Question: Please show answer step by step for both parts. Thank you Richard owns his own carpentry business as a sole proprietor and files a Schedule

Please show answer step by step for both parts. Thank you

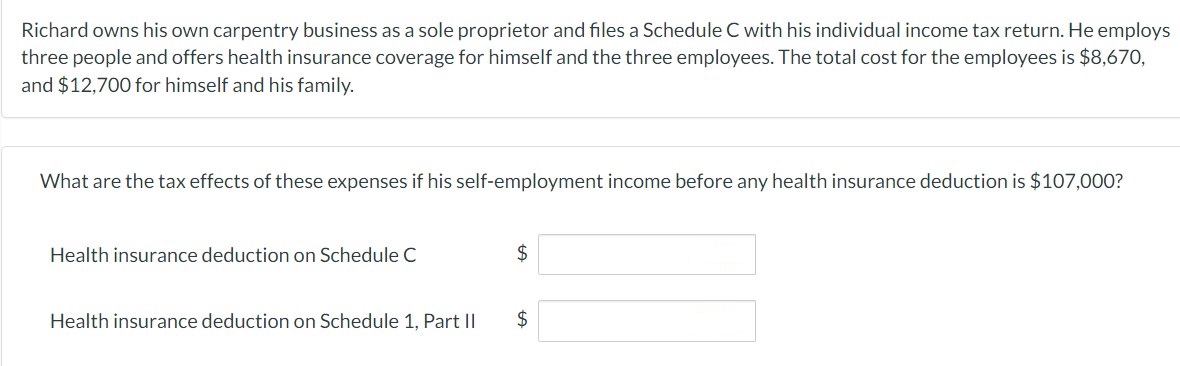

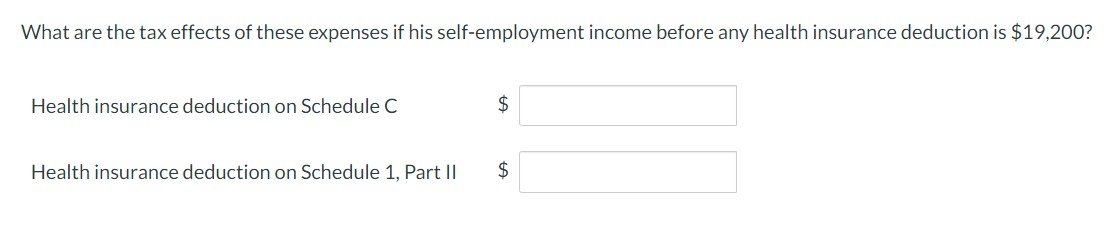

Richard owns his own carpentry business as a sole proprietor and files a Schedule C with his individual income tax return. He employs three people and offers health insurance coverage for himself and the three employees. The total cost for the employees is $8,670, and $12,700 for himself and his family. What are the tax effects of these expenses if his self-employment income before any health insurance deduction is $107,000 ? Health insurance deduction on Schedule C $ Health insurance deduction on Schedule 1, Part II $ What are the tax effects of these expenses if his self-employment income before any health insurance deduction is $19,200 ? Health insurance deduction on Schedule C $ Health insurance deduction on Schedule 1, Part II $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts