Question: Please show each steps An underlying asset has a current value of $80. Over the next interval (a year), its volatility is forecast to be

Please show each steps

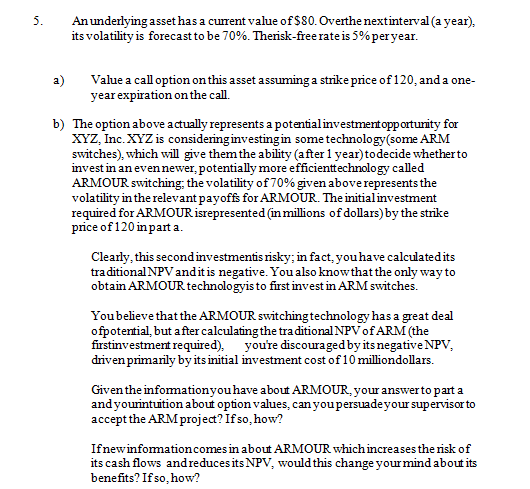

An underlying asset has a current value of $80. Over the next interval (a year), its volatility is forecast to be 70%. The risk-free rate is 5% per year. a) Value a call option on this asset assuming a strike price of 120, and a one-year expiration on the call. b) The option above actually represents a potential investment opportunity for XYZ, Inc. XYZ is considering investing in some technology(some ARM switches), which will give them the ability (after 1 year) to decide whether to invest in an even newer, potentially more efficient technology called ARMOUR switching: the volatility of 70% given above represents the volatility in the relevant pay offs for ARMOUR. The initial investment required for ARMOUR is represented (in millions of dollars) by the strike price of 120 in part a. Clearly, this second investment is risky: in fact, you have calculated its traditional NPV and it is negative. You also know that the only way to obtain ARMOUR technology is to first invest in ARM switches. You believe that the ARMOUR switching technology has a great deal of potential, but after calculating the traditional NPV o f ARM (the first investment required), you're discouraged by its negative NPV, driven primarily by its initial investment cost of 10 million dollars. Given the information you have about ARMOUR, your answer to part a and your intuition about option values, can you persuade your supervisor to accept the ARM project? If so, how? If new information comes in about ARMOUR which increases the risk of its cash flows and reduces its NPV, would this change your mind about its benefits? If so, how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts