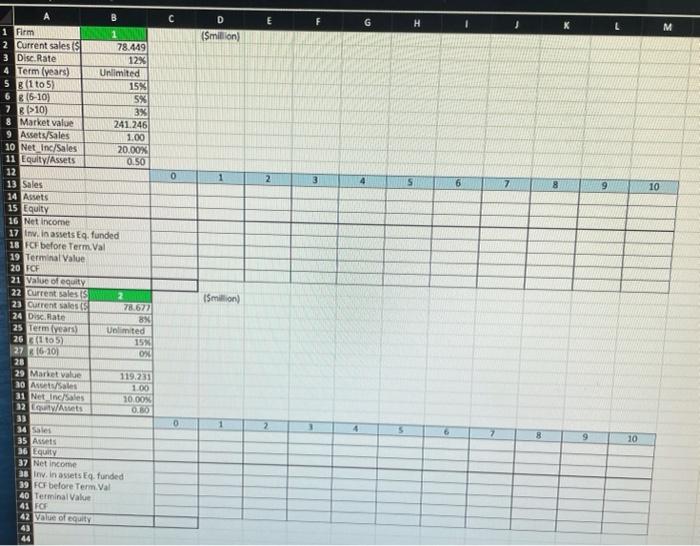

Question: Please show formulars complete a value based valuation show formula C E F G H K L D (Smillion M N 0 2 3 4

C E F G H K L D (Smillion M N 0 2 3 4 5 6 2 8 9 10 1 Firm 2 Current Sales 78.449 3 Disc Rate 12% 4 Term (years) Unlimited S 1105 158 6 R16-30) 5% 7 R10 3X & Market value 241 246 9 Assets/Sales 1.00 10 Net Inc/Sales 20.00% 11 Equity Assets 0.50 12 13 Sales 14 Assets 15 quity 16 Net Income 17 in intiq, funded 18 FCF before Term.Val 19 Terminal Value 20 FCF 21 VIELY 22 23 24 m 25 Current Sales 71672 26 DISERT SN 27 Term ears) Unlimited 28 Eltos 25 29216-101 OX 30 31 Market value 119.231 32 Assets/Sales 1.00 33 Net -c/Sales 10.00% 34 Louit/Assets O.RO 35 36 Sales 37 Assets 36 Luty 39 Net income 40 in. In assets to funded 41 FG before Term.Val 42 Terminal Value 43 FOS 44 Value of equity 45 46 Smillion O 1 2 3 4 5 6 9 10 C E F G H } D (Smilion L M 0 1 2 3 4 S 6 7 8 9 10 A B 1 Firm 1 2 Current sales is 78.449 3 Disc Rate 12% 4 Term (years) Unlimited 5 R1 to 5) 15% 6 (6-10) 5% 7 >10) 3% 8 Market value 241.246 9 Assets/Sales 1.00 10 Net Inc/Sales 20.00% 11 Equity/Assets 0.50 12 13 Sales 14 Assets 15 Equity 16 Net Income 17 inw, in assets Eq. funded 18 FCF before Term. Val 19 Terminal Value 20 FCF 21 Value of equity 22 Current Sales 2 23 Current Sales 78.622 24 Disc Hate 8X 25 Term (years) Unlimited 26 (1105) 15% 27 16101 OX 28 29 Market Value 119.231 30 Aut/Sales 1.00 31 Net Inc/Sales 10.00 12 Lets TOBO 33 34 Sales 35 Ades 36 Equity 37 Net income 28 Inv. In assets Eq. funded 39 FCF before Term. Val 40 Terminal Value 41 FOR 42 Value of equity 43 44 ISmillion) 0 4 5 8 9 10 C E F G H K L D (Smillion M N 0 2 3 4 5 6 2 8 9 10 1 Firm 2 Current Sales 78.449 3 Disc Rate 12% 4 Term (years) Unlimited S 1105 158 6 R16-30) 5% 7 R10 3X & Market value 241 246 9 Assets/Sales 1.00 10 Net Inc/Sales 20.00% 11 Equity Assets 0.50 12 13 Sales 14 Assets 15 quity 16 Net Income 17 in intiq, funded 18 FCF before Term.Val 19 Terminal Value 20 FCF 21 VIELY 22 23 24 m 25 Current Sales 71672 26 DISERT SN 27 Term ears) Unlimited 28 Eltos 25 29216-101 OX 30 31 Market value 119.231 32 Assets/Sales 1.00 33 Net -c/Sales 10.00% 34 Louit/Assets O.RO 35 36 Sales 37 Assets 36 Luty 39 Net income 40 in. In assets to funded 41 FG before Term.Val 42 Terminal Value 43 FOS 44 Value of equity 45 46 Smillion O 1 2 3 4 5 6 9 10 C E F G H } D (Smilion L M 0 1 2 3 4 S 6 7 8 9 10 A B 1 Firm 1 2 Current sales is 78.449 3 Disc Rate 12% 4 Term (years) Unlimited 5 R1 to 5) 15% 6 (6-10) 5% 7 >10) 3% 8 Market value 241.246 9 Assets/Sales 1.00 10 Net Inc/Sales 20.00% 11 Equity/Assets 0.50 12 13 Sales 14 Assets 15 Equity 16 Net Income 17 inw, in assets Eq. funded 18 FCF before Term. Val 19 Terminal Value 20 FCF 21 Value of equity 22 Current Sales 2 23 Current Sales 78.622 24 Disc Hate 8X 25 Term (years) Unlimited 26 (1105) 15% 27 16101 OX 28 29 Market Value 119.231 30 Aut/Sales 1.00 31 Net Inc/Sales 10.00 12 Lets TOBO 33 34 Sales 35 Ades 36 Equity 37 Net income 28 Inv. In assets Eq. funded 39 FCF before Term. Val 40 Terminal Value 41 FOR 42 Value of equity 43 44 ISmillion) 0 4 5 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts