Question: Please show work step by step. Please answer both parts because they relate to the same question. Richard owns his own carpentry business as a

Please show work step by step. Please answer both parts because they relate to the same question.

Please show work step by step. Please answer both parts because they relate to the same question.

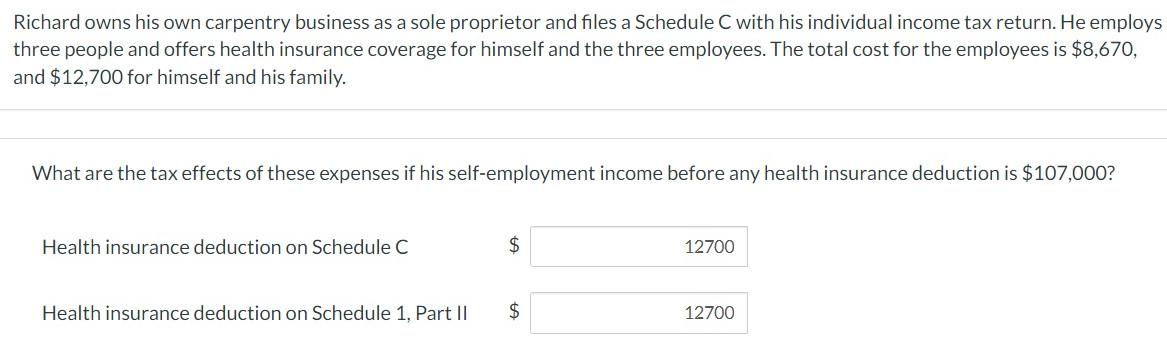

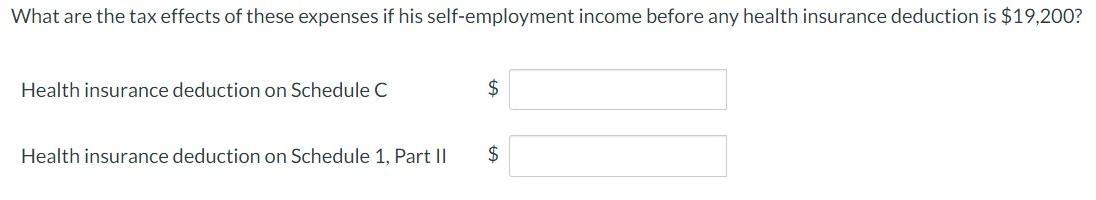

Richard owns his own carpentry business as a sole proprietor and files a Schedule C with his individual income tax return. He employs three people and offers health insurance coverage for himself and the three employees. The total cost for the employees is $8,670, and $12,700 for himself and his family. What are the tax effects of these expenses if his self-employment income before any health insurance deduction is $107,000? Health insurance deduction on Schedule C $ Health insurance deduction on Schedule 1, Part II $ 12700 12700

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

The tax effects of health insurance expenses for Richard depend on his selfemployment income Lets ca... View full answer

Get step-by-step solutions from verified subject matter experts