Question: PLEASE SHOW ALL WORK!!! The Facts When Angle Eggs was launched in 2020, Justin chose not to participate. He thought it was not a good

PLEASE SHOW ALL WORK!!!

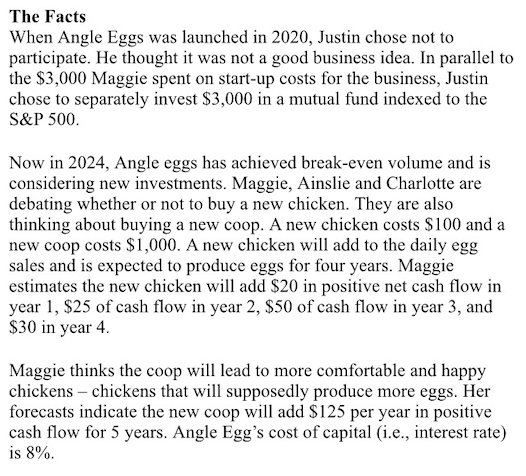

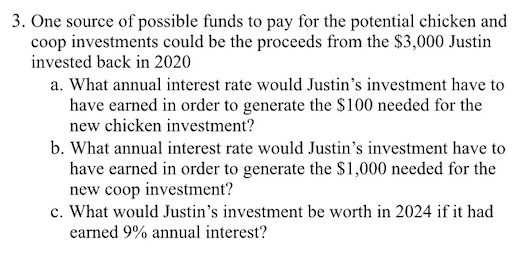

The Facts When Angle Eggs was launched in 2020, Justin chose not to participate. He thought it was not a good business idea. In parallel to the $3,000 Maggie spent on start-up costs for the business, Justin chose to separately invest $3,000 in a mutual fund indexed to the S&P 500 Now in 2024, Angle eggs has achieved break-even volume and is considering new investments. Maggie, Ainslie and Charlotte are debating whether or not to buy a new chicken. They are also thinking about buying a new coop. A new chicken costs $100 and a new coop costs $1,000. A new chicken will add to the daily egg sales and is expected to produce eggs for four years. Maggie estimates the new chicken will add $20 in positive net cash flow in year 1, $25 of cash flow in year 2, $50 of cash flow in year 3, and $30 in year 4. Maggie thinks the coop will lead to more comfortable and happy chickens - chickens that will supposedly produce more eggs. Her forecasts indicate the new coop will add $125 per year in positive cash flow for 5 years. Angle Egg's cost of capital (i.e., interest rate) is 8%. 3. One source of possible funds to pay for the potential chicken and coop investments could be the proceeds from the $3,000 Justin invested back in 2020 a. What annual interest rate would Justin's investment have to have earned in order to generate the $100 needed for the new chicken investment? b. What annual interest rate would Justin's investment have to have earned in order to generate the $1,000 needed for the new coop investment? c. What would Justin's investment be worth in 2024 if it had earned 9% annual interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts