Question: PLEASE ANSWER ALL THE QUESTION NO EXPLANATION NEEDED !! 7. You buy a year, zero coupon bond with a 7.45% yield to maturity and par

PLEASE ANSWER ALL THE QUESTION NO EXPLANATION NEEDED !!

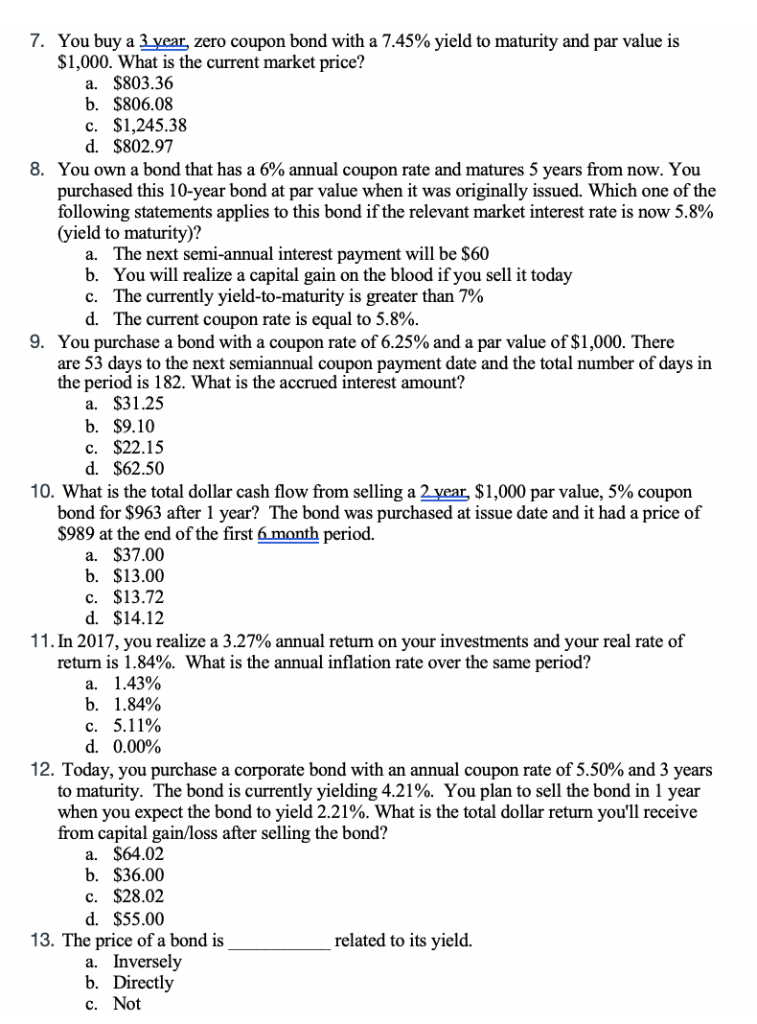

7. You buy a year, zero coupon bond with a 7.45% yield to maturity and par value is S1,000. What is the current market price? a. $803.36 b. $806.08 c. $1,245.38 d. $802.97 8. You own a bond that has a 6% annual coupon rate and matures 5 years from now. You purchased this 10-year bond at par value when it was originally issued. Which one of the following statements applies to this bond if the relevant market interest rate is now 5.8% (yield to maturity)? The next semi-annual interest payment will be $60 b. a. You will realize a capital gain on the blood if you sell it today The currently yield-to-maturity is greater than 7% d C. The current coupon rate is equal to 5.8% 9. You purchase a bond with a coupon rate of 6.25% and a par value of $1,000. There are 53 days to the next semiannual coupon payment date and the total number of days in the period is 182. What is the accrued interest amount? a. $31.25 b. $9.10 c. $22.15 d. $62.50 10. What is the total dollar cash flow from selling a 2year, $1,000 par value, 5% coupon bond for $963 after 1 year? The bond was purchased at issue date and it had a price of S989 at the end of the first 6month period. a. $37.00 b. $13.00 c. $13.72 d. $14.12 11 . In 2017, you realize a 3.27% annual return on your investments and your real rate of return is 1.84%. What is the annual inflation rate over the same period? a. 1.43% b. 1.84% 5.11% 0.00% C. d. 12. Today, you purchase a corporate bond with an annual coupon rate of 5.50% and 3 years to maturity. The bond is currently yielding 4.21%. You plan to sell the bond in 1 year when you expect the bond to yield 2.21%. What is the total dollar return you'll receive from capital gain/loss after selling the bond? a. $64.02 b. $36.00 c. $28.02 d. $55.00 13. The price of a bond is related to its yield. a. Inversely b. Directly c. Not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts