Question: Please show how to get each answer to each question on excel. thank you Bond Return 1: You bought a $10,000-face 1%-coupon bond that had

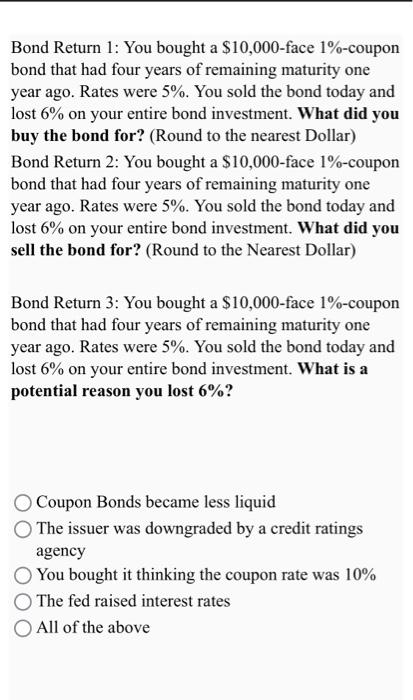

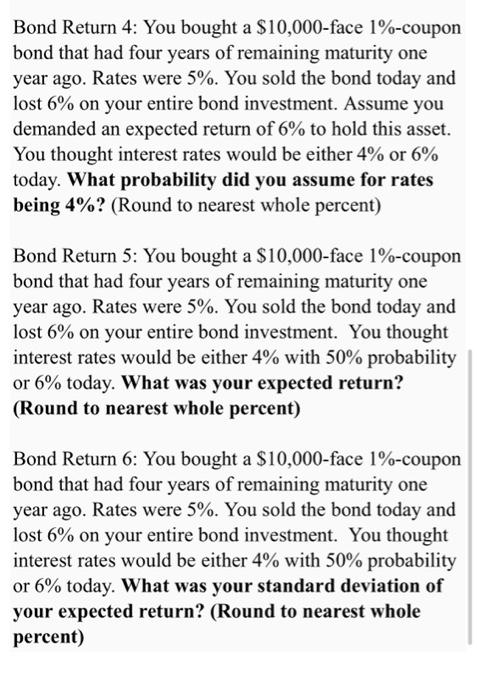

Bond Return 1: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What did you buy the bond for? (Round to the nearest Dollar) Bond Return 2: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What did you sell the bond for? (Round to the Nearest Dollar) Bond Return 3: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What is a potential reason you lost 6%? Coupon Bonds became less liquid The issuer was downgraded by a credit ratings agency You bought it thinking the coupon rate was 10% The fed raised interest rates All of the above Bond Return 4: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. Assume you demanded an expected return of 6% to hold this asset. You thought interest rates would be either 4% or 6% today. What probability did you assume for rates being 4%? (Round to nearest whole percent) Bond Return 5: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. You thought interest rates would be either 4% with 50% probability or 6% today. What was your expected return? (Round to nearest whole percent) Bond Return 6: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. You thought interest rates would be either 4% with 50% probability or 6% today. What was your standard deviation of your expected return? (Round to nearest whole percent) Bond Return 1: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What did you buy the bond for? (Round to the nearest Dollar) Bond Return 2: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What did you sell the bond for? (Round to the Nearest Dollar) Bond Return 3: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. What is a potential reason you lost 6%? Coupon Bonds became less liquid The issuer was downgraded by a credit ratings agency You bought it thinking the coupon rate was 10% The fed raised interest rates All of the above Bond Return 4: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. Assume you demanded an expected return of 6% to hold this asset. You thought interest rates would be either 4% or 6% today. What probability did you assume for rates being 4%? (Round to nearest whole percent) Bond Return 5: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. You thought interest rates would be either 4% with 50% probability or 6% today. What was your expected return? (Round to nearest whole percent) Bond Return 6: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. You thought interest rates would be either 4% with 50% probability or 6% today. What was your standard deviation of your expected return? (Round to nearest whole percent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts