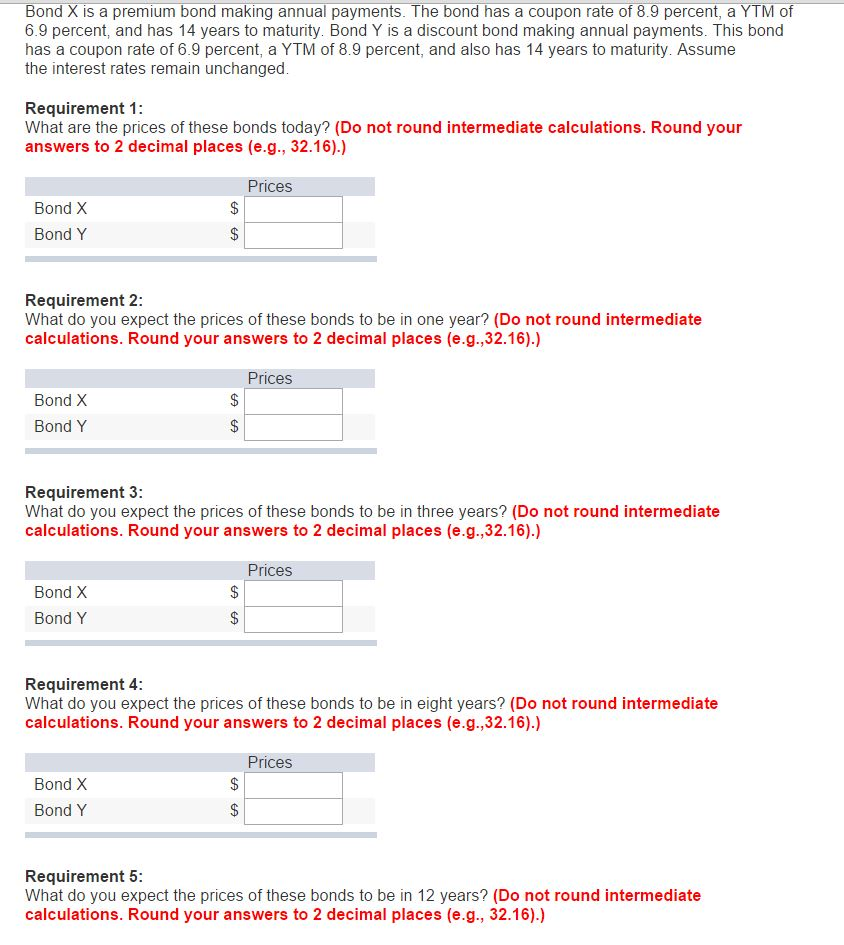

Bond X is a premium bond making annual payments. The bond has a coupon rate of 8.9 percent, a YTM of 6.9 percent, and has 14 years to maturity. Bond Y is a discount bond making annual payments. This bond has a coupon rate of 6.9 percent, a YTM of 8.9 percent, and also has 14 years to maturity. Assume the interest rates remain unchanged.Requirement 1: What are the prices of these bonds today? Bond x $ Bond y $ What do you expect the prices of these bonds to be in one year? What do you expect the prices of these bonds to be in three years?: Bond x $ Bond y $ What do you expect the prices of these bonds to be in eight years? Bond x $ Bond y $ What do you expect the prices of these bonds to be in 12 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts