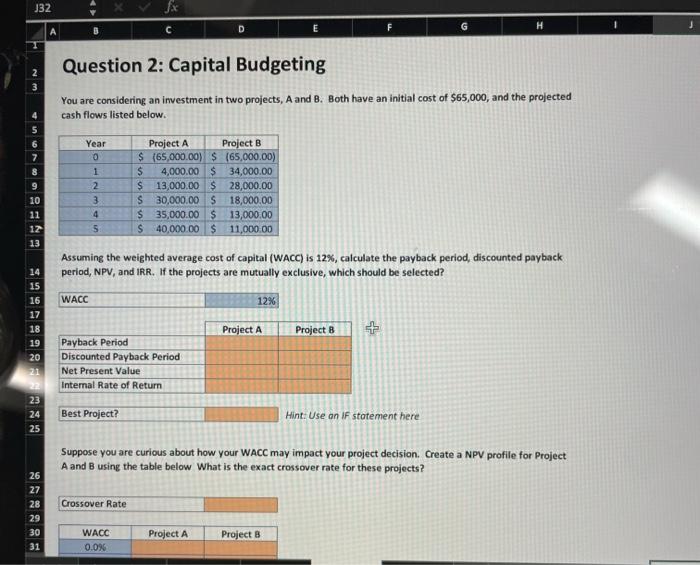

Question: please show equations used 332 fx D E H Question 2: Capital Budgeting 3 You are considering an investment in two projects, A and B.

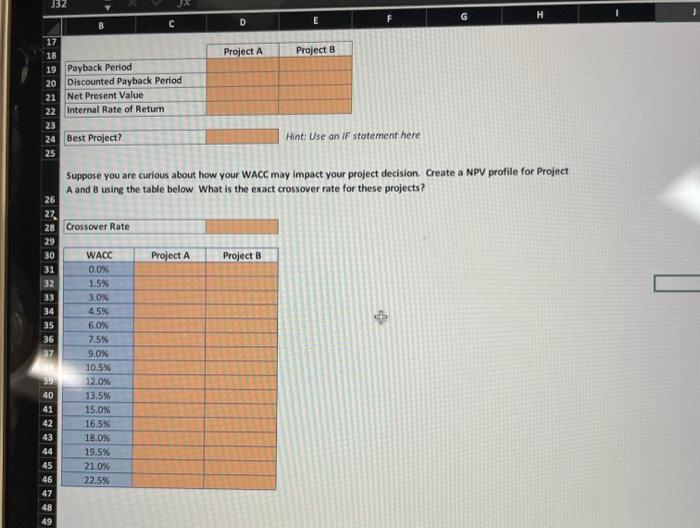

332 fx D E H Question 2: Capital Budgeting 3 You are considering an investment in two projects, A and B. Both have an initial cost of $65,000, and the projected cash flows listed below. Year 7 0 8 WN 9 10 11 12 13 1 2 3 4 5 Project A Project B $ (65,000.00) $ (65,000.00) $ 4,000.00 $ 34,000.00 $ 13,000.00 $ 28,000.00 S30,000.00 $ 18,000.00 $ 35,000.00 $ 13,000.00 $ 40,000.00 $ 11,000.00 Assuming the weighted average cost of capital (WACC) is 12%, calculate the payback period, discounted payback period, NPV, and IRR. If the projects are mutually exclusive, which should be selected? WACC 12% Project A Project 8 + 14 15 16 17 18 19 20 21 22 23 24 25 Payback Period Discounted Payback Period Net Present Value Internal Rate of Return Best Project? Hint: Use on IF statement here Suppose you are curious about how your WACC may impact your project decision. Create a NPV profile for Project A and B using the table below What is the exact crossover rate for these projects? Crossover Rate 26 27 28 29 30 31 WACC 0.0% Project A Project B J32 H D Project B 17 18 Project A 19 Payback Period 20 Discounted Payback Period 21 Net Present Value 22 Internal Rate of Return 23 24 Best Project? Hint: Use an IF statement here 25 Suppose you are curious about how your WACC may impact your project decision Create a NPV profile for Project A and B using the table below What is the exact crossover rate for these projects? 26 27 28 Crossover Rate 29 30 WACC Project A Project B 31 0.0% 32 1.5% 33 3.0% 34 4.5% 35 6.0% 36 7.5N 37 9.0% 10.5% 39 12.0% 40 13.596 41 15.0% 42 16.5% 43 18.0% 44 19.5% 45 21.0% 46 22.5% 47 48 49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts