Question: PLEASE SHOW ALL WORK!!! The Facts When Angle Eggs was launched in 2020, Justin chose not to participate. He thought it was not a good

PLEASE SHOW ALL WORK!!!

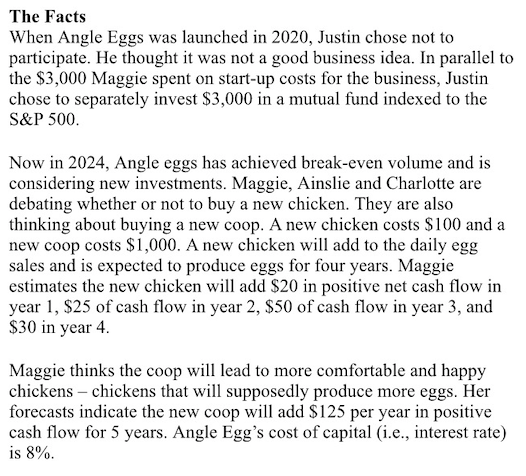

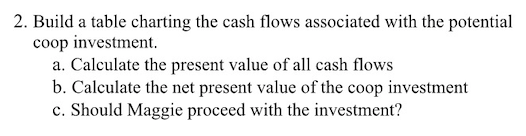

The Facts When Angle Eggs was launched in 2020, Justin chose not to participate. He thought it was not a good business idea. In parallel to the $3,000 Maggie spent on start-up costs for the business, Justin chose to separately invest $3,000 in a mutual fund indexed to the S&P 500 Now in 2024, Angle eggs has achieved break-even volume and is considering new investments. Maggie, Ainslie and Charlotte are debating whether or not to buy a new chicken. They are also thinking about buying a new coop. A new chicken costs $100 and a new coop costs $1,000. A new chicken will add to the daily egg sales and is expected to produce eggs for four years. Maggie estimates the new chicken will add $20 in positive net cash flow in year 1, $25 of cash flow in year 2, $50 of cash flow in year 3, and $30 in year 4. Maggie thinks the coop will lead to more comfortable and happy chickens - chickens that will supposedly produce more eggs. Her forecasts indicate the new coop will add $125 per year in positive cash flow for 5 years. Angle Egg's cost of capital (i.e., interest rate) is 8%. 2. Build a table charting the cash flows associated with the potential coop investment. a. Calculate the present value of all cash flows b. Calculate the net present value of the coop investment c. Should Maggie proceed with the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts