Question: Please show excel formulas. Thanks 5. See the below table for the Dog Voices Corporation (DVC): a. Pick any three (3) ratios and explain on

Please show excel formulas.

Thanks

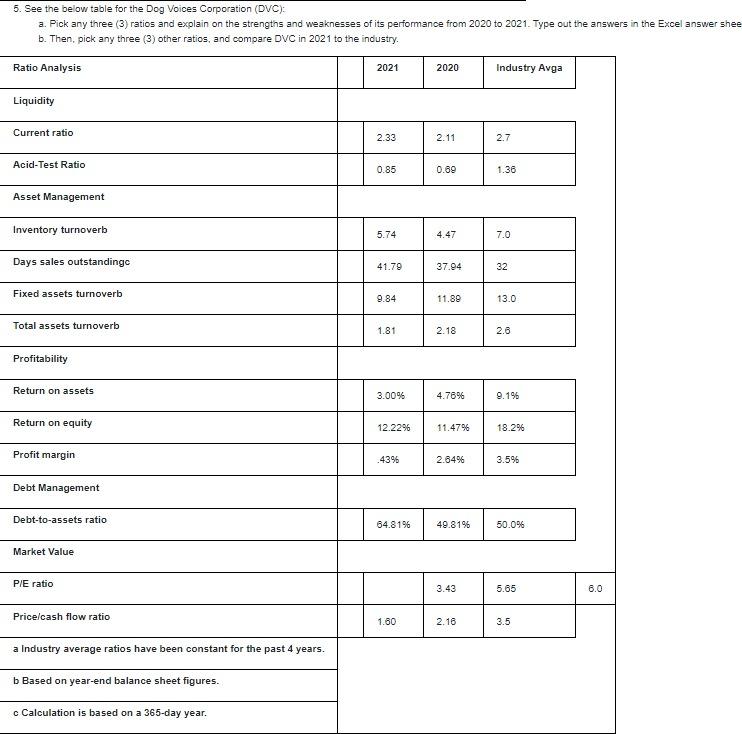

5. See the below table for the Dog Voices Corporation (DVC): a. Pick any three (3) ratios and explain on the strengths and weaknesses of its performance from 2020 to 2021. Type out the answers in the Excel answer shee b. Then, pick any three (3) other ratios, and compare DVC in 2021 to the industry. Ratio Analysis 2021 2020 Industry Avga Liquidity Current ratio 2.33 2.11 2.7 Acid-Test Ratio 0.85 0.69 1.36 Asset Management Inventory turnoverb 5.74 4.47 7.0 Days sales outstandinge 41.79 37.94 32 Fixed assets turnoverb 9.84 11.89 13.0 Total assets turnoverb 1.81 2.18 2.6 Profitability Return on assets 3.00% 4.7696 9.196 Return on equity 12.2296 11.4796 18.2% Profit margin .4396 2.84% 3.596 Debt Management Debt-to-assets ratio 64.8196 49.81% 50.0% Market Value PIE ratio 3.43 5.65 6.0 Price/cash flow ratio 1.60 2.16 3.5 a Industry average ratios have been constant for the past 4 years. b Based on year-end balance sheet figures. c Calculation is based on a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts